Roche (RHHBY) announced new data from two studies on ophthalmology drug Vabysmo (faricimab).

Vabysmo is already approved in several countries for people with neovascular or ‘wet’ age-related macular degeneration (nAMD) and diabetic macular edema and macular edema following retinal vein occlusion.

New data from the AVONELLE-X and SALWEEN studies on Vabysmo were presented at the 25th Euretina Congress in Paris, France.

Data from these studies reinforce Vabysmo’s efficacy, safety and durability in nAMD.

More on RHHBY’s Studies on Vabysmo

The AVONELLE-X study was a two-year open-label extension of the two-year phase III TENAYA and LUCERNE studies of Vabysmo in nAMD.

Vision remained stable throughout the two years of AVONELLE-X and anatomic improvement from the parent trials was sustained through AVONELLE-X.

Data from the study showed that disease control and durability were maintained over four years, with nearly 80% of patients on extended dosing by study end.

Results showed that after up to four years of treatment with Vabysmo, nearly 80% of patients had extended their treatment intervals to every three months or four months, reinforcing the results seen in TENAYA and LUCERNE. Vabysmo was well tolerated and safety data was consistent with its known safety profile in nAMD.

Data from the single-arm SALWEEN study showed Vabysmo resulted in clinically meaningful vision gains and retinal drying over a year in polypoidal choroidal vasculopathy (“PCV”), a vision-threatening subtype of nAMD that is especially common in Asia.

Per RHHBY, Vabysmo also had a clinically meaningful impact on the abnormal, polyp-like blood vessels characteristic of PCV, with these lesions completely resolving in more than 60% of patients and inactivation of polypoidal lesions in the majority (86%) of eyes.

Vabysmo is one of the top drugs in RHHBY’s portfolio. The drug’s sales grew 18% to CHF 2.1 billion in the first half of 2025 on strong demand in all regions.

Vabysmo has given stiff competition to Regeneron’s (REGN) lead drug Eylea in the United States. Sales of Eylea have been under pressure of late.

To counter the decline in Eylea sales, Regeneron has developed a higher dose of the drug, Eylea HD.

RHHBY’s Strong Portfolio Drives Growth

Roche’s performance in the first half of 2025 was good as high demand for key drugs offset the decline in sales of legacy drugs.

Sales in the Pharmaceuticals Division grew 10% in the first half to CHF 24 billion, driven by strong growth in demand for its key drugs — Phesgo (breast cancer), Xolair (food allergies), Hemlibra (hemophilia A), Vabysmo and Ocrevus (multiple sclerosis or MS).

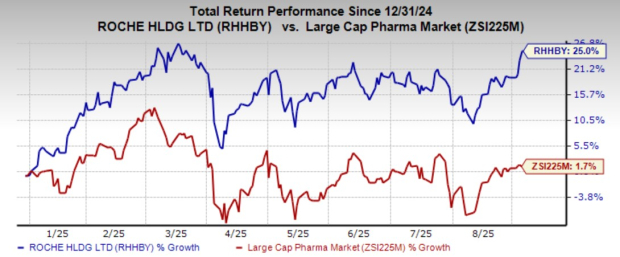

Roche’s shares have risen 25% year to date compared with the industry’s growth of 1.7%.

Image Source: Zacks Investment Research

Along with Vabsymo, growth in hemophilia treatment Hemlibra and multiple sclerosis drug Ocrevus also boosted the top line.

However, pipeline setbacks weigh on the stock. Roche earlier announced that the phase III ARNASA study on chronic obstructive pulmonary disease candidate astegolimab did not meet the primary endpoint of a statistically significant reduction in the annualized exacerbation rate (“AER”) at 52 weeks.

Nonetheless, the phase IIb ALIENTO study met the primary endpoint of a statistically significant reduction in the AER at 52 weeks when astegolimab was given every two weeks.

The performance of the Diagnostic division was also disappointing.

RHHBY’s Zacks Rank & A Key Pick

Roche currently carries a Zacks Rank #3 (Hold).

A better-ranked large-cap pharma is Bayer (BAYRY), which currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bayer stock has risen 71.3% in the year-to-date period. The Zacks Consensus Estimate for Bayer’s 2025 earnings has risen from $1.27 per share to $1.30 over the past 60 days, while that for 2026 has risen from $1.34 to $1.36.

Bayer’s earnings beat expectations in two of the trailing four quarters while missing in one and delivering in-line results in the other. It delivered a four-quarter negative earnings surprise of 3.91%, on average.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpRegeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.