PPG Industries Inc. PPG recently announced that its SEM Products business has launched a full line of performance abrasives aimed at simplifying complex automobile collision repairs while emphasizing technicians' demands.

SEM Performance Abrasives are specifically tailored for each stage of the repair procedure. The product line includes precision grain technology, which is intended to provide rapid cutting, longevity and consistency across a wide range of repairs and substrates.

SEM abrasives offer high durability, great edgewear and an even cutting surface, allowing professionals to accomplish remarkable feather-edging results. Another benefit is the multi-hole design, which enables dustless sanding. This increases the product's longevity while also creating a cleaner work environment, which reduces the need for regular cleanups and improves overall efficiency.

PPG's novel line of SEM Performance Abrasives was created with technicians in mind, giving them the products they need to attain great results while streamlining their repair process.

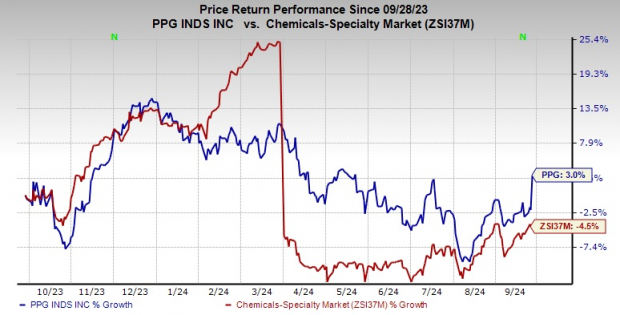

Shares of PPG have gained 3% over the past year compared with a 4.5% decline of its industry.

Image Source: Zacks Investment Research

PPG expects adjusted earnings per share (EPS) for the third quarter in the range of $2.10-$2.20. For the full year, the company expects adjusted EPS in the band of $8.15 to $8.30. These projections consider various factors such as current global economic activity, uneven global industrial production, reduced global automotive production, stabilizing demand in Europe, sustained growth in Mexico and India and low single-digit growth in China.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Zacks Rank & Key Picks

PPG currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO and Hawkins, Inc. HWKN.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.9%. The company's shares have soared 111.7% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Eldorado’s current-year earnings is pegged at $1.40 per share, indicating a year-over-year rise of 145.6%. EGO, a Zacks Rank #1 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 430.3%. The company's shares have rallied roughly 71.6% in the past year.

The Zacks Consensus Estimate for Hawkins’ current fiscal-year earnings is pegged at $4.14, indicating a rise of 15.3% from year-ago levels. The Zacks Consensus Estimate for HWKN’s current fiscal-year earnings has increased 12.8% in the past 60 days. HWKN, a Zacks Rank #2 (Buy) stock, has rallied around 99.1% in the past year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Eldorado Gold Corporation (EGO) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.