Fintel reports that Renaissance Technologies has filed a 13G/A form with the SEC disclosing ownership of 1.39MM shares of Trinity Biotech PLC (TRIB). This represents 3.66% of the company.

In their previous filing dated February 11, 2022 they reported 1.57MM shares and 7.50% of the company, a decrease in shares of 11.16% and a decrease in total ownership of 3.84% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 267.57% Upside

As of February 12, 2023, the average one-year price target for Trinity Biotech is $4.08. The forecasts range from a low of $4.04 to a high of $4.20. The average price target represents an increase of 267.57% from its latest reported closing price of $1.11.

The projected annual revenue for Trinity Biotech is $82MM, an increase of 7.66%. The projected annual EPS is -$0.04.

What is the Fund Sentiment?

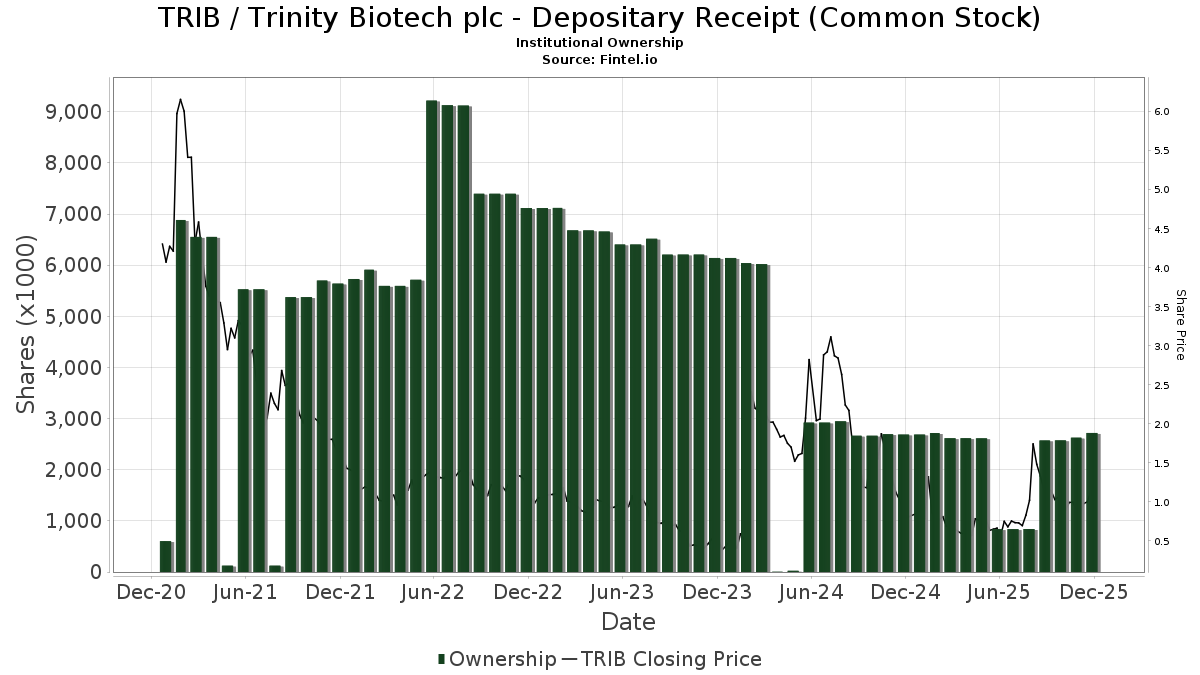

There are 28 funds or institutions reporting positions in Trinity Biotech. This is an increase of 1 owner(s) or 3.70% in the last quarter. Average portfolio weight of all funds dedicated to TRIB is 0.08%, a decrease of 18.18%. Total shares owned by institutions decreased in the last three months by 3.48% to 7,155K shares. The put/call ratio of TRIB is 0.22, indicating a bullish outlook.

What are large shareholders doing?

Stonehill Capital Management holds 2,068K shares representing 5.43% ownership of the company. In it's prior filing, the firm reported owning 2,271K shares, representing a decrease of 9.79%. The firm decreased its portfolio allocation in TRIB by 2.78% over the last quarter.

Hunter Associates Investment Management holds 1,824K shares representing 4.79% ownership of the company. In it's prior filing, the firm reported owning 1,797K shares, representing an increase of 1.45%. The firm decreased its portfolio allocation in TRIB by 11.88% over the last quarter.

Acadian Asset Management holds 760K shares representing 1.99% ownership of the company. No change in the last quarter.

Whitefort Capital Management holds 410K shares representing 1.07% ownership of the company. No change in the last quarter.

Aristides Capital holds 232K shares representing 0.61% ownership of the company. In it's prior filing, the firm reported owning 241K shares, representing a decrease of 3.96%. The firm decreased its portfolio allocation in TRIB by 7.50% over the last quarter.

Trinity Biotech Background Information

(This description is provided by the company.)

Trinity Biotech develops, acquires, manufactures and markets diagnostic systems, including both reagents and instrumentation, for the point-of-care and clinical laboratory segments of the diagnostic market. The products are used to detect infectious diseases and to quantify the level of Haemoglobin A1c and other chemistry parameters in serum, plasma and whole blood. Trinity Biotech sells direct in the United States, Germany, France and the U.K. and through a network of international distributors and strategic partners in over 75 countries worldwide.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.