QuidelOrtho Corporation QDEL recently announced the FDA 510(k) clearance for its QuickVue COVID-19 test.With CLIA certificates of waiver, this approval permits the test to be used accurately and conveniently in home and medical healthcare settings.

The company also provided an update on the Savanna platform that received approval in December 2023.

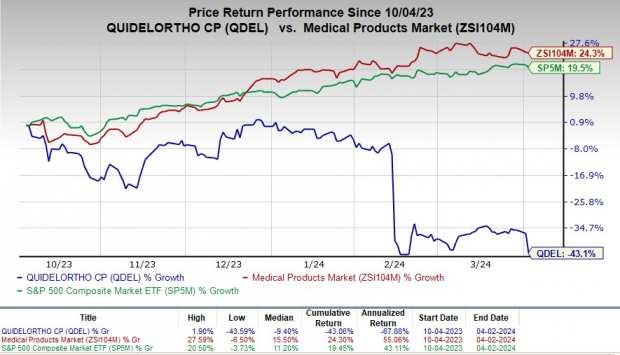

Price Performance

In the past six months, QDEL’s shares have plunged 43.1% against the industry’s rise of 24.3%. The S&P 500 has gained 19.5% in the same time frame.

Image Source: Zacks Investment Research

More on the News

The QuickVue COVID-19 test was developed for symptomatic individuals within six days of symptom onset. It is approved for use in people aged 14 years and older for self-administration. The test can be administered to people aged two years and older by an adult.

Symptomatic individuals receiving an initial negative result need to undergo e-testing between 48 and 72 hours later with an antigen like QuickVue or a molecular test for SARS-CoV-2. The QuickVue COVID-19 test comes with thorough usage instructions for healthcare providers, making it easy to incorporate into current diagnostic procedures.

Savanna Platform Update

The company received approval for Savanna HSV 1+2/VZV PCR assay in December 2023. This authorization permits U.S. laboratories performing diagnostic testing with moderate to high complexity to market and sell the Savanna multiplex molecular platform and the Savanna HSV 1+2/VZV assay.

The company is also developing a Savanna RVP4+ assay intended for use with the Savanna instrument for the simultaneous qualitative detection and differentiation of influenza A (flu A), influenza B (flu B), respiratory syncytial virus (RSV), and SARS-CoV-2 RNA. It had submitted FDA 510(k) submission in July 2023 based on promising initial study data. However, data generated over nine months for the four viruses targeted by the assay failed to meet expectations, which led to the withdrawal of the regulatory submission in February.

Meanwhile, the company continues to develop the next-generation RVP4+ assay, which is expected to be commercially available during the 2024/2025 respiratory season.

The company is also developing a sexually transmitted infection (STI) panel. It is also planning to start a clinical study in the second quarter.

Notable Developments

QuidelOrtho recently announced Health Canada’s approval for its Triage PLGF (placental growth factor) test for laboratory use in Canada. The test is intended to detect the presence of angiogenic imbalance (a consequence of abnormal placentation and poor blood flow in the placenta), which may lead to maternal and fetal complications of pregnancy, including pre-eclampsia.

QuidelOrtho Corporation Price

QuidelOrtho Corporation price | QuidelOrtho Corporation Quote

Zacks Rank & Stocks to Consider

QDEL carries a Zacks Rank #5 (Strong Sell) at present.

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 58.3% compared with the industry’s 18.9% rise in the past year.

Cardinal Health, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 51.9% compared with the industry’s 3.2% rise in the past year.

Cencora, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have surged 51.5% compared with the industry’s 3.6% rise in the past year.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

QuidelOrtho Corporation (QDEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.