Risk Reduction Using Volatility-Weighting

The Nasdaq Victory Volatility Weighted Index Family (NQVW) is Nasdaq and Victory Capital’s practical solution for volatility-weighting within a liquid, broad market exposure and maximally risk-diversified benchmark framework. It contains 14 sub-indexes that cover four capital markets: US Large Cap, US Small Cap, International and Emerging Markets. Appendix A provides a complete list of descriptions for the Nasdaq Victory Volatility Weighted Index Family.

Why Volatility-Weighting?

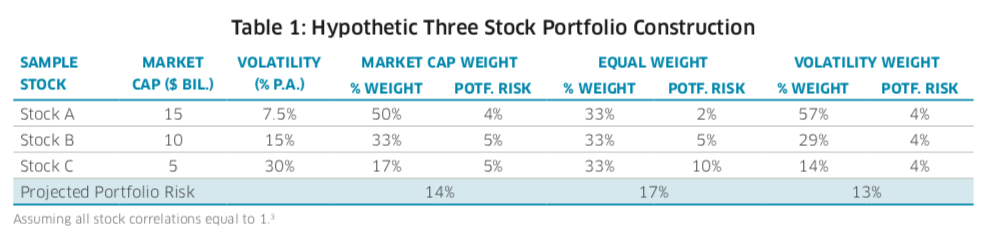

Nasdaq Volatility Weighted Indexes (NQVW) use volatility to determine constituent weights. Simply put, the weight of each stock is based on the inverse of its volatility. The most important benefit of volatility-weighting is equal risk contribution. Stocks with historically higher price volatilities are assigned lower portfolio weights with the goal that each stock will contribute an equal amount of ex-ante (estimated) risk to the portfolio. It appears to be a very intuitive way of reducing portfolio risk through enhanced diversification. The following hypothetical three-stock portfolio example compared the portfolio risk contribution among three different weighting schemes: market cap-weighted, equal-weighted and volatility-weighted. This demonstrates how volatility weights are calculated and assigns each stock with an equal amount of portfolio risk. The volatility weighted portfolio is the most diversified and achieves the lowest portfolio risk among the three weighting methods in our example.

Fundamentals Make a Difference

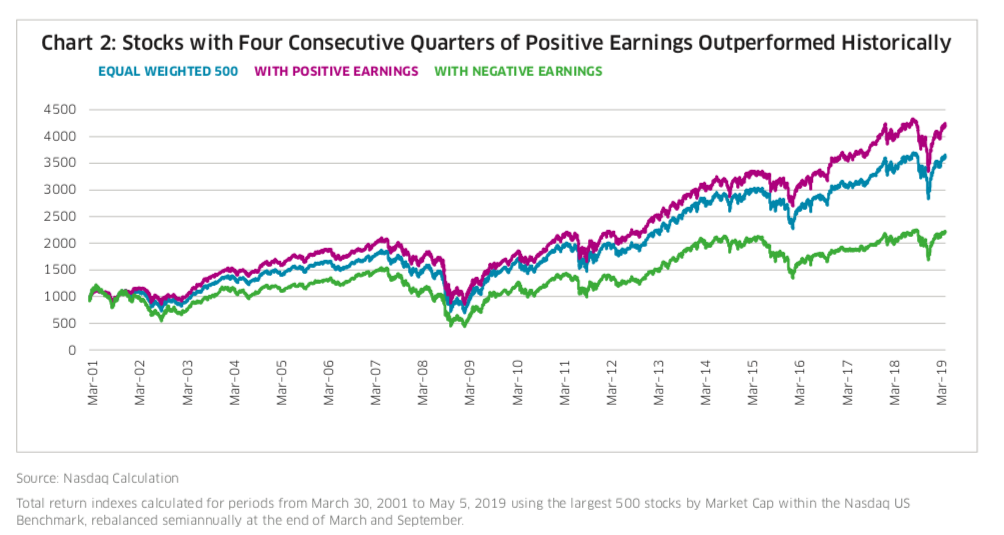

Nasdaq Volatility Weighted Indexes (NQVW) implement a fundamental screen to include only securities with at least four consecutive quarters of net positive earnings.5 Conventional wisdom expects that capital markets will reward profitable companies in the long run. To validate that claim, we conducted similar research with two equal weight portfolios: the first portfolio containing only stocks with positive earnings reported in the most recent four quarters; the second, all remaining stocks in the Nasdaq US Benchmark top 500 list. Our research demonstrated that negative-earnings stocks as a group not only underperformed, but also exhibited higher volatility and experienced much larger drawdowns than the positive-earnings stock portfolio. NQVW’s implementation of a fundamental screen to remove negative-earnings stocks provides another effective way of reducing portfolio risk at the stock selection level.

5. Or two consecutive semi-annual periods of net positive earnings if quarterly earnings were not available.

Summary

The NQVW Indexes originate from the Nasdaq Global Index Family (NQGI). For each market type, the screening process first removes any securities with insufficient liquidity, followed by another screen to remove any unprofitable companies. Then, only the remaining top 500 stocks by market cap are selected. The final indexes are weighted by the inverse of volatility, and capped with maximum country and sector exposures at 20% and 25%, respectively. The major benefits of NQVW’s volatility-weighting schema include:

- Equal contribution of portfolio risk by individual stocks, as well as maximized diversification

- 180-day standard deviation utilized to determine a stock’s volatility, which reduces overall portfolio risk without sacrificing total return (and actually improves Sharpe ratios)

- Lower portfolio volatility and smaller drawdowns as a result of excluding unprofitable companies

- Enhanced diversification due to sector and country constraints.

Please click here to view the full research, including Index Family Descriptions.

Visit the Victory Indexes page on Nasdaq.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.