Cisco Systems CSCO security business is benefiting from a strong portfolio that comprises Network Security, Identity and Access Management, Secure Access Service Edge (SASE), and Threat Intelligence, Detection, and Response (TIDR) solutions. The acquisition of Splunk has been a game-changer for Cisco’s security business, which accounted for 19.5% of fiscal 2025 revenues that jumped 59% from 2024 to $8.09 billion.

The addition of Splunk has strengthened CSCO’s TIDR offerings. The company has been integrating Cisco Extended Detection and Response (XDR) with Splunk Enterprise Security to create a unified and highly effective solution that helps in preventing, detecting, and responding to sophisticated cyber threats. Cisco has been expanding its SASE architecture, and its cloud-native, AI-powered Hypershield solution is helping the company gain traction in AI-scale data centers.

In the fourth quarter of fiscal 2025, security revenues were $1.95 billion, up 9% year over year, driven by growth in Cisco’s offerings from Splunk and SASE. Splunk and Cisco synergies reported 14% year-over-year growth in new logos for Splunk. Secure Access, XDR, Hypershield and AI Defense added 750 new customers collectively in the reported quarter. More importantly, orders grew mid-single-digit, which reflects the growth prospects for CSCO’s security business.

The Zacks Consensus Estimate for the first quarter of fiscal 2026 service revenues is pegged at $2.24 billion, indicating 11% growth over the figure reported in the year-ago quarter.

CSCO Faces Tough Competition in the Security Domain

Cisco is facing stiff competition from Fortinet FTNT and Okta OKTA in the security domain.

Fortinet benefits from an innovative portfolio backed by more than 500 AI patents and 15 years of development expertise. Fortinet has emerged as a recognized leader across multiple Gartner Magic Quadrants, including SASE Platforms, Enterprise Wired and Wireless LAN Infrastructure, and SD-WAN. The expansion of FortiCloud with new services like FortiIdentity, FortiDrive and FortiConnect demonstrates Fortinet's evolution beyond traditional firewalls into a comprehensive security ecosystem.

Okta’s offerings include Okta AI, a suite of AI-powered capabilities embedded across several products, which empowers organizations to harness AI to build better experiences and protect against cyberattacks. The company benefits from strong demand for its new products, including Identity Governance, Privileged Access, Device Access, Fine Grained Authorization, Identity Security Posture Management, and Identity Threat Protection with Okta AI.

CSCO Share Price Performance, Valuation & Estimates

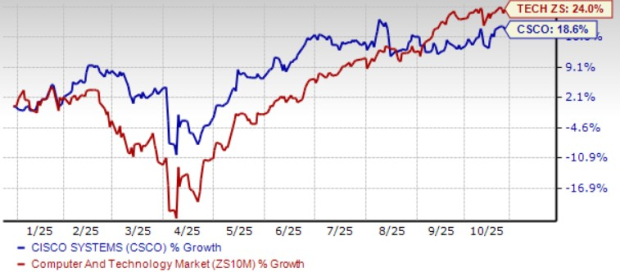

Cisco shares have appreciated 18.6% year to date, underperforming the broader Zacks Computer and Technology sector’s return of 24%.

CSCO Stock Lags Sector

Image Source: Zacks Investment Research

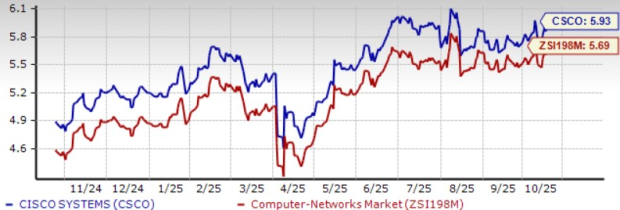

The CSCO stock is trading at a premium, with a trailing 12-month price/book of 5.93X compared with the industry’s 5.69X. Cisco has a Value Score of C.

CSCO Stock is Overvalued

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for the first quarter of fiscal 2026 earnings is currently pegged at 98 cents per share, unchanged over the past 30 days, suggesting 7.7% growth from the figure reported in the year-ago quarter.

Cisco Systems, Inc. Price and Consensus

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

The Zacks Consensus Estimate for fiscal 2026 earnings is currently pegged at $4.04 per share, unchanged over the past 30 days, suggesting 6% growth from the figure reported in the year-ago quarter.

Cisco currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.