Fintel reports that on July 21, 2023, Stephens & Co. maintained coverage of Preferred Bank (NASDAQ:PFBC) with a Overweight recommendation.

Analyst Price Forecast Suggests 8.98% Upside

As of July 6, 2023, the average one-year price target for Preferred Bank is 69.10. The forecasts range from a low of 60.60 to a high of $75.60. The average price target represents an increase of 8.98% from its latest reported closing price of 63.41.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Preferred Bank is 289MM, an increase of 3.49%. The projected annual non-GAAP EPS is 9.75.

Preferred Bank Declares $0.55 Dividend

On June 21, 2023 the company declared a regular quarterly dividend of $0.55 per share ($2.20 annualized). Shareholders of record as of July 7, 2023 received the payment on July 21, 2023. Previously, the company paid $0.55 per share.

At the current share price of $63.41 / share, the stock's dividend yield is 3.47%.

Looking back five years and taking a sample every week, the average dividend yield has been 2.62%, the lowest has been 1.51%, and the highest has been 4.82%. The standard deviation of yields is 0.65 (n=235).

The current dividend yield is 1.31 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.21. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.83%, demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

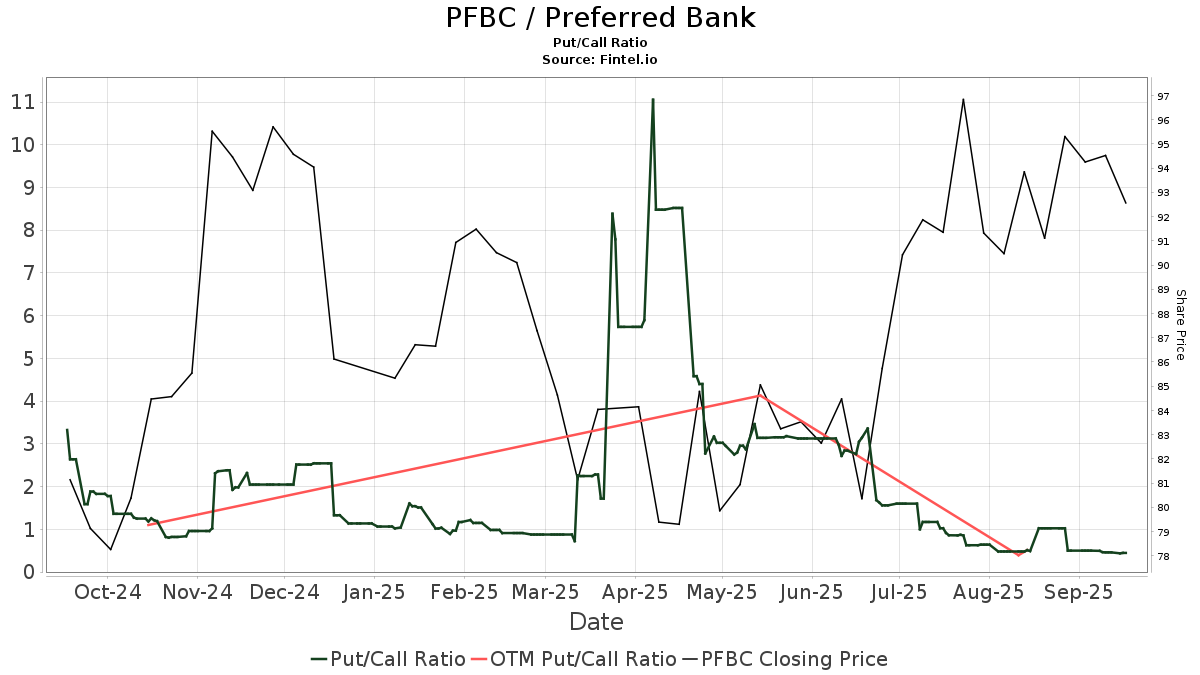

There are 466 funds or institutions reporting positions in Preferred Bank. This is an increase of 13 owner(s) or 2.87% in the last quarter. Average portfolio weight of all funds dedicated to PFBC is 0.09%, a decrease of 34.34%. Total shares owned by institutions increased in the last three months by 1.06% to 12,798K shares.  The put/call ratio of PFBC is 1.61, indicating a bearish outlook.

The put/call ratio of PFBC is 1.61, indicating a bearish outlook.

What are Other Shareholders Doing?

T. Rowe Price Investment Management holds 1,050K shares representing 7.27% ownership of the company. In it's prior filing, the firm reported owning 1,043K shares, representing an increase of 0.65%. The firm decreased its portfolio allocation in PFBC by 30.92% over the last quarter.

PRSVX - T. Rowe Price Small-Cap Value Fund holds 720K shares representing 4.99% ownership of the company. In it's prior filing, the firm reported owning 722K shares, representing a decrease of 0.21%. The firm decreased its portfolio allocation in PFBC by 25.97% over the last quarter.

IJR - iShares Core S&P Small-Cap ETF holds 616K shares representing 4.27% ownership of the company. No change in the last quarter.

Boston Partners holds 531K shares representing 3.68% ownership of the company. In it's prior filing, the firm reported owning 498K shares, representing an increase of 6.35%. The firm decreased its portfolio allocation in PFBC by 21.44% over the last quarter.

Nuveen Asset Management holds 415K shares representing 2.88% ownership of the company. In it's prior filing, the firm reported owning 458K shares, representing a decrease of 10.42%. The firm decreased its portfolio allocation in PFBC by 36.20% over the last quarter.

Preferred Bank Background Information

(This description is provided by the company.)

Preferred Bank (the 'Bank') is one of the larger independent commercial banks headquartered in California. The Bank is chartered by the State of California, and its deposits are insured by the Federal Deposit Insurance Corporation, or FDIC, to the maximum extent permitted by law. The Bank conducts its banking business from its main office in Los Angeles, California, and through eleven full-service branch banking offices in California (Alhambra, Century City, City of Industry, Torrance, Arcadia, Irvine, Diamond Bar, Pico Rivera, Tarzana and San Francisco (2)) and one branch in Flushing, New York. Preferred Bank offers a broad range of deposit and loan products and services to both commercial and consumer customers. The Bank provides personalized deposit services as well as real estate finance, commercial loans and trade finance to small and mid-sized businesses, entrepreneurs, real estate developers, professionals and high net worth individuals. Although originally founded as a Chinese-American Bank, Preferred Bank now derives most of its customers from the diversified mainstream market but does continue to benefit from the significant migration to California of ethnic Chinese from China and other areas of East Asia.

See all Preferred Bank regulatory filings.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.