Stride, Inc. LRN offers online and blended education solutions that merge digital flexibility with in-person engagement. As the market is shifting from traditional school choices to more virtual and career-oriented options, the diversified offerings by the company fit perfectly in the puzzle. Its evolving model positions it at the intersection of technology, personalized instruction and workforce readiness.

This Virginia-based education company offers K-12 online school programs alongside expanding hybrid and in-person options through a career learning platform for areas like healthcare, IT and advanced manufacturing. Stride started fiscal 2026 with a bang, with its Career Learning segment’s revenues growing 16.3% year over year to $257.8 million in the first quarter. The enrollments in this segment also grew 20% during the quarter. This segment’s revenues outpaced the revenue growth for the General Education segment, which was 10.2% year over year in the first quarter of fiscal 2026.

Notably, its focus on hybrid innovation also benefits from state-level funding flexibility, enabling partnerships with school districts that seek scalable, cost-effective solutions. The K12 Tutoring collaboration with Lake Forest School District in Delaware to offer innovative and tailored educational solutions to students can be considered in this aspect. The tutoring service is another offering stream that diversifies Stride’s portfolio as well as revenue visibility.

Summing up, LRN’s long-term outlook looks promising as it is focusing on an adaptive ecosystem where online and offline components coexist seamlessly with hints of AI incorporation wherever necessary to boost engagement. As policymakers push for educational models that better prepare students for modern careers, Stride’s hybrid infrastructure could serve as a blueprint for future schooling.

Stride Competing in the Education Market

Stride competes in career learning and K-12 from a hybrid-strength position with other renowned market players, including Strategic Education, Inc. STRA and American Public Education, Inc. APEI.

Strategic Education brings a complementary playbook focused on career-relevant post-secondary credentials and campus-plus-online programs that emphasize workforce alignment, employer partnerships and outcomes-oriented program design — strengths that position it to capture demand for upskilling and credentialing at scale. Contrarily, American Public Education targets working adults, military and nursing markets with mission-built programs and stable enrollment channels, giving it niche depth in healthcare and public-service career pipelines where predictable demand and outcomes metrics matter.

Competitively, LRN’s advantage is its cross-age platform and scale in K-12 alongside fast Career Learning growth. Strategic Education’s advantage is deep postsecondary career programming and employer alignment, while American Public Education’s edge is mission-aligned niche programs with steady institutional funnels.

LRN Stock’s Price Performance & Valuation Trend

Shares of this Virginia-based education company have dropped 57.7% in the past three months, underperforming the Zacks Schools industry, the broader Zacks Consumer Discretionary sector and the S&P 500 Index.

Image Source: Zacks Investment Research

LRN stock is currently trading at a discount compared with its industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 7.65, as shown in the chart below.

Image Source: Zacks Investment Research

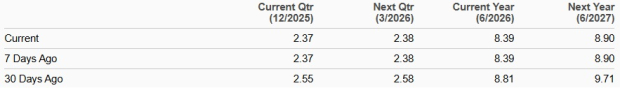

Earnings Estimate Revision of LRN

LRN’s earnings estimates for fiscal 2026 and fiscal 2027 have moved south over the past 30 days to $8.39 and $8.90 per share, respectively. However, the revised figures for fiscal 2026 and 2027 imply year-over-year improvements of 3.6% and 6.2%, respectively.

Image Source: Zacks Investment Research

Stride stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>American Public Education, Inc. (APEI) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.