Key Points

Spotify dominates the music streaming business, but it's currently betting big on other content formats like video podcasts.

Spotify had a record year for active users, revenue, and profit during 2025, yet its stock has declined by 40% from its record high.

Spotify now trades at an attractive valuation, which presents investors with a big long-term opportunity.

- These 10 stocks could mint the next wave of millionaires ›

Spotify (NYSE: SPOT) operates the world's largest music streaming platform, and it's coming off its best year ever in 2025 with a record number of users, revenue, and profit. As a result, its stock soared to a fresh all-time high, but its valuation reached an unsustainable level, which set the stage for its recent decline of over 40%.

Spotify is investing heavily in advanced technologies like artificial intelligence (AI), in addition to other content types like podcasts and audiobooks, which could fuel significant long-term growth for its platform. Therefore, should investors use the sharp sell-off in its stock as a buying opportunity?

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Leading the tech revolution in music streaming

Spotify has aglobal marketshare of around 31.7% in the music streaming business, so it's comfortably ahead of second-placed Tencent Music, which has a market share of 14.4%. Most platforms offer the same music catalogs, so they have to compete by charging lower subscription fees, developing new features, or including other content formats.

Spotify is widely considered to be the technology leader in this industry, having introduced over 50 new features in 2025 alone. They included the AI-powered Prompted Playlist tool, which gives users the power to control their recommendation algorithms. Through a chatbot-style interface, users can tell Prompted Playlist exactly what type of music they want to hear, and set boundaries for what content it presents.

By giving users more control over their listening experience, Spotify believes they will spend more time on the platform, which is a win for creators and artists.

On the content side, Spotify has always been a popular destination for podcasts, but it started investing heavily in the video podcast segment last year with a new partner program that rewards creators with significant financial incentives. More than 530,000 video podcasts have been added to the platform so far, and consumption of this content has soared by 90% since the program was introduced. In other words, video podcasts have become a powerful driver of engagement for Spotify.

Spotify's profits soared last year

Spotify ended 2025 with 751 million monthly active users, which was up 11% from the previous year. It had 476 million active free users who were monetized through ads, and 290 million Premium members who were paying a monthly subscription fee for an ad-free experience.

Premium members accounted for 89% of the company's $20.4 billion in total revenue last year, because advertising simply doesn't bring in much money. As a result, Spotify is always trying to convert as many free members into paying subscribers as possible.

Like most tech companies, Spotify spent its early years investing aggressively in growth even if it meant losing money. But the company is now very focused on generating profits to create a more sustainable business for the long term, which is why management actually trimmed operating expenses by around 2% during 2025.

With more money coming in and less money going out, Spotify's annual net income (profit) soared by 94% year over year, to a record $2.6 billion.

Spotify's stock has fallen to an attractive valuation

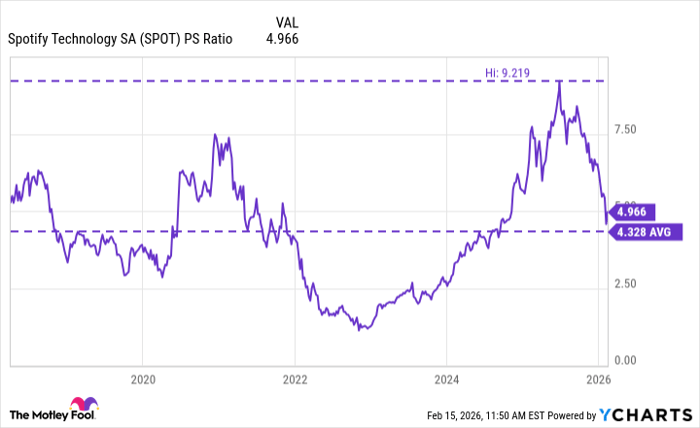

When Spotify stock peaked last year, its price-to-sales (P/S) ratio was at a record high of 9.2, which was more than double its average of around 4.3 dating back to when it went public in 2018.

However, the company's steady revenue growth, combined with the recent 40% decline in its stock, has pushed its P/S ratio down to 4.9. While still higher than its long-term average, it's definitely far more reasonable.

SPOT PS Ratio data by YCharts

Moreover, thanks to Spotify's 2025 earnings of $12.48 per share, its stock is trading at a price-to-earnings (P/E) ratio of 36.7. That is a premium to the Nasdaq-100 technology index, which trades at a P/E ratio of 31.7, but I would argue it isn't necessarily expensive given the streaming giant's long-term potential.

For example, 3.5% of the world's entire population are Spotify Premium subscribers right now, but co-CEO Alex Norström believes that number could climb to 10% or even 15% in the future. He's effectively predicting that the size of Spotify's business could rise more than fourfold, and if he's right, the stock would be an absolute bargain at the current price.

As a result, I think Spotify's recent dip could be a good buying opportunity for investors who are willing to hold on for the long term, preferably five years or more.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $479,761!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $50,247!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $415,256!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 18, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Spotify Technology and Tencent. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.