Rockwell Automation Inc. ROK announced that it is expanding its collaborations with NVIDIA NVDA to accelerate the development of safer and smarter industrial AI mobile robots in manufacturing. This move will help customers improve performance and efficiency.

Previously, in March 2024, the companies collaborated to accelerate a next-generation industrial architecture. ROK intends to transform the industry by designing the factory of the future, making it easier for automation customers to digitize industrial processes.

ROK plans on integrating NVIDIA Omniverse Cloud APIs with its Emulate3D digital twin application. This will enable factory analysis, including operations and simulation, to be quicker and more predictive than ever.

As part of this partnership, NVIDIA joined the Rockwell Automation PartnerNetwork, allowing customers to use their applications to improve resilience, agility and sustainability. The companies will benefit from Rockwell's industrial AI expertise and NVIDIA's AI and robotics capabilities, which will fuel an exciting new generation of autonomous mobile robots.

Rockwell Automation is poised well to benefit from broadening its portfolio of hardware and software products, solutions, and services. It is also gaining traction from investments in the cloud.

The company reported adjusted earnings per share (EPS) of $2.50 in second-quarter fiscal 2024 (ended Mar 31, 2024), surpassing the Zacks Consensus Estimate of $2.15. The bottom line declined 17% year over year, primarily attributed to lower sales volume and operating margins in the Intelligent Devices and Software & Control segments. The improved performance of the Lifecycle Services segment somewhat offset this.

Total revenues were $2.13 billion, down 6.6% from the prior-year quarter’s levels. The top line beat the Zacks Consensus Estimate of $2.04 billion.

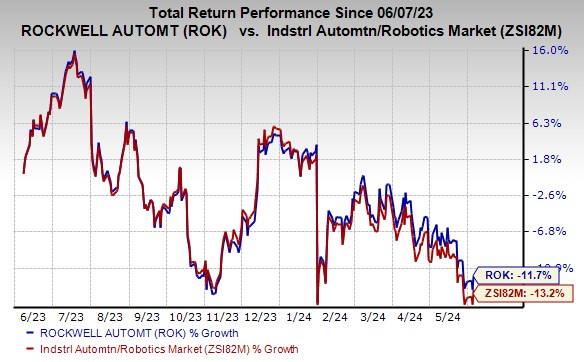

Price Performance

In the past year, Rockwell Automation’s shares have dropped 11.7% compared with the industry’s 13.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Rockwell Automation currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks from the Industrial Products sector are Intellicheck, Inc. IDN and ACCO Brands Corporation ACCO. IDN currently sports a Zacks Rank #1 (Strong Buy) and ACCO carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Intellicheck’s 2024 earnings is pegged at 2 cents. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 28.9%. IDN’s shares have gained 15.2% in the past year.

The Zacks Consensus Estimate for ACCO Brands’ 2024 earnings is pegged at $1.07 per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 25.9%. The stock has gained 6.6% in the past year.

Highest Returns for Any Asset Class

It’s not even close. Despite ups and downs, Bitcoin has been more profitable for investors than any other decentralized, borderless form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts another significant surge in months to come.

Hurry, Download Special Report – It’s FREE >>NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Acco Brands Corporation (ACCO) : Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.