Fintel reports that State Street has filed a 13G/A form with the SEC disclosing ownership of 9.79MM shares of Sangamo Therapeutics Inc (SGMO). This represents 5.97% of the company.

In their previous filing dated February 13, 2020 they reported 4.81MM shares and 4.15% of the company, an increase in shares of 103.32% and an increase in total ownership of 1.82% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 231.65% Upside

As of February 6, 2023, the average one-year price target for Sangamo Therapeutics is $11.48. The forecasts range from a low of $4.04 to a high of $23.10. The average price target represents an increase of 231.65% from its latest reported closing price of $3.46.

The projected annual revenue for Sangamo Therapeutics is $125MM, an increase of 11.20%. The projected annual EPS is $-1.38.

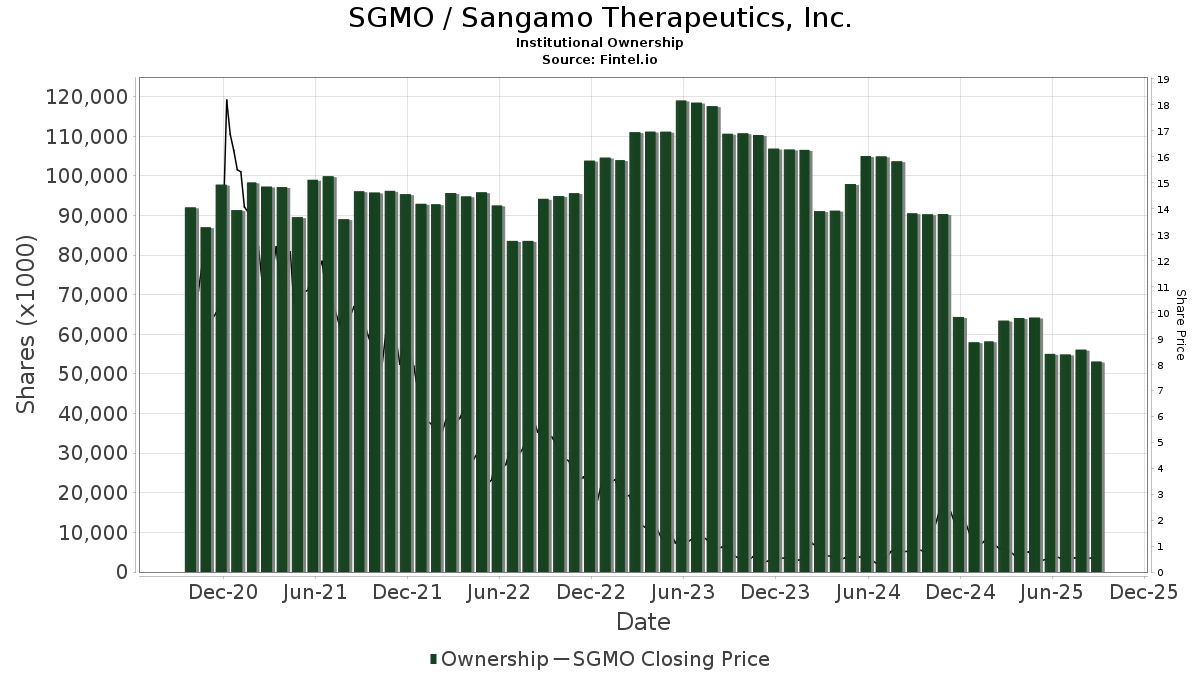

Fund Sentiment

There are 379 funds or institutions reporting positions in Sangamo Therapeutics. This is an increase of 1 owner(s) or 0.26%.

Average portfolio weight of all funds dedicated to US:SGMO is 0.0632%, a decrease of 3.0308%. Total shares owned by institutions increased in the last three months by 8.07% to 103,825K shares.

What are large shareholders doing?

Wasatch Advisors holds 13,122,116 shares representing 8.01% ownership of the company. In it's prior filing, the firm reported owning 12,392,319 shares, representing an increase of 5.56%. The firm increased its portfolio allocation in SGMO by 37.75% over the last quarter.

WAMCX - Wasatch Ultra Growth Fund Investor Class shares holds 4,959,973 shares representing 3.03% ownership of the company. In it's prior filing, the firm reported owning 4,280,057 shares, representing an increase of 13.71%. The firm increased its portfolio allocation in SGMO by 47.75% over the last quarter.

XBI - SPDR Biotech ETF holds 4,404,263 shares representing 2.69% ownership of the company. In it's prior filing, the firm reported owning 5,189,068 shares, representing a decrease of 17.82%. The firm increased its portfolio allocation in SGMO by 0.57% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 4,164,900 shares representing 2.54% ownership of the company. In it's prior filing, the firm reported owning 3,524,496 shares, representing an increase of 15.38%. The firm increased its portfolio allocation in SGMO by 45.79% over the last quarter.

Credit Suisse holds 3,803,127 shares representing 2.32% ownership of the company. In it's prior filing, the firm reported owning 3,793,300 shares, representing an increase of 0.26%. The firm increased its portfolio allocation in SGMO by 27.09% over the last quarter.

Sangamo Therapeutics Background Information

(This description is provided by the company.)

Sangamo Therapeutics is committed to translating ground-breaking science into genomic medicines with the potential to transform patients' lives using gene therapy, cell therapy, and genome engineering.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.