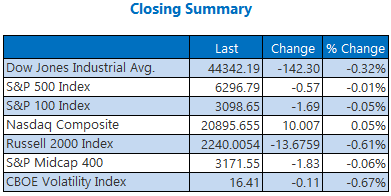

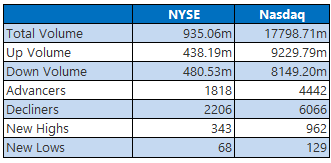

Wall Street had a choppy finish to an otherwise solid week. The Dow shed 142 points and moved into the red for the week, weighed down by blue-chip earnings and a Financial Times report that President Donald Trump is demanding a minimum tariff of between 15% and 20% in any deal with the European Union (EU).

The renewed tariff tensions overshadowed upbeat consumer sentiment data from the morning. The S&P 500 finished flat today but still managed an intraday record high and weekly win. The Nasdaq moved back into the black at the close, stealing a record close and securing an outsized weekly win.

Continue reading for more on today's market, including:

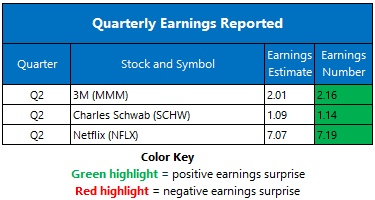

- Netflix earnings leave investors wanting more.

- Insurance stock cleared a key level, and is now ready to run.

- Plus, two more earnings reports to know; and a restaurant stock to target.

5 Things to Know Today

- This Federal Reserve President wants to cut interest rates right now. (Bloomberg)

- Global insured losses are at their highest point now since 2011. (CNBC)

- 3M earnings: Tariffs overshadow top-line beat.

- Another bank stock breaks out after earnings.

- Restaurant stock has a chart you should see.

Weekly Losses for Oil, Gold

Oil prices were lower today, with black gold trying to unpack the EU tightening of sanctions against Russia. August-dated West Texas Intermediate (WTI) crude lost 16 cents, or 0.3%, to settle at $67.38 per barrel. For the week, oil lost 1%.

Gold prices edged higher but were unable to nab weekly wins. August-dated gold futures added 0.4% to settle at $3,359.70. For the week, the safe-haven asset fell 0.1%.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.