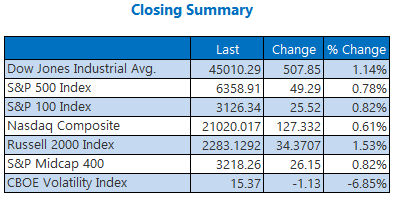

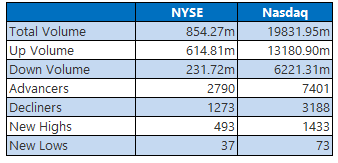

Stocks earned wins across the board today for the first time in roughly a week. The big story was the Dow, which added 507 points for a second-straight triple-digit pop and a record close. It was also the blue-chip index's best single-session gain since May 27.

Both S&P 500 and Nasdaq scored record settlements of their own, too, as trade deal tailwinds picked up, with the Financial Times reporting the European Union (EU) and U.S. are nearing a 15% tariff agreement. Right on cue, Wall Street's "fear gauge," the Cboe Volatility Index (VIX), logged its lowest close since Feb. 19.

Continue reading for more on today's market, including:

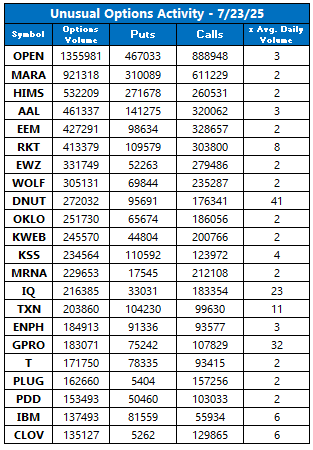

- Meme stocks are suddenly back, in a big way.

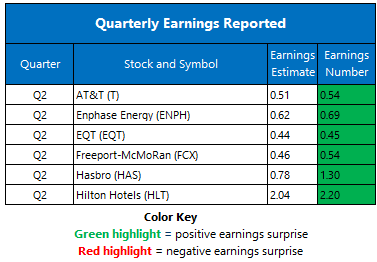

- Hasbro stock can't capitalize on upbeat earnings.

- Plus, a quantum computing stock to target; CELH upgraded; and ENPH in the red.

5 Things to Know Today

- Weekly mortgage applications are flatlining as rates remain high. (CNBC)

- A 'mega-dam' project in China has its neighbors on edge. (Reuters)

- Target this quantum computing stock before the next rally.

- Celsius stock gets much-needed upgrade boost.

- Solar stock suddenly in a very bleak position.

Commodities Cool as Tariff Deadline Looms

Oil prices turned in a fourth-straight loss, as black gold chops lower ahead of the Aug. 1 tariff deadline. September-dated West Texas Intermediate (WTI) crude gave back six cents, or 0.1%, to settle at $65.25 per barrel.

Gold prices also suffered, as investor optimism dulled demand for safe-haven assets. August-dated gold futures shed 1.4% to settle at $3,396.90.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.