Fintel reports that State Farm Mutual Automobile Insurance has filed a 13G/A form with the SEC disclosing ownership of 50.00MM shares of Hagerty Inc - Class A (HGTY). This represents 60.09% of the company.

In their previous filing dated December 10, 2021 they reported 59.00MM shares and 64.60% of the company, a decrease in shares of 15.25% and a decrease in total ownership of 4.51% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 58.71% Upside

As of January 31, 2023, the average one-year price target for Hagerty Inc - is $15.30. The forecasts range from a low of $15.15 to a high of $15.75. The average price target represents an increase of 58.71% from its latest reported closing price of $9.64.

The projected annual revenue for Hagerty Inc - is $948MM, an increase of 27.27%. The projected annual EPS is $-0.06.

Fund Sentiment

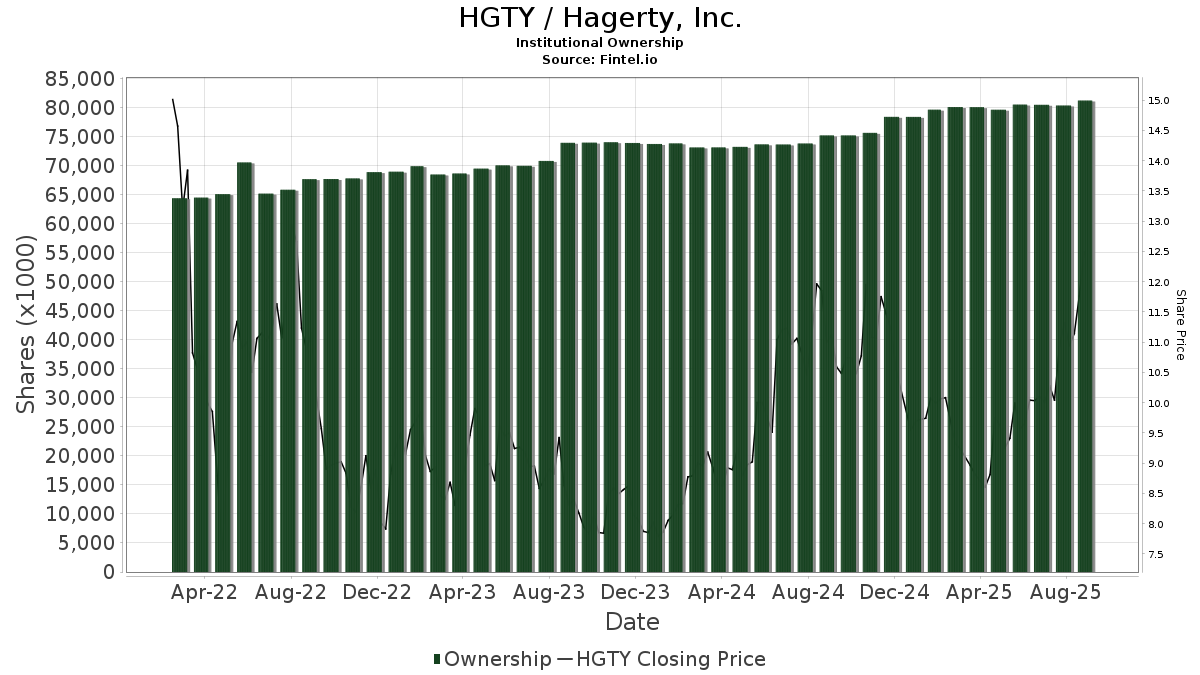

There are 100 funds or institutions reporting positions in Hagerty Inc -. This is an increase of 2 owner(s) or 2.04%.

Average portfolio weight of all funds dedicated to US:HGTY is 0.1674%, a decrease of 1.6516%. Total shares owned by institutions increased in the last three months by 3.35% to 70,051K shares.

What are large shareholders doing?

Wasatch Advisors holds 5,994,737 shares representing 7.20% ownership of the company. In it's prior filing, the firm reported owning 8,028,594 shares, representing a decrease of 33.93%. The firm decreased its portfolio allocation in HGTY by 35.79% over the last quarter.

Polar Capital Holdings holds 3,000,000 shares representing 3.61% ownership of the company. In it's prior filing, the firm reported owning 1,035,252 shares, representing an increase of 65.49%. The firm increased its portfolio allocation in HGTY by 145.99% over the last quarter.

WGROX - Wasatch Core Growth Fund Investor Class shares holds 2,220,087 shares representing 2.67% ownership of the company. In it's prior filing, the firm reported owning 3,000,000 shares, representing a decrease of 35.13%. The firm decreased its portfolio allocation in HGTY by 37.59% over the last quarter.

WAMCX - Wasatch Ultra Growth Fund Investor Class shares holds 1,525,922 shares representing 1.83% ownership of the company. In it's prior filing, the firm reported owning 2,345,482 shares, representing a decrease of 53.71%. The firm decreased its portfolio allocation in HGTY by 45.17% over the last quarter.

Granahan Investment Management holds 1,386,718 shares representing 1.67% ownership of the company. In it's prior filing, the firm reported owning 1,419,416 shares, representing a decrease of 2.36%. The firm decreased its portfolio allocation in HGTY by 26.92% over the last quarter.

Hagerty Background Information

(This description is provided by the company.)

Based in Traverse City, Michigan, Hagerty’s purpose is to save driving and preserve car culture for future generations and its mission is to build a global business to fund that purpose. Hagerty is home to Hagerty Drivers Club, Hagerty DriveShare, Hagerty Valuation Tools, Hagerty Media, Hagerty Drivers Club magazine, MotorsportReg, Hagerty Garage + Social, the Amelia Island Concours d’Elegance, the Concours d’Elegance of America, the Greenwich Concours d’Elegance, the California Mille, Motorworks Revival and more.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.