Rigetti Computing RGTI is pressing forward with one of the most structured superconducting quantum hardware roadmaps among public quantum companies. Its flagship Ankaa-3 system, launched in December 2024, features 84 qubits and delivers a 99% median iSWAP fidelity, with the capability to reach 99.5% using fSim gates. Powered by fast gate speeds (60-80 ns) and a modular architecture, Ankaa-3 reflects Rigetti’s commitment to scalable, low-latency systems that are tuned pre-packaging using its proprietary Alternating-Bias Assisted Annealing technique. The system’s strength lies not only in its fidelity but also in its adaptability for multi-chip expansion, validated by commercial deployments and heightened ecosystem interest.

The next steps in Rigetti’s roadmap are both incremental and strategic. By mid-2025, the company plans to release a 36-qubit multi-chip module, built by tiling four 9-qubit chips, a proof-of-concept for future modular systems. This will be followed by a 100+ qubit system by year-end, maintaining the 99.5% fidelity target. These modular builds are paving the way for Lyra, a 336-qubit processor expected in 2026, designed to demonstrate narrow quantum advantage. Collaborations with AI calibration firm Qruise, error-correction leader Riverlane, and server cloud partner Quanta signal a maturing ecosystem approach. With each hardware release, Rigetti continues to strengthen its claim as a technically focused, fidelity-driven player in the race for scalable quantum computing.

Update on Competitor’s Quantum Roadmap

International Business Machines Corporation’s IBM 2025-2026 quantum roadmap centers on Kookaburra, a 1,386-qubit multi-chip processor with on-chip quantum communication. By linking three Kookaburra chips, IBM aims to build a 4,158-qubit system, enabling true quantum parallelization. Alongside, IBM is upgrading its Qiskit Runtime with dynamic circuits and hybrid orchestration tools to support more complex, error-managed workloads, laying the groundwork for quantum-centric supercomputers.

IonQ IONQ is advancing its trapped-ion roadmap with key milestones in 2025 and 2026. It plans to launch the AQ 64 “Tempo” system in 2025, offering 99.9% native two-qubit fidelity and mid-circuit measurement capabilities. By 2026, IonQ aims to reach AQ 256 and achieve 99.999% logical fidelity using barium-based qubits and improved control systems. The company is also building modular quantum systems with multiple QPUs linked via photonic interconnects, a strategy strengthened by its recent acquisition of Lightsynq. These developments reflect IonQ’s push toward scalable, fault-tolerant quantum computing.

Rigetti’s Price Performance, Valuation and Estimates

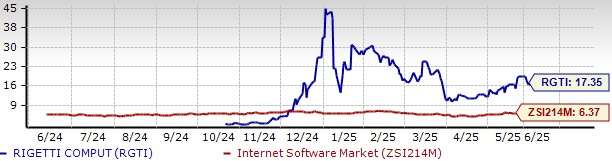

Shares of RGTI have lost 18% in the year-to-date period against the industry’s growth of 13.1%.

Image Source: Zacks Investment Research

From a valuation standpoint, Rigetti trades at a price-to-book ratio of 17.35, above the industry average. RGTI carries a Value Score of F.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Rigetti’s 2025 earnings implies a significant 86.1% rise from the year-ago period.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>International Business Machines Corporation (IBM) : Free Stock Analysis Report

IonQ, Inc. (IONQ) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.