Roblox Corporation RBLX delivered an impressive third-quarter 2025, setting records across user metrics and platform activity.

Daily active users surged 70% year over year to 151.5 million, while total engagement hours soared 91% to nearly 40 billion. Monetization also climbed, with bookings increasing 70% from the prior year. Management noted these gains came from both existing hits and a wave of new viral experiences, alongside rapid expansion in APAC markets like India and Indonesia.

Yet despite the strength across the top line and platform health, the company’s margin guidance has turned cautious. CFO Naveen Chopra acknowledged that 2026 will likely see margin pressure, not expansion. Roblox is deliberately prioritizing growth over near-term profitability, boosting developer payouts (DevEx), expanding infrastructure capacity (including data centers and GPU hardware) and investing heavily in safety and AI innovation.

Safety enhancements, such as AI-based facial age estimation for all users, could temporarily weigh on engagement and monetization as the company enforces stricter communication and content protections. And while the platform’s breakneck growth has reduced cost-to-serve in recent quarters, management cautioned that further improvements will be harder to achieve in the near term.

Roblox argues the short-term margin softness is a necessary trade-off to sustain multi-year expansion, including genre diversification, older-user adoption and long-run monetization opportunities like advertising and rewarded video. The company is winning the scale game, but investing heavily to ensure those gains continue, even if margins sag while it builds toward the next stage of growth.

Competitive Landscape: How Rivals Shape Roblox’s Investment Priorities

Roblox’s softer margin outlook comes amid rising competition within immersive gaming and user-generated content. A notable rival, Meta Platforms META, is expanding Horizon Worlds and integrating advanced AI and safety technologies across its ecosystem. Meta’s scale, advertising infrastructure and push into VR/AR experiences create competitive pressure for both users and developers. This dynamic reinforces why Roblox is accelerating investments in infrastructure, safety and AI, decisions that weigh on margins in the near term.

Another relevant competitor is Unity Software U, which powers the creation of a large share of global interactive 3D experiences. Unity is positioning itself as a development platform for next-generation gaming and real-time 3D environments, including creator-driven content. Its role in enabling alternative ecosystems intensifies competition for developers, influencing Roblox’s decision to raise DevEx payouts and enhance creation tools to retain talent. These competitive forces explain why Roblox is prioritizing long-term platform advantage over immediate margin expansion.

RBLX Price Performance, Valuation & Estimates

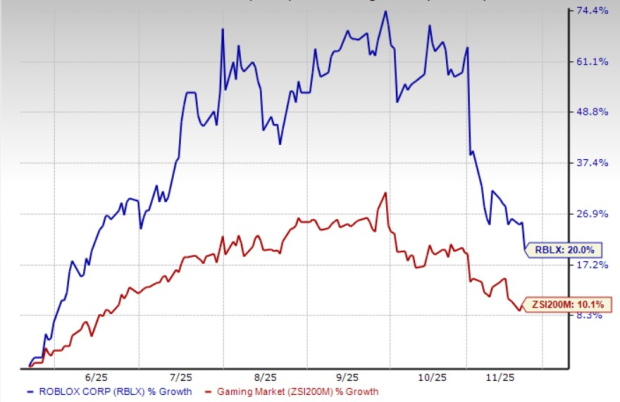

Roblox’s shares have gained 20% in the past six months compared with the industry’s rise of 10.1%.

RBLX Six-Month Price Performance

Image Source: Zacks Investment Research

RBLX stock is currently trading at a premium. It is currently trading at a forward 12-month price-to-sales (P/S) multiple of 8.04X, well above the industry average of 2.66X.

P/S (F12M)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Roblox’s 2025 loss per share has narrowed to $1.61 from $1.67 over the past 30 days.

Image Source: Zacks Investment Research

RBLX currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpUnity Software Inc. (U) : Free Stock Analysis Report

Roblox Corporation (RBLX) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.