Fintel reports that on May 12, 2023, Shore Capital reiterated coverage of Intertek Group (LSE:ITRK) with a Hold recommendation.

Analyst Price Forecast Suggests 13.15% Upside

As of May 11, 2023, the average one-year price target for Intertek Group is 4,659.72. The forecasts range from a low of 3,585.50 to a high of $5,775.00. The average price target represents an increase of 13.15% from its latest reported closing price of 4,118.00.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Intertek Group is 3,424MM, an increase of 7.24%. The projected annual non-GAAP EPS is 2.27.

Intertek Group Maintains 2.57% Dividend Yield

At the most recent price, the company's dividend yield is 2.57%.

Additionally, the company's dividend payout ratio is 0.59. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.The company has not increased its dividend in the last three years.

For a list of the companies with the highest dividend yield, see Fintel's Dividend Screener.

What is the Fund Sentiment?

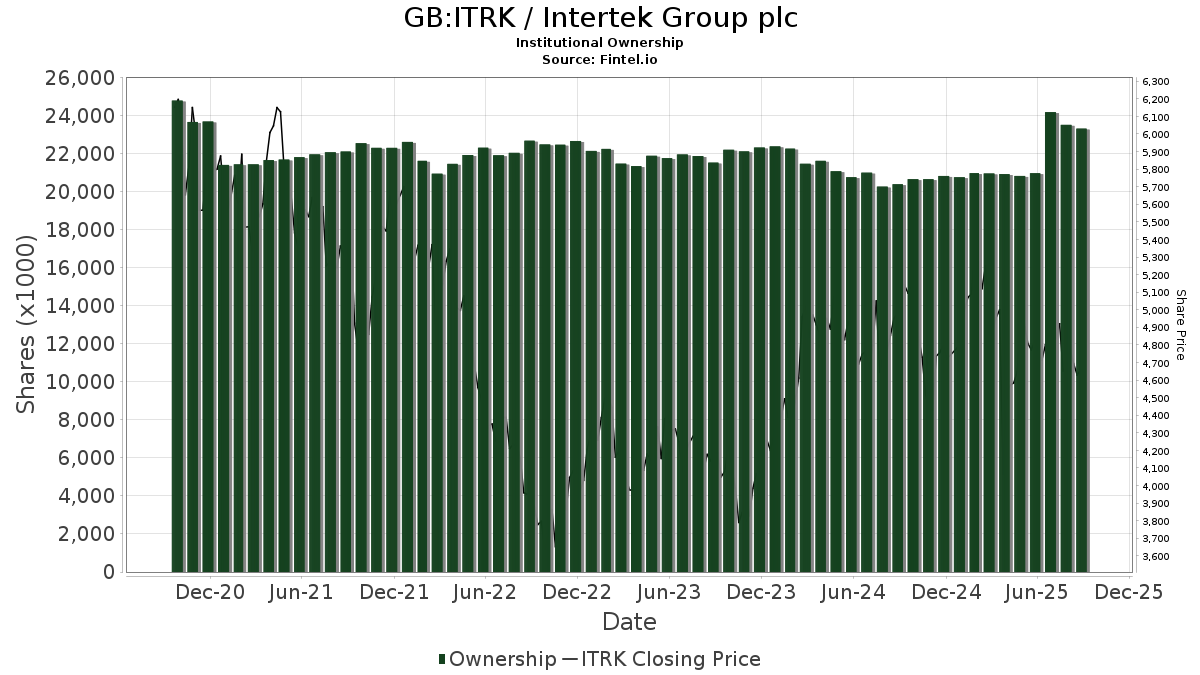

There are 267 funds or institutions reporting positions in Intertek Group. This is a decrease of 13 owner(s) or 4.64% in the last quarter. Average portfolio weight of all funds dedicated to ITRK is 0.27%, an increase of 7.97%. Total shares owned by institutions decreased in the last three months by 1.60% to 21,876K shares.

What are Other Shareholders Doing?

MGIAX - MFS International Intrinsic Value Fund A holds 3,734K shares representing 2.32% ownership of the company. No change in the last quarter.

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 2,134K shares representing 1.32% ownership of the company. In it's prior filing, the firm reported owning 2,154K shares, representing a decrease of 0.93%. The firm increased its portfolio allocation in ITRK by 8.31% over the last quarter.

VTMGX - Vanguard Developed Markets Index Fund Admiral Shares holds 1,230K shares representing 0.76% ownership of the company. In it's prior filing, the firm reported owning 1,203K shares, representing an increase of 2.26%. The firm increased its portfolio allocation in ITRK by 2.40% over the last quarter.

BBIEX - Bridge Builder International Equity Fund holds 942K shares representing 0.58% ownership of the company. In it's prior filing, the firm reported owning 933K shares, representing an increase of 0.95%. The firm increased its portfolio allocation in ITRK by 0.60% over the last quarter.

IEFA - iShares Core MSCI EAFE ETF holds 876K shares representing 0.54% ownership of the company. In it's prior filing, the firm reported owning 854K shares, representing an increase of 2.51%. The firm increased its portfolio allocation in ITRK by 8.89% over the last quarter.

See all Intertek Group regulatory filings.This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.