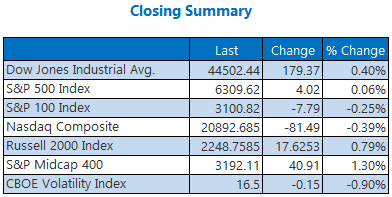

Stocks were a mixed bag again today, as a tech sector pullback dented the broader market. The Dow managed a 179-point win, while Nasdaq settled lower, and the S&P 500 scored another record close, brushing off losses from semiconductor giants Broadcom (AVGO) and Nvidia (NVDA). Between profit taking and a worrisome funding report about OpenAI's latest project, investors are on edge ahead of a slew of Magnificent Seven earnings reports.

Continue reading for more on today's market, including:

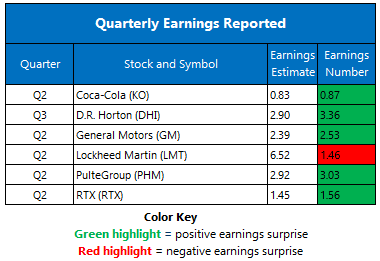

- 2 homebuilding stocks made moves today.

- Why this defense stock dragged the Dow.

- Plus, lucrative sectors to watch; pre-earnings look at Alphabet stock; and another Dow laggard.

5 Things to Know Today

- Euro zone loan demand is on the move even amid tariff pressures. (Reuters)

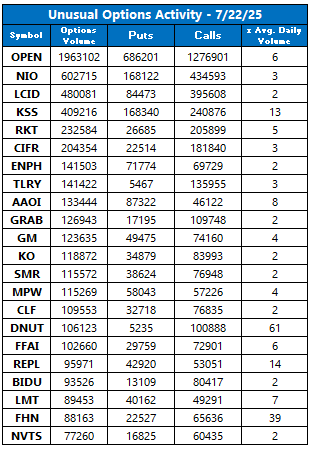

- Zero-day expiration (ODTE) options volume continues to boom. (MarketWatch)

- 3 sectors with short squeeze potential.

- Alphabet stock gears up for earnings.

- This blue-chip stock is now a downgrade risk.

Commodities Cool as Tariff Deadline Looms

Oil prices logged a third-straight loss, as black gold chops lower ahead of the Aug. 1 tariff deadline. August-dated West Texas Intermediate (WTI) crude gave back 99 cents, or 1.5%, to settle at $66.21 per barrel.

Gold prices also suffered from profit-taking, but the safe-haven asset's losses were kept in check by growing tariff tensions. August-dated gold futures shed 0.3% to settle at $3,396.10.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.