The Procter & Gamble Company PG has delivered a dismal performance in recent months, weighed down by softer category demand, heightened promotional activity and a tough macro environment across several core markets. The company is contending with mounting pressures in North America and Europe, where increasingly value-conscious consumers and intensified competitive discounting are creating additional headwinds.

The slowdown in its performance has led the shares to decline 11.9% in the past three months, causing it to underperform the broader sector and the S&P 500 index, while it outpaced the Consumer Products - Staples industry. The Consumer Staples sector has declined 6.2% in the past three months, but the S&P 500 has rallied 5.1%. Meanwhile, the broader industry has fallen 13.9% in the same period.

PG's 3-Month Price Performance

Image Source: Zacks Investment Research

Amid these pressures, the Cincinnati-based consumer goods giant has slipped to fresh 52-week lows twice in the past two months. PG first touched a low of $144.09 on Nov. 10, 2025, and then fell further to a new 52-week low of $138.14 on Dec. 8, 2025, underscoring the market’s growing caution toward the stock.

PG’s performance is notably weaker than that of its competitors, Unilever Plc UL, BJ's Wholesale Club BJ and Albertsons Companies ACI, which declined 10.3%, 7.8% and 7.9%, respectively, in the past three months.

At the current share price of $139.63, PG trades 1.1% above its recent 52-week low mark of $138.14. Also, the PG stock trades 22.4% below its 52-week high of $179.99.

PG is trading below its 50 and 200-day moving averages, indicating a bearish sentiment at least for the near term. SMA is an essential tool in technical analysis that helps investors evaluate price trends by smoothing out short-term fluctuations. This approach provides a clearer perspective on a stock's long-term direction.

PG Stock Trades Below 50 & 200-Day Moving Averages

Image Source: Zacks Investment Research

What Is Behind PG Stock’s Recent Decline?

Procter & Gamble’s recent stock weakness reflects growing concern around its softening fundamentals and a tougher competitive landscape, as highlighted in its first-quarter fiscal 2026 earnings discussion. While the company posted its 40th consecutive quarter of organic sales growth, the underlying trends revealed pressure.

Category consumption decelerated through the quarter, with unit volumes essentially flat across key markets. In North America and Europe, two of PG’s most important regions, heightened competitive intensity has emerged as rivals lean aggressively into promotions, particularly in Fabric Care, Baby Care and Oral Care. This has weighed on market share, with global aggregate share down 30 basis points in the past three and six months.

PG also acknowledged slowing momentum in developed markets as value-conscious consumers become more selective and competitors push deeper discounting. Increased promotional spending in response is squeezing margins and raising investor concerns about near-term profitability. Meanwhile, the company’s ambitious restructuring, spanning supply-chain changes, portfolio streamlining and reductions of up to 7,000 non-manufacturing roles, signals that structural adjustments are needed to restore competitiveness.

Although innovation pipelines in categories like Tide, Pampers and SK-II remain strong, the near-term environment is challenging. The combination of softer category growth, intensifying price competition and ongoing restructuring has contributed meaningfully to PG’s recent stock decline.

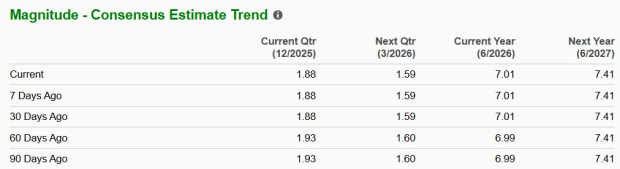

PG’s Estimate Revision Trend

The Zacks Consensus Estimate for PG’s fiscal 2026 and 2027 EPS was unchanged in the last 30 days. For fiscal 2026, the Zacks Consensus Estimate for PG’s sales and EPS implies 3.2% and 2.6% year-over-year growth, respectively. The consensus mark for fiscal 2027 sales and earnings indicates growth of 2.9% and 5.7% year-over-year, respectively.

Image Source: Zacks Investment Research

Despite recent market pressures, analyst expectations for Procter & Gamble remain steady, reflecting confidence in the company’s long-term strategy and execution. The Zacks Consensus Estimates for fiscal 2026 and 2027 EPS have held firm in the past month, suggesting that analysts view current headwinds as manageable rather than structural.

For fiscal 2026, the company projected organic sales growth of up to 4% and modest EPS expansion, supported by innovation-led pricing, stronger productivity benefits and early contributions from restructuring initiatives. Additionally, there is optimism surrounding PG’s significant investments, ranging from its robust innovation pipeline to Supply Chain 3.0 and organizational streamlining, which is expected to drive enhanced margin leverage.

With management reaffirming its full-year guidance and highlighting improving momentum in China and Latin America, the stable estimates reinforce confidence that PG is positioned for gradual but profitable growth despite near-term volatility.

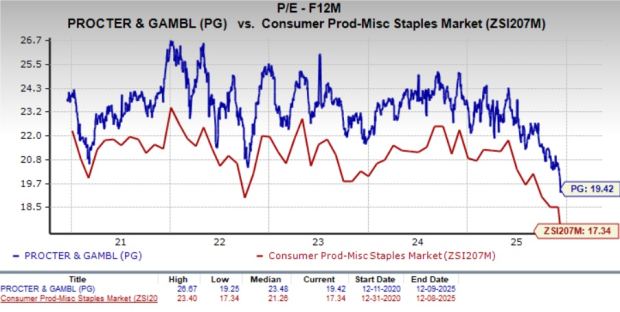

PG’s Premium Valuation

Procter & Gamble undoubtedly commands a high valuation, reflecting its strong market positioning, brand power and long-term growth potential compared with its peers. However, we believe that its valuation is too stretched at this time.

Despite the considerable decline in its share price, PG still trades at a significant premium to industry peers with a forward 12-month price-to-earnings (P/E) multiple of 19.42X. The current valuation is below its five-year high of 26.67X and ahead of the broader industry’s multiple of 17.34X.

At 19.42X P/E, Procter & Gamble is trading at a valuation higher than its competitors, like Unilever and Albertsons Companies. Unilever and Albertsons Companies have forward 12-month P/E ratios of 18.14X and 8.34X — lower than Procter & Gamble. Meanwhile, its competitor BJ's Wholesale Club has a forward 12-month P/E ratio of 19.54X, slightly higher than PG.

Image Source: Zacks Investment Research

Should You Still Buy PG?

Procter & Gamble’s recent share price decrease and its premium valuation create a paradox for investors. The stock’s drop to fresh 52-week lows reflects concerns around slowing category demand, intensified promotional activity and competitive pressure in key markets. Despite this weakness, PG continues to trade at a valuation premium, suggesting that investors still recognize its strong brand equity, category leadership and long-term earnings durability.

Analyst expectations reinforce this view, pointing to steady sales and EPS growth even amid short-term volatility. Management’s reaffirmed guidance, improving productivity and early benefits from restructuring, indicates confidence in the company’s ability to navigate current challenges.

For investors, PG’s setup offers a balanced perspective: while the recent decline may warrant caution for value-focused buyers, the Zacks Rank #3 (Hold) company’s premium valuation and stable outlook reflect ongoing confidence in its long-term growth potential. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Unilever PLC (UL) : Free Stock Analysis Report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.