Rithm Capital said on June 23, 2023 that its board of directors declared a regular quarterly dividend of $0.25 per share ($1.00 annualized). Previously, the company paid $0.25 per share.

Shareholders of record as of July 3, 2023 will receive the payment on July 28, 2023.

At the current share price of $9.57 / share, the stock's dividend yield is 10.45%.

Looking back five years and taking a sample every week, the average dividend yield has been 10.23%, the lowest has been 2.25%, and the highest has been 37.81%. The standard deviation of yields is 3.62 (n=235).

The current dividend yield is 0.06 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 1.34. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 1.50%, demonstrating that it has increased its dividend over time.

Learn to Harvest Dividends

Buy Stock. Capture Dividend. Sell Stock. Repeat. This is the essence of dividend harvesting and you can do it easily with Fintel's Dividend Capture Calendar.

What is the Fund Sentiment?

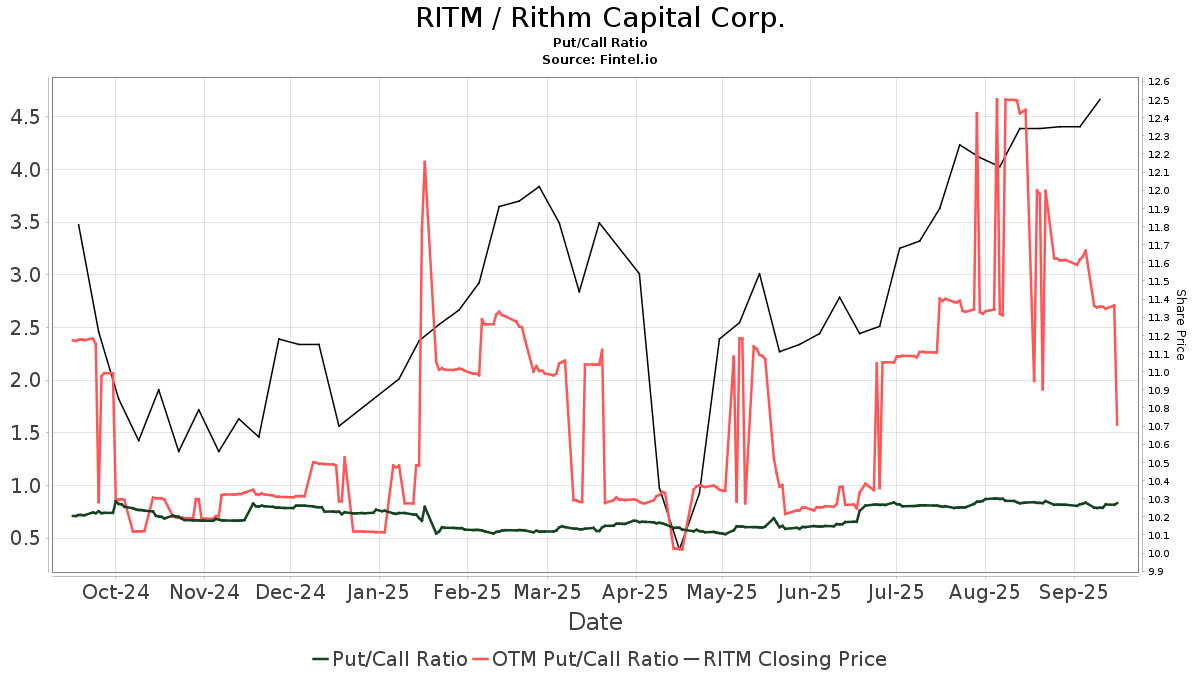

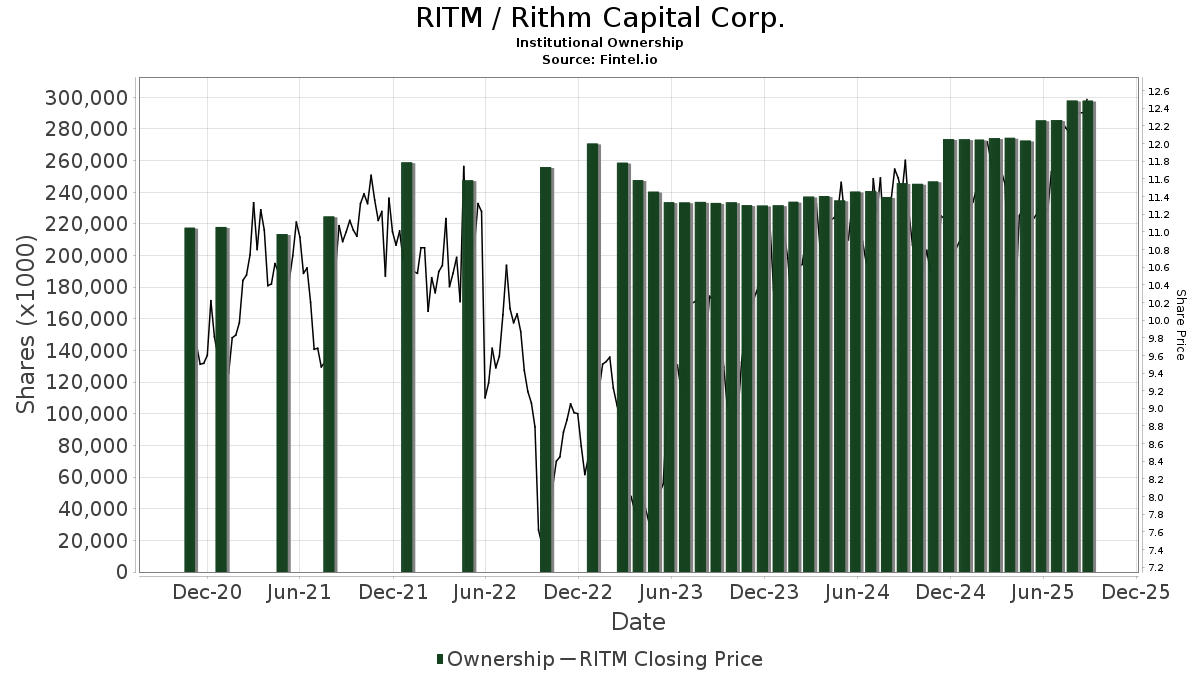

There are 651 funds or institutions reporting positions in Rithm Capital. This is a decrease of 29 owner(s) or 4.26% in the last quarter. Average portfolio weight of all funds dedicated to RITM is 0.16%, a decrease of 20.25%. Total shares owned by institutions decreased in the last three months by 9.68% to 233,604K shares.  The put/call ratio of RITM is 1.04, indicating a bearish outlook.

The put/call ratio of RITM is 1.04, indicating a bearish outlook.

Analyst Price Forecast Suggests 18.84% Upside

As of June 2, 2023, the average one-year price target for Rithm Capital is 11.37. The forecasts range from a low of 9.09 to a high of $13.65. The average price target represents an increase of 18.84% from its latest reported closing price of 9.57.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Rithm Capital is 1,203MM, a decrease of 50.83%. The projected annual non-GAAP EPS is 1.39.

What are Other Shareholders Doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 14,781K shares representing 3.06% ownership of the company. In it's prior filing, the firm reported owning 14,237K shares, representing an increase of 3.68%. The firm decreased its portfolio allocation in RITM by 6.13% over the last quarter.

NAESX - Vanguard Small-Cap Index Fund Investor Shares holds 12,403K shares representing 2.57% ownership of the company. In it's prior filing, the firm reported owning 12,204K shares, representing an increase of 1.60%. The firm decreased its portfolio allocation in RITM by 4.49% over the last quarter.

Bank Of America holds 9,832K shares representing 2.04% ownership of the company. In it's prior filing, the firm reported owning 7,979K shares, representing an increase of 18.84%. The firm increased its portfolio allocation in RITM by 8.80% over the last quarter.

VISVX - Vanguard Small-Cap Value Index Fund Investor Shares holds 8,702K shares representing 1.80% ownership of the company. In it's prior filing, the firm reported owning 8,550K shares, representing an increase of 1.75%. The firm decreased its portfolio allocation in RITM by 0.74% over the last quarter.

Geode Capital Management holds 8,493K shares representing 1.76% ownership of the company. In it's prior filing, the firm reported owning 6,209K shares, representing an increase of 26.89%. The firm increased its portfolio allocation in RITM by 24.10% over the last quarter.

Rithm Capital Background Information

(This description is provided by the company.)

New Residential is a leading provider of capital and services to the mortgage and financial services industry. The Company's mission is to generate attractive risk-adjusted returns in all interest rate environments through a portfolio of investments and operating businesses. New Residential has built a diversified, hard-to-replicate portfolio with high-quality investment strategies that have generated returns across different interest rate environments over time. New Residential's portfolio is composed of mortgage servicing related assets (including investments in operating entities consisting of servicing, origination, and affiliated businesses), residential securities (and associated called rights) and loans, and consumer loans. New Residential's investments in operating entities include its mortgage origination and servicing subsidiary, NewRez, and its special servicing division, Shellpoint Mortgage Servicing, as well as investments in affiliated businesses that provide services that are complementary to the origination and servicing businesses and other portfolios of mortgage related assets. Since inception in 2013, New Residential has a proven track record of performance, growing and protecting the value of its assets while generating attractive risk-adjusted returns and delivering over $3.4 billion in dividends to shareholders. New Residential is organized and conducts its operations to qualify as a real estate investment trust (REIT) for federal income tax purposes. New Residential is managed by an affiliate of Fortress Investment Group LLC, a global investment management firm, and headquartered in New York City.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.