Fintel reports that Renaissance Technologies has filed a 13G/A form with the SEC disclosing ownership of 0.04MM shares of Chicago Rivet & Machine Co. (CVR). This represents 3.95% of the company.

In their previous filing dated February 11, 2022 they reported 0.05MM shares and 5.50% of the company, a decrease in shares of 28.05% and a decrease in total ownership of 1.55% (calculated as current - previous percent ownership).

What is the Fund Sentiment?

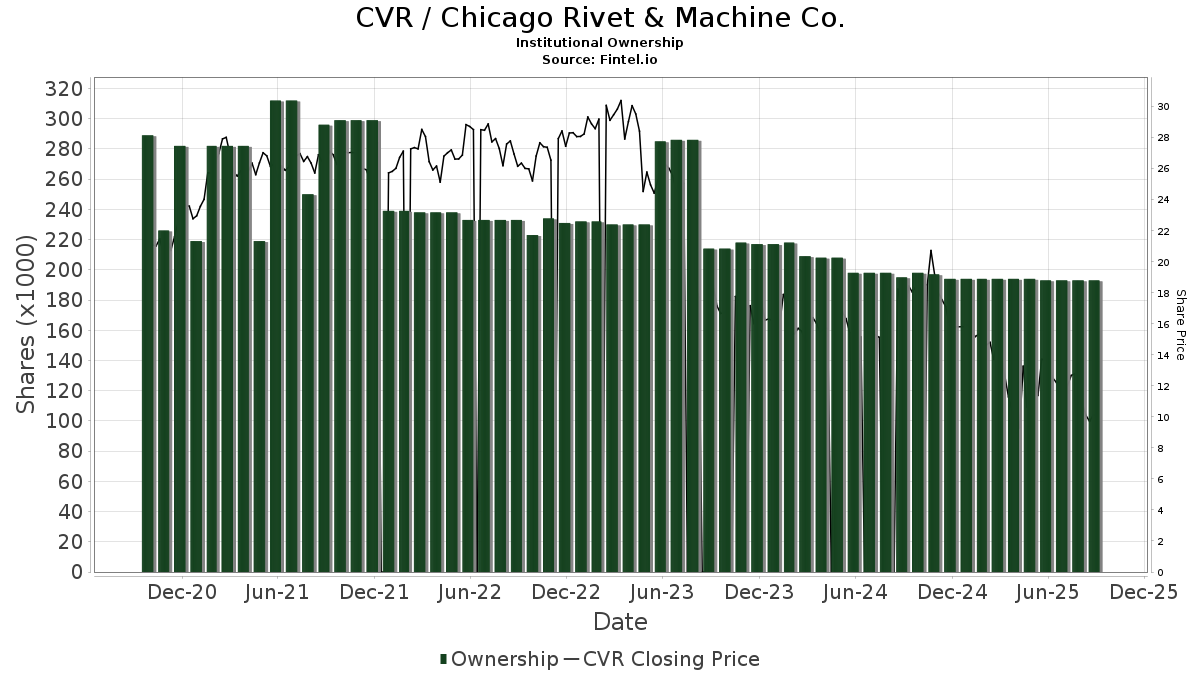

There are 42 funds or institutions reporting positions in Chicago Rivet & Machine. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to CVR is 0.01%, an increase of 10.32%. Total shares owned by institutions decreased in the last three months by 0.77% to 233K shares.

What are large shareholders doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 28K shares representing 2.94% ownership of the company. No change in the last quarter.

DFSVX - U.s. Small Cap Value Portfolio - Institutional Class holds 28K shares representing 2.92% ownership of the company. No change in the last quarter.

HighTower Advisors holds 25K shares representing 2.61% ownership of the company. No change in the last quarter.

DFSCX - U.s. Micro Cap Portfolio - Institutional Class holds 18K shares representing 1.83% ownership of the company. No change in the last quarter.

Bridgeway Capital Management holds 10K shares representing 1.04% ownership of the company. No change in the last quarter.

Chicago Rivet & Machine Declares $0.22 Dividend

On November 21, 2022 the company declared a regular quarterly dividend of $0.22 per share ($0.88 annualized). Shareholders of record as of December 2, 2022 received the payment on December 20, 2022. Previously, the company paid $0.22 per share.

At the current share price of $28.85 / share, the stock's dividend yield is 3.05%. Looking back five years and taking a sample every week, the average dividend yield has been 3.40%, the lowest has been 1.51%, and the highest has been 4.89%. The standard deviation of yields is 0.79 (n=230).

The current dividend yield is 0.44 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.20. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is -0.25%.

Chicago Rivet & Machine Background Information

(This description is provided by the company.)

Chicago Rivet & Machine Co. produces and sells rivets, cold-formed fasteners and parts, screw machine products, automatic rivet setting machines, automatic assembly equipment, and parts and tools for such machines. The Company also leases automatic rivet setting machines. Chicago Rivet & Machine markets its products to the automotive and appliance industries in the United States.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.