Plug Power Inc. PLUG has been benefiting from robust demand for the electrolyzer product line. In the first nine months of 2025, revenues from the electrolyzer product line surged 61% on a year-over-year basis, constituting 24.7% of PLUG’s total business. This solid growth was supported by increased demand for the company’s GenEco proton exchange membrane (PEM) electrolyzers across the industrial and energy sectors globally. PLUG has a robust pipeline of electrolyzer projects and is working to mobilize more than 230 MW of its GenEco electrolyzers across North America, Europe and Australia.

In December 2025, PLUG signed a letter of intent for the installation of a five MW PEM electrolyzer at Hy2gen’s Sunrhyse hydrogen production plant in Signes. Both companies are working to create a global framework for the production and distribution of renewable hydrogen, which would enhance the transition to energy across major international markets. Also, in November, the company started installing a five MW electrolyzer for the H2 Hollandia project in the Netherlands, which will use solar power to produce green hydrogen by 2026.

Apart from this, in October, Plug Power delivered a 10-megawatt (MW) GenEco electrolyzer to Galp’s Portugal-based Sines Refinery, which is Europe’s largest PEM hydrogen project. The company secured an order to install a total of 10 arrays of GenEco electrolyzers with Hydrogen Processing Units by early 2026.

Overall, strong electrolyzer demand positions Plug Power well for stronger revenue growth in the quarters ahead. This momentum is expected to continue supporting the company’s growth trajectory going forward.

Snapshot of Plug Power’s Peers

Among its major peers, Flux Power Holdings, Inc. FLUX reported revenues of $13.2 million in the first quarter of fiscal 2026 (ended September 2025). Flux Power’s total revenues decreased 18% year over year in the quarter, due to a shift of sales mix to lower-priced products in the material handling market and reduced volumes in the ground support market.

In the third quarter of 2025, another PLUG peer, Bloom Energy Corp.’s BE product and service revenues rose 55.7% year over year. Bloom Energy’s total revenues surged 57.1% year over year. The growth was fueled by robust demand for Bloom Energy’s solid oxide fuel cell systems and expanding adoption of hydrogen-capable solutions.

The Zacks Rundown for PLUG

Shares of Plug Power have gained 89.5% in the past six months compared with the industry’s growth of 24.6%.

Image Source: Zacks Investment Research

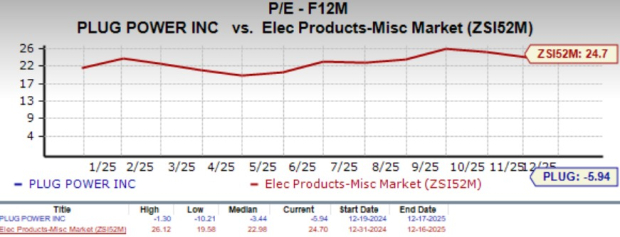

From a valuation standpoint, Plug Power is trading at a forward price-to-earnings ratio of a negative 5.94X against the industry average of 24.70X. PLUG carries a Value Score of F.

Image Source: Zacks Investment Research

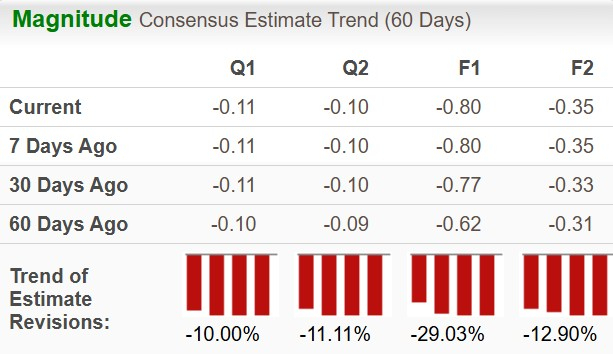

The Zacks Consensus Estimate for PLUG’s bottom line for 2025 has declined in the past 60 days.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Plug Power, Inc. (PLUG) : Free Stock Analysis Report

Flux Power Holdings, Inc. (FLUX) : Free Stock Analysis Report

Bloom Energy Corporation (BE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.