Fintel reports that on June 1, 2023, Stifel maintained coverage of Veritone (NASDAQ:VERI) with a Hold recommendation.

Analyst Price Forecast Suggests 60.08% Upside

As of May 11, 2023, the average one-year price target for Veritone is 6.31. The forecasts range from a low of 4.04 to a high of $10.60. The average price target represents an increase of 60.08% from its latest reported closing price of 3.94.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Veritone is 168MM, an increase of 15.20%. The projected annual non-GAAP EPS is -0.05.

What is the Fund Sentiment?

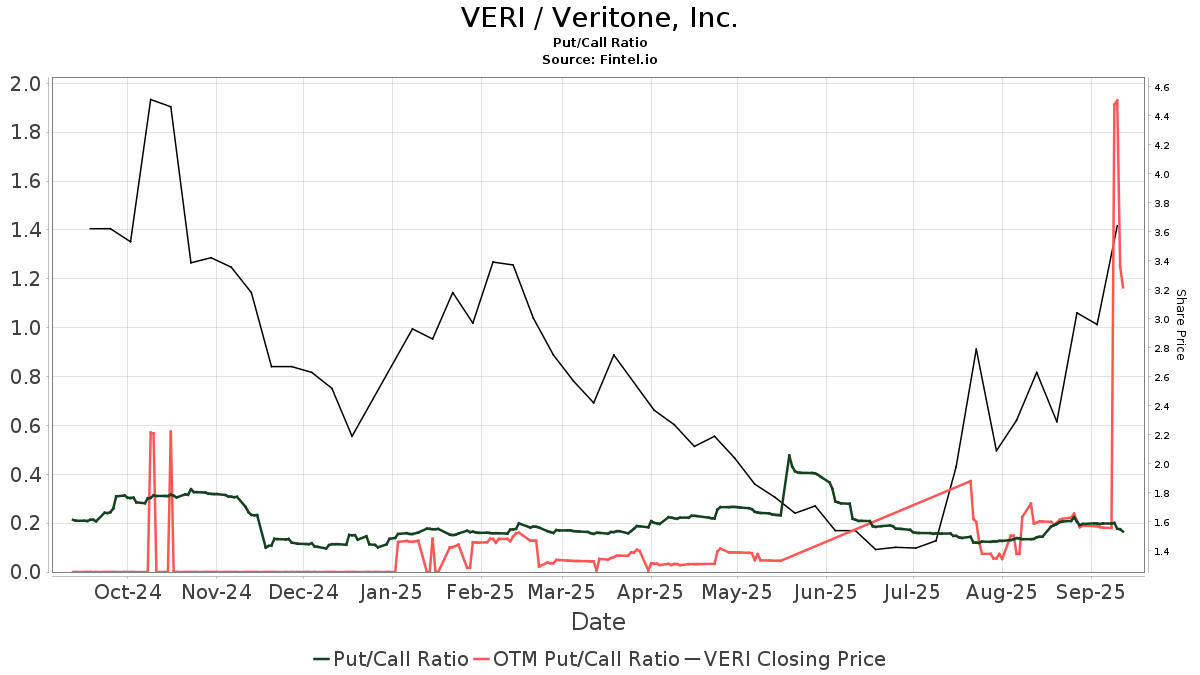

There are 208 funds or institutions reporting positions in Veritone. This is an increase of 5 owner(s) or 2.46% in the last quarter. Average portfolio weight of all funds dedicated to VERI is 0.14%, an increase of 0.81%. Total shares owned by institutions decreased in the last three months by 5.03% to 14,398K shares.  The put/call ratio of VERI is 0.06, indicating a bullish outlook.

The put/call ratio of VERI is 0.06, indicating a bullish outlook.

What are Other Shareholders Doing?

Banta Asset Management holds 2,280K shares representing 6.19% ownership of the company. In it's prior filing, the firm reported owning 2,281K shares, representing a decrease of 0.05%. The firm increased its portfolio allocation in VERI by 137,670.08% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,137K shares representing 3.09% ownership of the company. In it's prior filing, the firm reported owning 1,079K shares, representing an increase of 5.10%. The firm increased its portfolio allocation in VERI by 7.03% over the last quarter.

IWM - iShares Russell 2000 ETF holds 717K shares representing 1.95% ownership of the company. In it's prior filing, the firm reported owning 766K shares, representing a decrease of 6.95%. The firm increased its portfolio allocation in VERI by 7.46% over the last quarter.

Geode Capital Management holds 602K shares representing 1.64% ownership of the company. In it's prior filing, the firm reported owning 577K shares, representing an increase of 4.15%. The firm increased its portfolio allocation in VERI by 6.21% over the last quarter.

D. E. Shaw holds 590K shares representing 1.60% ownership of the company. In it's prior filing, the firm reported owning 441K shares, representing an increase of 25.16%. The firm increased its portfolio allocation in VERI by 12.11% over the last quarter.

Veritone Background Information

(This description is provided by the company.)

Veritone is a leading provider of artificial intelligence (AI) technology and solutions. The company's proprietary operating system, aiWARE™, powers a diverse set of AI applications and intelligent process automation solutions that are transforming both commercial and government organizations. aiWARE orchestrates an expanding ecosystem of machine learning models to transform audio, video, and other data sources into actionable intelligence. The company's AI developer tools enable its customers and partners to easily develop and deploy custom applications that leverage the power of AI to dramatically improve operational efficiency and unlock untapped opportunities. Veritone is headquartered in Costa Mesa, California, and has offices in Denver, London, New York and San Diego.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.