Shopify’s SHOP capacity to monetize the economic activity on its platform is evident in the rapid acceleration of its Merchant Solutions revenues, which jumped 37% year over year in the second quarter of 2025. Rising sales among existing merchants and new additions resulted in a 31% increase in Gross Merchandise Volume (GMV), which reached $87.84 billion.

The increased use of Shopify Payments, which attained a 64% penetration rate in the second quarter, has been a major driver of this acceleration. Shop Pay, Shopify's quick and safe checkout system, processed $27 billion in GMV, marking a 65% year-over-year jump. Merchant Solutions' revenues were significantly driven by the 29% growth in the offline commerce category and the remarkable 101% rise in the B2B segment.

Shopify expects mid-to-high 20% revenue growth for the third quarter of 2025, led by sustained strength in Merchant Solutions. Continued expansion of payment solutions in more countries, further adoption of AI and agentic commerce technologies, and strategic performance marketing investments are expected to drive ongoing acceleration. International growth, especially in Europe and emerging markets, is a key catalyst.

New merchant-friendly tools like Shop Minis, Shop Cash, Sign in with Shop, and Shop Pay solutions are helping Shopify win merchants rapidly. The Zacks Consensus Estimate for third-quarter 2025 Merchant solutions revenues is pegged at $2.03 billion, indicating 31% growth from the figure reported in the year-ago quarter.

Tough Competition Hurts SHOP’s Prospects

Shopify is facing stiff competition in the e-commerce marketplace from the likes of eBay EBAY and Amazon AMZN.

eBay is a significant player in e-commerce, with 134 million active buyers and $19.5 billion GMV in the second quarter of 2025. eBay leverages generative AI to enhance ads and listings, driving advertising revenues 17% on an FX-neutral basis. Focus category GMV rose more than 10% in the second quarter of 2025, outpacing core categories, with all focus areas accelerating year over year. Collectibles led the growth, as trading card GMV rose for the tenth straight quarter, driven by continued strength in sports and collectible card games.

Amazon dominates the U.S. e-commerce market, driven by its “Buy with Prime" service, which combines its payments and fulfillment services and makes them available at checkout on other websites, and promises faster delivery for Prime members. Amazon’s vast customer base, logistics and AI tools make it a formidable competitor worldwide.

SHOP’s Share Price Performance, Valuation & Estimates

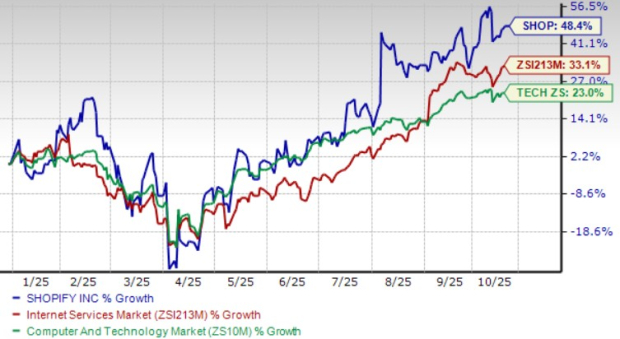

Shopify shares have jumped 48.4% year to date, outperforming the broader Zacks Computer and Technology sector’s return of 23% and the Zacks Internet Services industry’s appreciation of 33.1%.

SHOP Stock’s Performance

Image Source: Zacks Investment Research

Shopify stock is overvalued, with a forward 12-month price/sales of 15.58X compared with the broader sector’s 6.9X. SHOP has a Value Score of F.

SHOP Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2025 earnings is pegged at $1.45 per share, which has remained unchanged over the past 30 days. This suggests 11.5% year-over-year growth.

Shopify Inc. Price and Consensus

Shopify Inc. price-consensus-chart | Shopify Inc. Quote

Shopify currently sports a Zacks Rank #1 (Strong buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.