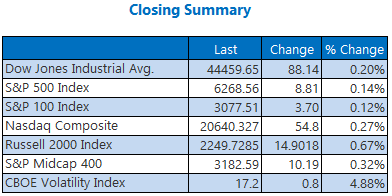

Stocks started a new week on a high note, with the Dow brushing off tariff talk and paring early morning losses. The S&P 500 and Nasdaq also pivoted into the black after midday choppiness, the latter nabbing a record close as cryptocurrency Bitcoin (BTC) barreled higher.

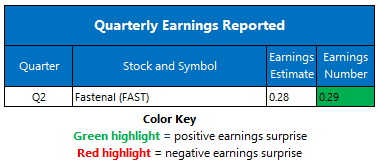

Despite President Trump's sharp tariff rhetoric over the weekend -- including threats of 30% tariffs on the European Union (EU) and Mexico on Aug. 1 -- it seems investors are for now banking on these tensions to be talked down as the deadline nears. Wall Street is also gearing up for a data-driven week, with June's consumer price index (CPI) on tap and big banks set to unofficially kick off earnings season.

Continue reading for more on today's market, including:

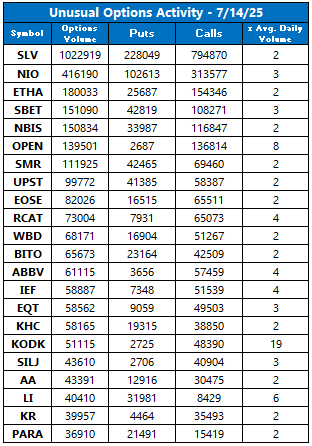

- Nvidia's historic milestone draws options frenzy.

- Analyst: Fintech sector is way too crowded.

- Plus, more on crypto's breakout; a C-suite shakeup to monitor; and RIVN stalled.

5 Things to Know Today

- The federal government is detaching from student loans. (The Wall Street Journal)

- China exports -- especially rare earth metals -- soared in June. (CNBC)

- 'Crypto Week' is sending stocks higher.

- Call traders cheer Kenvue's C-suite shakeup.

- Rivian Automotive stock a bear note risk going forward.

Oil Prices Impacted by Growing Trump-Russia Rift

Oil prices moved lower today, unfazed by President Trump's threat of 100% tariffs on Russia if a deal with Ukraine isn't reached in 50 days. August-dated West Texas Intermediate (WTI) crude fell $1.47 or 2.1%, to settle at $66.98 a barrel.

Gold prices cooled off from three-week highs in the morning. August-dated gold futures lost 0.2% to settle at $3,358.90.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.