Simon Property SPG and bp’s global EV charging business, bp pulse joined hands for the installation and operation of more than 900 ultra-fast EV chargers at 75 sites in the United States. The move will benefit Simon in expanding its EV charging options across its portfolio and lure more shoppers.

The first location with chargers from bp pulse will be made open to the public in early 2026 and support vehicles from nearly all EV makers. The Simon portfolio aligns with bp pulse’s strategy to deploy ultra-fast charging across the West Coast, East Coast, Sun Belt and Great Lakes.

Simon focuses on providing best-in-class brands, amenities, experiences and sustainable practices to their customers and the communities it serves. The latest move is also in line with such efforts and is likely to drive healthy demand for its properties, aiding leasing activity, occupancy levels and rent growth.

Simon Property has been restructuring its portfolio, aiming at premium acquisitions and transformative redevelopments. In fact, over the past years, the company has been investing billions to transform its properties, focusing on creating value and driving footfall.

Its focus on supporting omnichannel retailing and developing mixed-use assets is encouraging. Simon Property also capitalized on buying recognized retail brands in bankruptcy. With the brands generating a decent amount from digital sales, investments in them seem strategic for Simon Property.

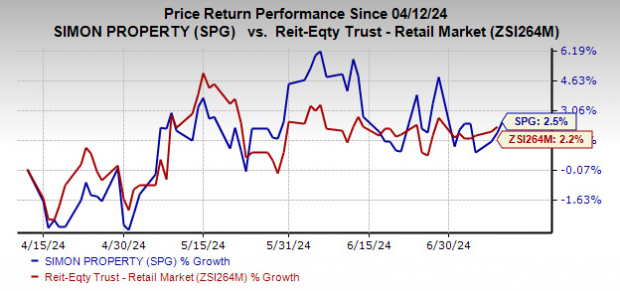

Over the past three months, shares of this Zacks Rank #3 (Hold) company have increased 2.5% compared with the industry’s rise of 2.2%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Tanger Inc. SKT and Realty Income O, each currently carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for SKT’s 2024 FFO per share stands at $2.06, indicating an increase of 5.1% from the year-ago reported figure.

The Zacks Consensus Estimate for O’s 2024 FFO per share is pinned at $4.21, suggesting year-over-year growth of 5.3%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Tanger Inc. (SKT) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.