Super Micro Computer SMCI and Vertiv Holdings VRT are two key providers of solutions in the data center liquid-cooling space. The data center liquid-cooling space is driven mainly by coolant architectures needed for AI and high-performance computing at present and both SMCI and VRT are capitalizing on its growth.

Per a report by MarketsAndMarkets, the data center cooling market is anticipated to witness a CAGR of 11.8% from 2025 to 2032. With this strong industry outlook, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects and market challenges to find out the stock that has more upside potential.

The Case for SMCI Stock

Super Micro Computer’s next-generation air-cooled and liquid-cooled GPU and AI platforms are experiencing massive growth in traction, leading to more than 70% contribution to its top line in the fourth quarter of fiscal 2025. SMCI’s server and storage revenues are driven by its direct liquid cooling products for data-center applications, which reached a production volume of more than 2000 DLC racks per month.

High volume shipments of liquid-cooled 4U NVIDIA B200 HGX systems and GB200 NVL72 racks developed by SMCI in the third quarter of fiscal 2025 further reflect traction in SMCI’s liquid cooling technology. Furthermore, SMCI launched DLC-2 technology in May 2025 with features like water and space saving, noise reduction and reduced power consumption to lower the electricity cost by up to 40%, putting it at the forefront of liquid cooling technology.

However, SMCI is facing some near-term headwinds like delayed purchasing decisions from customers as they are evaluating the adoption of next-generation AI platforms. SMCI is also facing margin contraction due to the growing price competition from established competitors like HPE and Dell Technologies in the server space. The Zacks Consensus Estimate for the first and second quarters of fiscal 2026 earnings is pegged at 47 and 58 cents per share, indicating a year-over-year decline of 37% and 5%, respectively.

Image Source: Zacks Investment Research

The Case for VRT Stock

Vertiv also commands a strong thermal management portfolio. It provides Coolant Distribution Units, chillers, rear-door heat exchangers, and immersion cooling systems to optimize performance, power utilization, control, and heat re-use. The complexity of hybrid air and liquid cooling brought in by AI and HPC workloads presents significant opportunities for the company to innovate its offerings. Vertiv acquired CoolTera in 2023 to deepen its expertise in advanced cooling technology, controls and systems.

Vertiv continues to invest in research and capacity expansion to support the growing AI infrastructure deployment needs. Vertiv’s high-density reference design for NVIDIA’s GB300 NVL72 platform supports up to 142kW per rack through a combination of liquid and air cooling for AI factories. Vertiv has also developed the iGenius Colosseum sovereign AI factory in collaboration with NVIDIA.

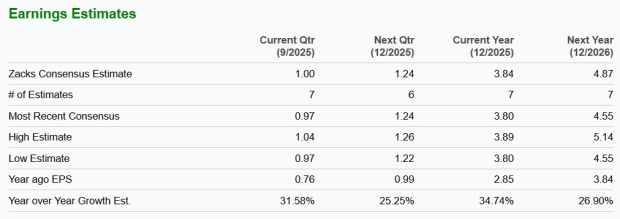

These factors are contributing to both the top and bottom-line growth of Vertiv. The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $9.98 billion, indicating year-over-year growth of 24.6%. The Zacks Consensus Estimate for fiscal 2025 earnings is pegged at $3.84 per share, indicating year-over-year growth of 34.74%.

Image Source: Zacks Investment Research

Stock Price Performance and Valuation of SMCI & VRT

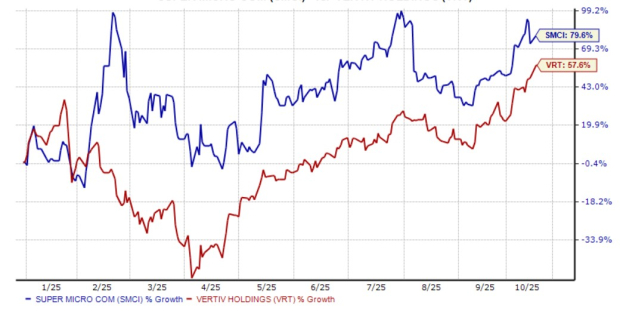

Shares of SMCI and VRT have gained 79.7% and 57.6%, respectively, in the year-to-date period.

Image Source: Zacks Investment Research

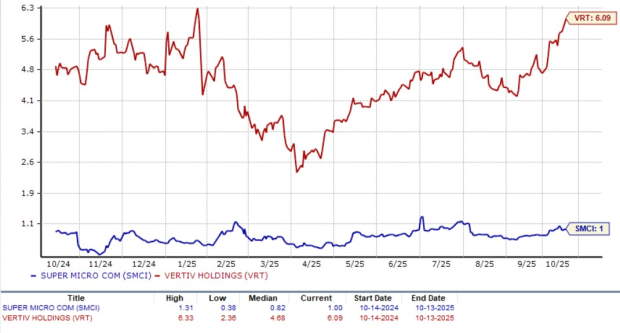

SMCI is trading at a forward 12-month Price to Sales ratio of 1.00X, which is higher than its median of 0.82X. VRT is trading at a forward sales multiple of 6.09X, higher than its median of 4.68X.

Image Source: Zacks Investment Research

Conclusion: SMCI vs. VRT Stock

Both SMCI and VRT are gaining from the momentum in the cooling technology due to the use case in AI workloads and HPC. However, VRT’s financials make it a stronger pick among the two.

VRT carries a Zacks Rank #2 (Buy) at present, making the stock a stronger pick compared with SMCI, which has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.