Safety Insurance Group said on May 3, 2023 that its board of directors declared a regular quarterly dividend of $0.90 per share ($3.60 annualized). Previously, the company paid $0.90 per share.

Shares must be purchased before the ex-div date of May 31, 2023 to qualify for the dividend. Shareholders of record as of June 1, 2023 will receive the payment on June 15, 2023.

At the current share price of $70.78 / share, the stock's dividend yield is 5.09%.

Looking back five years and taking a sample every week, the average dividend yield has been 4.16%, the lowest has been 3.23%, and the highest has been 5.32%. The standard deviation of yields is 0.49 (n=236).

The current dividend yield is 1.89 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 2.01. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company has not increased its dividend in the last three years.

Learn to Harvest Dividends

Buy Stock. Capture Dividend. Sell Stock. Repeat. This is the essence of dividend harvesting and you can do it easily with Fintel's Dividend Capture Calendar.

What is the Fund Sentiment?

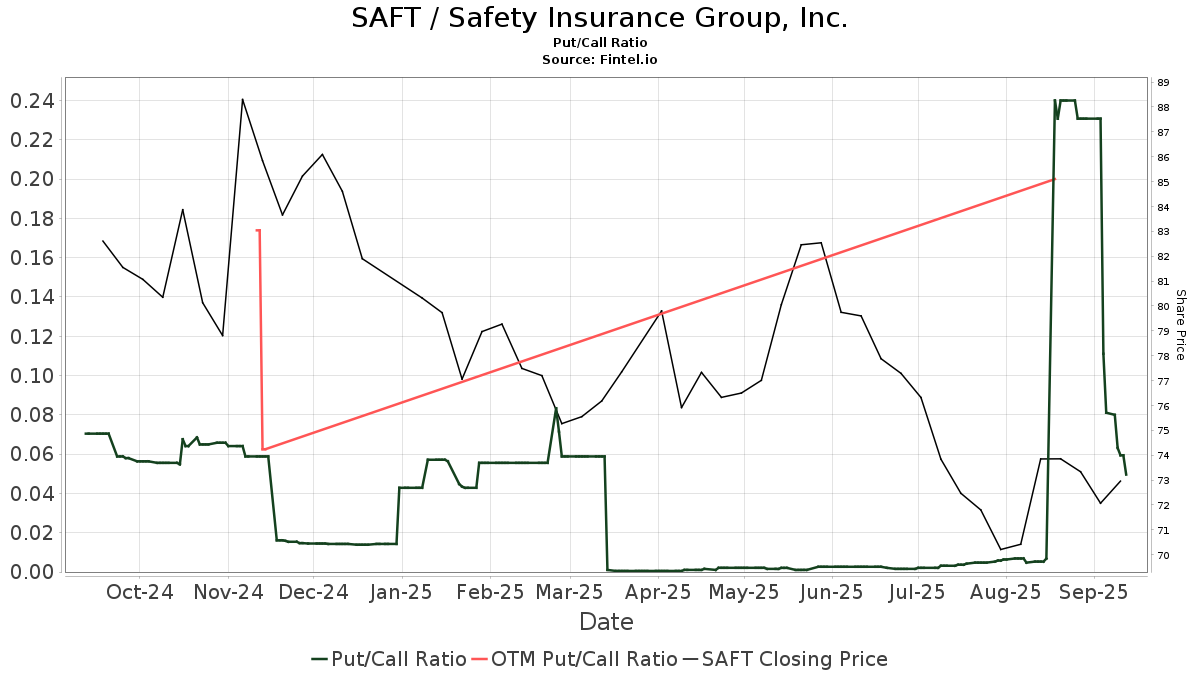

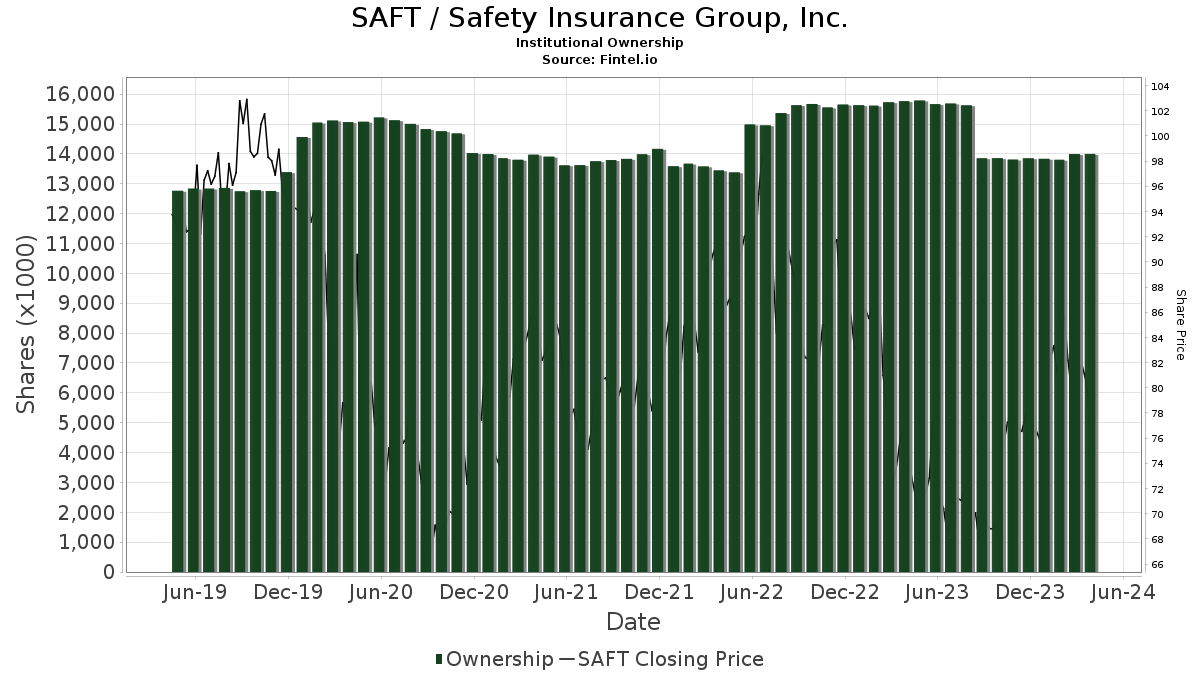

There are 452 funds or institutions reporting positions in Safety Insurance Group. This is an increase of 9 owner(s) or 2.03% in the last quarter. Average portfolio weight of all funds dedicated to SAFT is 0.15%, a decrease of 0.12%. Total shares owned by institutions increased in the last three months by 1.69% to 15,871K shares.  The put/call ratio of SAFT is 3.42, indicating a bearish outlook.

The put/call ratio of SAFT is 3.42, indicating a bearish outlook.

What are Other Shareholders Doing?

Bank of New York Mellon holds 1,874K shares representing 12.71% ownership of the company. In it's prior filing, the firm reported owning 1,857K shares, representing an increase of 0.87%. The firm decreased its portfolio allocation in SAFT by 1.95% over the last quarter.

SRB holds 1,675K shares representing 11.36% ownership of the company. No change in the last quarter.

IJR - iShares Core S&P Small-Cap ETF holds 982K shares representing 6.66% ownership of the company. No change in the last quarter.

Victory Capital Management holds 959K shares representing 6.51% ownership of the company. In it's prior filing, the firm reported owning 864K shares, representing an increase of 9.98%. The firm decreased its portfolio allocation in SAFT by 40.29% over the last quarter.

SSGSX - Victory Sycamore Small Company Opportunity Fund holds 482K shares representing 3.27% ownership of the company. In it's prior filing, the firm reported owning 467K shares, representing an increase of 3.03%. The firm decreased its portfolio allocation in SAFT by 5.76% over the last quarter.

Safety Insurance Group Background Information

(This description is provided by the company.)

Safety Insurance Group, Inc., based in Boston, MA, is the parent of Safety Insurance Company, Safety Indemnity Insurance Company, and Safety Property and Casualty Insurance Company. Operating exclusively in Massachusetts, New Hampshire, and Maine, Safety is a leading writer of property and casualty insurance products, including private passenger automobile, commercial automobile, homeowners, dwelling fire, umbrella, and business owner policies.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.