Trinet Group (NYSE:TNET) will release its quarterly earnings report on Friday, 2025-07-25. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Trinet Group to report an earnings per share (EPS) of $0.91.

Anticipation surrounds Trinet Group's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

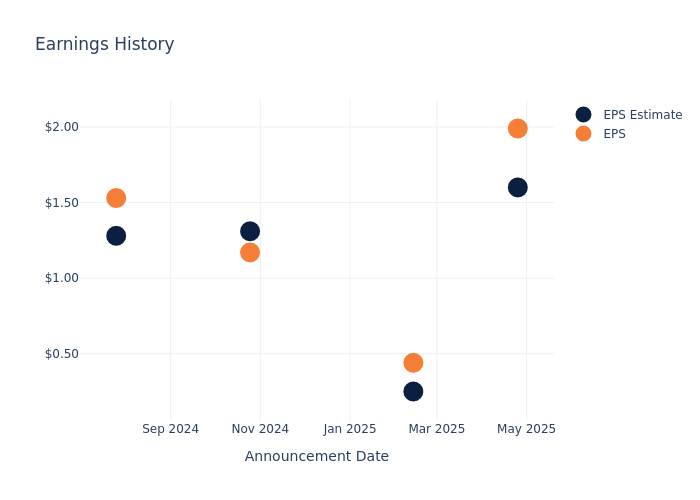

Earnings Track Record

The company's EPS beat by $0.39 in the last quarter, leading to a 0.0% drop in the share price on the following day.

Here's a look at Trinet Group's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.60 | 0.25 | 1.31 | 1.28 |

| EPS Actual | 1.99 | 0.44 | 1.17 | 1.53 |

| Price Change % | -0.0% | -1.0% | -12.0% | 2.0% |

Stock Performance

Shares of Trinet Group were trading at $66.0 as of July 23. Over the last 52-week period, shares are down 40.91%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analysts' Perspectives on Trinet Group

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Trinet Group.

The consensus rating for Trinet Group is Underperform, based on 1 analyst ratings. With an average one-year price target of $76.0, there's a potential 15.15% upside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of First Advantage, Alight and Korn Ferry, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for First Advantage, with an average 1-year price target of $18.0, suggesting a potential 72.73% downside.

- Analysts currently favor an Buy trajectory for Alight, with an average 1-year price target of $8.5, suggesting a potential 87.12% downside.

- Analysts currently favor an Neutral trajectory for Korn Ferry, with an average 1-year price target of $78.0, suggesting a potential 18.18% upside.

Summary of Peers Analysis

The peer analysis summary offers a detailed examination of key metrics for First Advantage, Alight and Korn Ferry, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Trinet Group | Underperform | 0.78% | $279M | 128.79% |

| First Advantage | Neutral | 109.30% | $162.02M | -3.19% |

| Alight | Buy | -1.97% | $171M | -0.59% |

| Korn Ferry | Neutral | 2.84% | $637.22M | 3.47% |

Key Takeaway:

Trinet Group ranks at the bottom for Revenue Growth and Gross Profit among its peers. It is at the top for Return on Equity.

Unveiling the Story Behind Trinet Group

Trinet Group Inc outsourced payroll and human capital management solutions for small and midsize businesses via a professional employer organization model. Under the PEO model, TriNet enters a co-employment arrangement and acts as the employer of record for administrative and regulatory purposes for clients' employees, known as worksite employees. Clients leverage the scale and expertise of TriNet to access competitive employee benefits, share employment risk liability, access compliance support, and outsource mission-critical day-to-day HR functions such as payroll and tax administration. Following the acquisition of Zenefits and Clarus R+D in 2022, TriNet derives the minority of its revenue from self-service HCM software and R&D tax credit services.

Key Indicators: Trinet Group's Financial Health

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Trinet Group's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 0.78%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Trinet Group's net margin excels beyond industry benchmarks, reaching 6.58%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 128.79%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.15%, the company showcases effective utilization of assets.

Debt Management: Trinet Group's debt-to-equity ratio surpasses industry norms, standing at 16.17. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Trinet Group visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TNET

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2025 | JP Morgan | Maintains | Underweight | Underweight |

| Mar 2025 | Needham | Reiterates | Hold | Hold |

| Feb 2025 | Needham | Reiterates | Hold | Hold |

View More Analyst Ratings for TNET

View the Latest Analyst Ratings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.