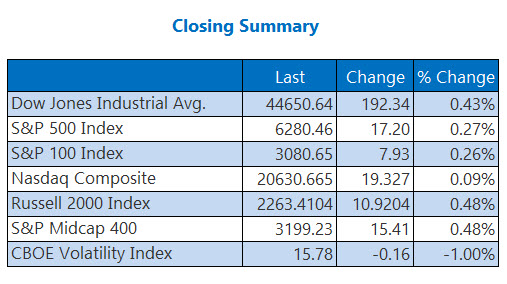

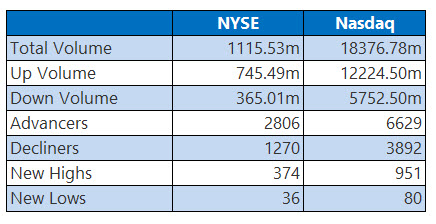

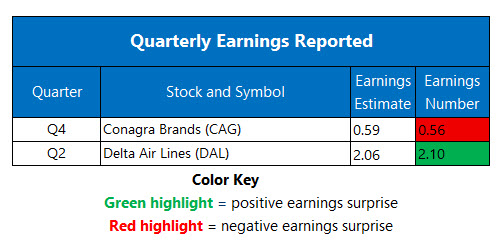

Stocks secured solid wins across the board today, as investors moved past the latest tariff tensions, now with Brazil. Even as Brazilian president Luiz Inácio Lula da Silva mulls retaliatory tariffs, the Dow added 192 points -- its second-straight triple-digit win. Meanwhile, the S&P 500 and Nasdaq each nabbed record closes, the latter's second-straight. As Wall Street eyes another earnings season, the Cboe Volatility Index (VIX) closed at its lowest level since early February.

Continue reading for more on today's market, including:

- Rare earths stock scales the Street.

- Airline stocks enjoying a halo lift today.

- Plus, two upgrades to note; and an energy stock to buy on the dip.

5 Things to Know Today

- The Federal Reserve could be changing its bank regulations. (CNBC)

- Coffee and orange juice prices are soaring amid Brazil trade tensions. (MarketWatch)

- Streaming stock could burn short sellers.

- Analyst: Semiconductor stock could enjoy AI tailwinds.

- Don't sweat this energy stock cooling off.

Global Economic Concerns Dents Oil

Tariff tensions impacted oil prices today, given Brazil's role in global economic growth, with oversupply concerns also weighing. August-dated West Texas Intermediate (WTI) crude fell $1.81 or 2.7%, to settle at $66.57 a barrel.

Gold prices were lackluster today, as investor sentiment proved resilient along with the U.S. dollar. August-dated gold futures added 0.1% to settle at $3,325.70.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.