Pure-play quantum computing stocks such as IonQ IONQ, D-Wave Quantum QBTS and Rigetti Computing RGTI have attracted strong investor interest due to sharp stock moves and major technology announcements. However, while their technological breakthroughs and rapid stock appreciation have drawn attention, their financial fundamentals remain early-stage and speculative. In such a situation, analysts are increasingly recommending established tech companies with quantum divisions — like NVIDIA NVDA or Microsoft MSFT — as less risky ways to capture quantum upside alongside other core revenue streams.

Quantum Pure Plays With Wobbly Financials

IonQ has delivered solid year-over-year revenue growth and formed partnerships with leading cloud providers, supporting expectations for future commercial growth. However, it posted substantial net losses and depends on periodic equity raises to extend its cash runway.

Rigetti, in its most recently reported quarter, incurred an operating loss of $20.5 million, reflecting continued investment in research and development and core operations. On a non-GAAP basis, which excludes certain non-cash items, the company recorded a net loss of $10.7 million or a loss of 3 cents per share.

D-Wave reported $3.7 million in revenues in the third quarter of 2025, up year over year and sequentially. However, the company recorded a GAAP net loss of roughly $140 million, largely due to non-cash warrant-related charges. On a non-GAAP basis, the net loss was approximately $18 million, reflecting continued operating losses. D-Wave ended the quarter with more than $836 million in cash and investments, highlighting strong liquidity despite its early-stage, loss-making profile.

Analysts accordingly frequently emphasize that these stocks trade more like assets than traditional growth equities, making them ill-suited for investors who prioritize stable fundamentals.

Established Tech With Quantum: A More Reliable Bet

In contrast, established technology companies with a quantum wing can offer indirect quantum exposure within diversified, cash-generating business models. These firms continue investing heavily in quantum research and development while benefiting from strong revenue streams in cloud computing, artificial intelligence and enterprise software, making them comparatively more stable investment options.

2 Stocks to Focus on

NVIDIA: Its quantum strategy focuses on enabling hybrid quantum-classical computing rather than developing its own quantum processors. Through its CUDA-Q platform, the company allows developers to integrate quantum hardware with NVIDIA GPUs and high-performance computing systems. Its NVLink and related interconnect technologies support large-scale simulations and quantum-classical workloads.

NVIDIA also established the NVIDIA Accelerated Quantum Research Center in Boston to collaborate with academic and industry partners on advancing quantum algorithms and system architectures. In 2026, NVIDIA is expected to further expand CUDA-Q capabilities and deepen hybrid computing collaborations to accelerate practical quantum-AI integration.

This Zacks Rank #2 (Buy) company is projected to report earnings growth of 55.9% on revenue growth of 62.9% in 2026. Based on short-term price targets offered by 47 analysts, the average price target for NVIDIA represents an increase of 34.4% from the last closing price of $190.04. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Microsoft: It is advancing a full-stack quantum strategy that combines hardware research, cloud integration and software development. The company continues to pursue topological qubit research through its Azure Quantum program while providing access to multiple quantum hardware partners via the Azure cloud platform.

Microsoft has also expanded its quantum development tools and hybrid quantum-classical capabilities within Azure Quantum, enabling researchers and enterprises to experiment with quantum algorithms alongside high-performance computing resources. In 2026, Microsoft is expected to further develop its scalable qubit research efforts and strengthen Azure Quantum’s hybrid ecosystem as part of its long-term roadmap toward fault-tolerant quantum computing.

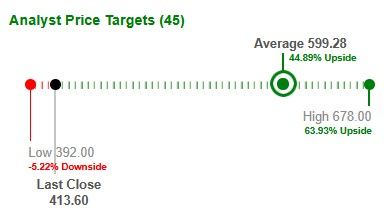

This Zacks Rank #3 (Hold) company is projected to report earnings growth of 16% on revenue growth of 24.3% in 2026. Based on short-term price targets offered by 45 analysts, the average price target for MSFT represents an increase of 44.9% from the last closing price of $413.6.

Image Source: Zacks Investment Research

Zacks' Research Chief Picks Stock Most Likely to "At Least Double"

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

IonQ, Inc. (IONQ) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.