Aurora Cannabis ACB sits at the intersection of a shifting regulatory landscape as the Trump administration moves to reclassify marijuana. While the decision marks a constructive step for the cannabis industry, its financial implications are uneven across operators.

Notably, ACB stock has lost over 5% in the past month despite the positive regulatory development, suggesting investors are weighing company-specific fundamentals more heavily than sector-wide policy momentum.

Let’s delve into the company’s fundamentals to gain a better understanding of how to play the stock amid this recent development.

Aurora’s Medical Cannabis Strategy Sets It Apart

Aurora Cannabis continues to derive the majority of its growth from its medical cannabis segment, underscoring the company’s strategic focus on higher-margin, regulated markets. For the six months of fiscal 2026 (year ended March 2026), Aurora delivered solid top-line growth, driven primarily by record performance in global medical cannabis.

Medical cannabis revenues rose nearly 25% year over year to C$135.3 million, accounting for 72% of total revenues. Growth was fueled by higher sales in international markets like Australia, Germany, Poland and the UK, as well as increased revenues in Canada from insurance-covered and self-paying patients.

The higher sales also helped improve adjusted gross margin numbers for the medical cannabis segment. While Aurora did not disclose these numbers on a six-month basis, it reported a year-over-year improvement in medical cannabis margins in each of the first two quarters of fiscal 2026, reflecting a favorable mix of international sales, premium products and ongoing production efficiencies.

These margin gains, combined with disciplined cost control, helped adjusted EBITDA rise 92% year over year to C$26.2 million for the six months ended September 2025, highlighting the operating leverage embedded in Aurora’s medical-focused model.

Looking ahead, Aurora expects the trend of growth in international medical cannabis sales to continue in the fiscal third quarter, supported by new product introductions and market expansion initiatives. It also expects to generate positive cash flow during the quarter, driven by improved operating cash yield.

Aurora’s Declining Cannabis Consumer Sales

Aurora Cannabis continues to face pressure in its consumer cannabis business, even as its medical segment delivers consistent growth. Persistent price compression and intense competition in Canada’s adult-use market have weighed on revenues and margins, limiting the segment’s contribution to overall performance.

In response, Aurora Cannabis has deliberately scaled back its exposure to low-margin recreational products and redirected resources toward higher-value opportunities. It is now prioritizing the production and supply of GMP-certified medical cannabis, where pricing power and regulatory barriers support more attractive margins and greater earnings visibility.

This strategic realignment reflects management’s focus on profitability over volume. While the weaker consumer cannabis performance remains a near-term headwind, Aurora’s emphasis on premium medical offerings and ongoing cost optimization is expected to help stabilize earnings and reduce reliance on Canada’s challenged recreational market.

Other Players in the Cannabis Space

Aurora Cannabis operates in a highly competitive market where growth opportunities remain limited and fragmented. It faces stiff competition from its peers like Canopy Growth CGC and Tilray Brands TLRY, both of which are also focused on international expansion and cost efficiency.

As ACB continues to expand its presence in regulated medical cannabis markets, competitive responses from CGC and TLRY are likely to intensify. This could lead to more aggressive moves from these peers and possibly further consolidation in the sector.

ACB Stock Performance & Valuation Estimates

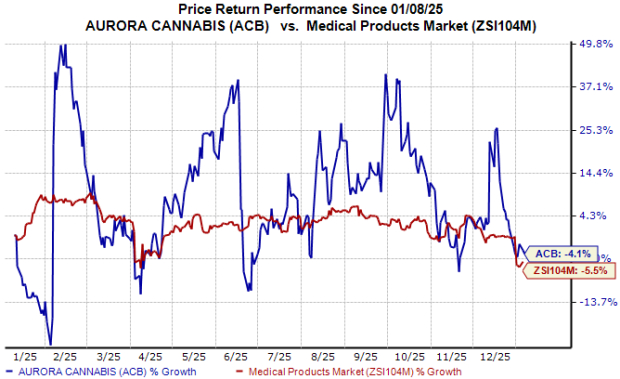

The stock has outperformed the industry in the past year, as seen in the chart below.

Image Source: Zacks Investment Research

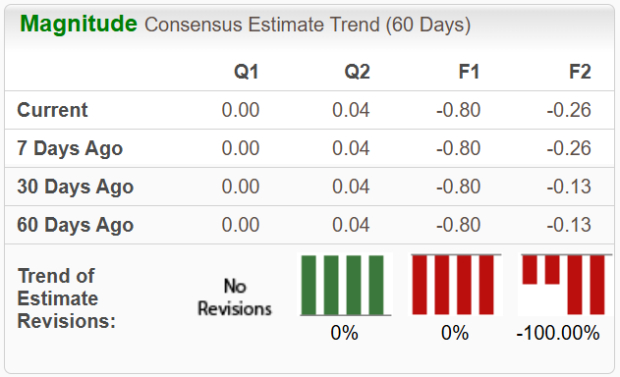

While loss per share estimates for fiscal 2026 have remained unchanged at 80 cents in the last 30 days, those for 2027 have widened from 13 cents to 26 cents during the same time frame.

Image Source: Zacks Investment Research

How to Play ACB Stock?

While marijuana reclassification is expected to favor medical cannabis, the benefits are uneven across the industry. Aurora Cannabis, despite being listed in the United States, has minimal operating exposure to the U.S. market, limiting its ability to benefit directly from potential federal reforms.

At the same time, valuation signals remain mixed. Loss estimates for fiscal 2027 have widened sharply, doubling over the past month. This shift points to a more cautious analyst outlook and suggests rising uncertainty around the sustainability of earnings momentum beyond the near term.

Given these factors, investors may want to hold off on initiating or adding to positions until Aurora reports its fiscal fourth-quarter results. A cautious approach toward this Zacks Rank #3 (Hold) stock remains warranted.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Canopy Growth Corporation (CGC) : Free Stock Analysis Report

Tilray Brands, Inc. (TLRY) : Free Stock Analysis Report

Aurora Cannabis Inc. (ACB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.