Key Points

ASML stock's recent surge has led to a nice jump in its market cap.

Micron Technology and Oracle are not only cheaper than ASML, but they are also clocking faster growth rates than the semiconductor equipment supplier.

- 10 stocks we like better than Micron Technology ›

ASML Holding (NASDAQ: ASML) is one of the most important companies in the world. It's the only manufacturer of extreme ultraviolet (EUV) lithography machines, which are vital equipment for printing the most advanced computer chips.

The Dutch semiconductor sector bellwether reported impressive growth for 2025. Its solid order backlog and the inflow of new bookings to meet the growing demand for chips capable of powering artificial intelligence (AI) workloads should help it maintain a healthy growth rate in 2026. On average, analysts covering the company expect a 14% jump in its top line and a 20% jump in earnings this year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

As a result, it won't be surprising to see ASML's market cap head higher over the next year from its current reading of $546 billion. However, there is a good chance that both Micron Technology (NASDAQ: MU) and Oracle (NYSE: ORCL) will be worth more than ASML one year from now.

Let's see why that may be the case.

Image source: ASML.

Micron Technology can continue to outperform ASML on the stock market

Micron Technology stock has jumped by more than 313% in the past year, easily outpacing the 87% jump in ASML's shares over the same period. As a result, Micron's market cap of $463 billion is only 18% lower than ASML's, and it won't be surprising to see the former easily close that gap in the coming year, as Micron's revenues are growing at a significantly faster pace than ASML's.

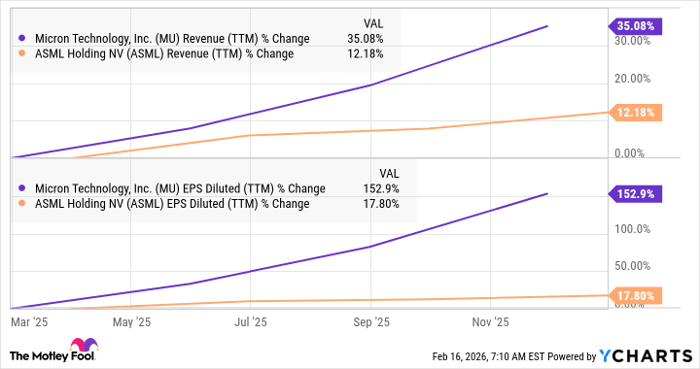

MU Revenue (TTM) data by YCharts

That trend is here to stay in 2026, with Micron's earnings expected to more than triple as revenue doubles, according to analysts' consensus estimates. Micron is capable of achieving such outstanding growth thanks to the supply-constrained nature of the memory market, where demand is significantly outpacing current production capacity.

Micron manufactures both dynamic random-access memory (DRAM) and NAND flash memory. While DRAM is deployed in data centers, smartphones, gaming consoles, computers, and other applications to enable fast processing and multitasking, NAND flash is used to store data. The demand for both these memory types has gone through the roof, as both perform critical functions in AI data centers, which are being constructed at a rapid pace.

In order for AI accelerator chips to perform optimally as they process huge data sets, they need extremely rapid access to that data, which Micron's high-bandwidth memory (HBM) can supply. As a result, all the HBM that the company is capable of manufacturing in 2026 is sold out.

A similar scenario has unfolded in the NAND flash market, where the need for faster and more efficient storage has created unprecedented demand for solid-state drives (SSDs). It is worth noting that the market prices of both NAND and DRAM memory chips are increasing at a solid clip. Market research firm TrendForce is anticipating an 80% to 85% increase in DRAM prices this quarter, and a 55% to 60% rise in NAND flash prices.

Moreover, as its high-bandwidth memory chips are sold out in advance for the rest of the year, the price rises are likely to continue, which would help Micron achieve the remarkable earnings growth it is expected to deliver. Throw in the fact that Micron is trading at just 13 times forward earnings -- well below ASML stock's forward earnings multiple of 40 -- and it's clear why the memory-maker can deliver bigger gains. It's likely to be rewarded with a premium valuation on the back of its eye-popping growth.

As such, there is a strong possibility that Micron will become a larger company than ASML by market cap over the next year.

Oracle could regain its mojo thanks to a massive order backlog

Cloud infrastructure solutions provider Oracle ranks just after Micron on the list of companies by market cap, with a figure of $462 billion. However, Oracle stock has underperformed ASML and the market over the past year, losing 8%.

That decline can be attributed to the company's massive spending to build new AI data centers, which is inflating its debt. Oracle expects to raise $45 billion to $50 billion in funding this year through debt and equity financing to build additional AI infrastructure capacity. Savvy investors, however, will want to look at the bigger picture.

Oracle needs financing to satisfy the massive order backlog it is sitting on. The company's remaining performance obligation (RPO) -- the total value of orders it has yet to fulfill -- shot up 438% year over year to a whopping $523 billion as of Nov. 30, 2025 (the end of its fiscal 2026 second quarter).

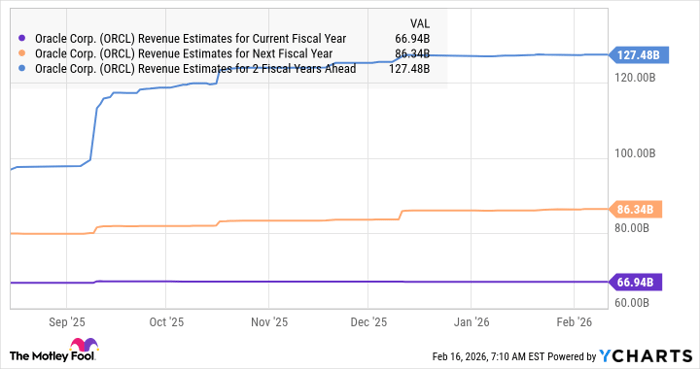

This huge order book is why Oracle is forecasting $67 billion in revenue in the current fiscal year, an increase of 17% over the previous fiscal year, when its top line jumped by 8%. What's more, the analyst community's forecasts for the next couple of fiscal years are even better.

ORCL Revenue Estimates for Current Fiscal Year data by YCharts.

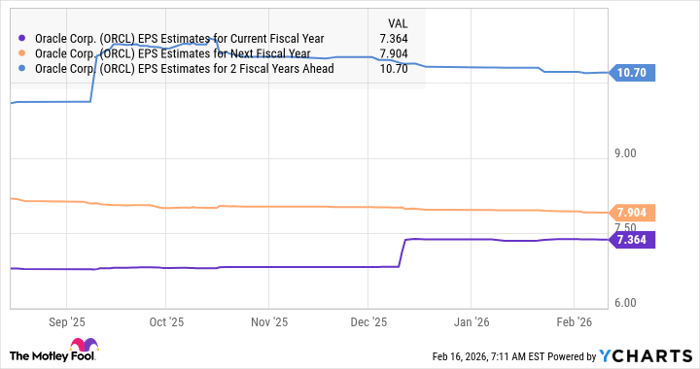

Of course, the heavy spending is going to take a toll on Oracle's bottom line along the way, which explains why analysts expect slower earnings growth next fiscal year before a bigger jump in the following one.

ORCL EPS Estimates for Current Fiscal Year data by YCharts.

As the company brings more AI cloud capacity online, it should be able to quickly convert more of its backlog into revenue and get its balance sheet in order. That's why it may be a good idea to buy this AI stock while it's beaten down. It's trading at just 7.6 times sales, a discount to ASML's sales multiple of 14.1.

Moreover, analysts' median 12-month price target of $275 for Oracle suggests it could jump by 72% from current levels, well above the 19% upside analysts are anticipating from ASML. Given that Oracle's growth is poised to accelerate on the back of its sizable backlog, and that it trades at a significantly cheaper valuation, it could indeed become a bigger company than ASML in the coming year.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 18, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Micron Technology, and Oracle. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.