RTX Corporation’s RTX business segment, Raytheon, recently secured an order worth $536 million from the U.S. Navy to upgrade Flight IIA warships with its SPY-6(v)4 variant of radar.

Per the deal, Raytheon will continue to support the SPY-6 radar family with training, technical services, ship installation, integration and testing, and software upgrades to improve radar capabilities. The contract is projected to be finished by May 2026.

RTX's Proficiency in Producing Superior Radars

Amid rising geopolitical tensions, defense budgets from varied nations have expanded significantly, boosting demand for advanced military weapons, including radar systems.

This must have been ushering in a solid order flow for radar manufacturers like RTX, whose extensive expertise in radar technology applies to a vast range of advanced radar systems for various applications, including air defense, missile defense and maritime surveillance. The latest contract win is a bright example of that.

In particular, the SPY-6 radar family can protect against ballistic missiles, cruise missiles, hostile aircraft and surface ships at the same time. They offer various advantages over conventional radars, including a much longer detection range, higher sensitivity and more accurate discrimination.

Its solid demand is evidenced by the fact that SPY-6 is set to be installed on more than 60 U.S. Navy ships over the next decade.

RTX’s Growth Opportunities

Rising geopolitical tensions, increased defense spending and the need for advanced threat detection are driving demand for military radars. This must have prompted the Mordor Intelligence firm to project a CAGR of 5.2% for the military radar market in the 2025-2030 period. Such growth projections bode well for prominent radar manufacturers like RTX.

RTX’s product portfolio consists of varied radars, such as AN/TPY-2, AN/APG-79, APG-82(V)1, GhostEye MR and a few more, which enjoy solid demand in the global military radar market.

Opportunities for Other Defense Companies

Some other defense contractors that manufacture radars and are thus projected to gain from the expanding global military radar market have been discussed below:

Lockheed Martin Corp. LMT: The company’s radars are the choice of more than 45 nations across six continents. Its product portfolio consists of varied radars like TPY-4, AN/APY-9 Radar, AN/TPQ-53 Radar System, SPY-7, TPS-77 and Sentinel A4.

LMT has a long-term (three to five years) earnings growth rate of 10.5%. The Zacks Consensus Estimate for the company’s 2025 sales indicates year-over-year growth of 4.6%.

Northrop Grumman Corp. NOC: The company is a pioneer in manufacturing Active Electronically Scanned Array radars, with more than 60 years of experience. Its diverse product portfolio also includes a handful of radars like AN/ZPY-5 VADER, AN/TPS-80 G/ATOR, AN/SPQ-9B and HAMMR.

Northrop has a long-term earnings growth rate of 3.3%. The Zacks Consensus Estimate for the company’s 2025 sales calls for year-over-year growth of 2.8%.

L3Harris Technologies, Inc. LHX: The company’s product portfolio includes the SPS-48 land-based surveillance radar, AN/APY-11 Multimode radar, Tactical Air Surveillance radar, AN/SPS-48G Long range 3D surveillance radar and many more.

L3Harris has a long-term earnings growth rate of 12%. The Zacks Consensus Estimate for LHX’s 2025 sales implies an improvement of 1%.

RTX Stock Price Movement

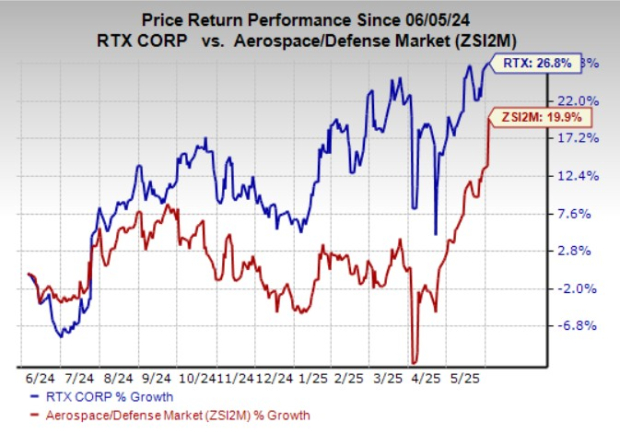

In the past year, shares of RTX have risen 26.8% compared with the industry’s growth of 19.9%.

Image Source: Zacks Investment Research

RTX’s Zacks Rank

RTX currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.