Sandisk SNDK is riding on strong datacenter revenue growth, which increased 26% sequentially in the first quarter of fiscal 2026, driven by strong demand for the “Stargate” product line. Growing interest in the company’s technology from global hyperscalers, neocloud and OEM customers is noteworthy. Stargate — SNDK’s storage-focused SSD product line — is expected to gain traction among these customers.

Meanwhile, Sandisk’s BiCS8 technology accounted for 15% of total bits shipped and is expected to reach the majority of bit production exiting fiscal 2026. Rapid growth of AI is creating a strong tailwind for SNDK’s high-capacity, power-efficient SSDs enabled by the BiCS8 technology. Investments in data centers and AI infrastructure are expected to surpass $1 trillion by 2030, which bodes well for Sandisk’s prospects.

For the second quarter of fiscal 2026, Sandisk expects revenues between $2.55 billion and $2.65 billion, driven by double-digit price increases and mid-single-digit bit growth. SNDK expects non-GAAP operating expenses between $450 million and $475 million, primarily to support data center business expansion and high-bandwidth flash innovation. The Zacks Consensus Estimate for second-quarter fiscal 2026 revenues is currently pegged at $2.62 billion.

SNDK Faces Tough Competition in the Datacenter & AI Space

Sandisk competes against Dell Technologies DELL and Micron Technology MU in the datacenter and AI space.

In the third quarter of fiscal 2026, Dell Technologies’ AI-optimized server momentum saw an increase of $12.3 billion in orders and $30 billion of orders year to date. DELL shipped $5.6 billion worth of AI servers in the fiscal third quarter, and the AI server backlog remained healthy at $18.4 billion. Dell Technologies’ focus on AI infrastructure has positioned it as a leader in the market. DELL expects to ship approximately $9.4 billion worth of AI servers in the fiscal fourth quarter of 2026. Its AI server shipments are expected to reach $25 billion for fiscal 2026, indicating remarkable 150% year-over-year growth.

Micron is capitalizing on the AI boom with its HBM3E solutions, which are increasingly being adopted by major hyperscalers and enterprise customers. On the first-quarter fiscal 2026earnings call the company highlighted strong customer interest in its HBM3E portfolio, which is expected to drive substantial revenue growth in the quarters ahead. Micron’s HBM portfolio is generating multi-billion-dollar quarterly revenues. MU is poised to be the key beneficiary of surging AI-related infrastructure spending, as companies continue to build out GPU clusters and AI data centers that require advanced memory solutions.

SNDK’s Share Price Performance, Valuation & Estimates

Sandisk shares have appreciated 418.3% in the trailing six-month period, outperforming the broader Zacks Computer and Technology sector’s return of 21.1%.

SNDK Stock Outperforms Sector

Image Source: Zacks Investment Research

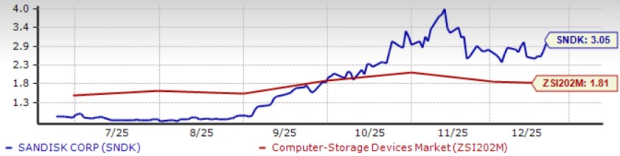

The SNDK stock is trading at a premium, with a forward 12-month price/sales of 3.05X compared with the Zacks Computer-Storage Devices’ 1.81X. Sandisk has a Value Score of D.

SNDK Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for fiscal 2026 earnings is pegged at $12.59 per share, up 3.2% over the past 30 days. Sandisk reported earnings of $2.99 per share in fiscal 2025.

Sandisk Corporation Price and Consensus

Sandisk Corporation price-consensus-chart | Sandisk Corporation Quote

Sandisk currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

Sandisk Corporation (SNDK) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.