PPG Industries, Inc. PPG recently highlighted innovations in paints, coatings and specialty products at the Coatings Innovation Center in Allison Park, PA. The company focused on exhibiting advancements in innovative and sustainable solutions that will enhance customer productivity and accelerate its organic growth.

PPG highlighted innovations, a few of which have been award-winning technologies and systems, like its Precision Application automotive OEM overspray-free coating system and the Low-temperature, expanded-bake electrocoat. Additionally, PPG CORASEAL and PPG CORASHIELD 4-Wet Advantage, PPG STEELGUARD 951 and PPG NUTRISHIELD MAX metal packaging coatings were also among the line of products being showcased.

PPG also featured advanced architectural and marine coatings, which align with its sustainability goals. The exhibition went on to underline PPG’s constant efforts to drive innovation to develop and deliver solutions. These sustainably advantaged products are defined using PPG's internal methodology that validates product attributes and their contribution toward the UN Sustainable Development Goals.

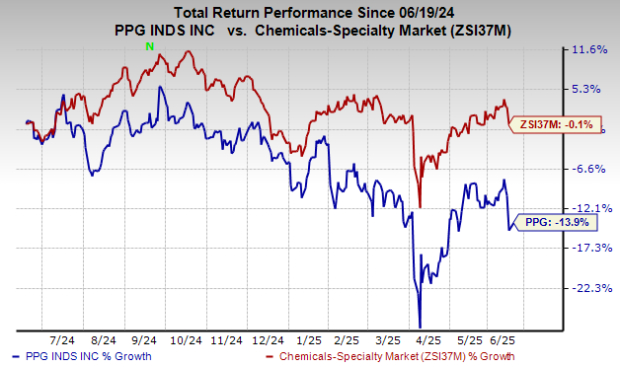

PPG stock has lost 13.9% over the past year compared with the industry’s 0.1% decline.

Image Source: Zacks Investment Research

On the first-quarter call, the company reaffirmed its full-year 2025 adjusted earnings per share guidance of $7.75 to $8.05. This range is backed by the momentum of share gains and self-help efforts, as well as factors in current global economic activity, foreign exchange rates and mixed demand across PPG's many regions and businesses.

PPG’s Zacks Rank & Key Picks

PPG currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Akzo Nobel N.V. AKZOY, Newmont Corporation NEM and Balchem Corporation BCPC. While AKZOY currently sports a Zacks Rank #1 (Strong Buy), NEM and BCPC carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Akzo Nobel’s current-year earnings is pegged at $1.66 per share, implying an 18.6% year-over-year increase. Its earnings beat the Zacks Consensus Estimate in three of the trailing four quarters while missing once.

The Zacks Consensus Estimate for NEM’s current-year earnings is pegged at $4.18 per share, indicating a 20.1% year-over-year rise.Its earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with an average surprise of 32.41%. NEM’s shares have gained 41.5% in the past year.

The Zacks Consensus Estimate for BCPC’s 2025 earnings is pegged at $5.15 per share, indicating a rise of 31% from year-ago levels. The company’s earnings beat the consensus estimate in two of the trailing four quarters while missing the rest. Its shares have gained 6.5% in the past year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

Akzo Nobel NV (AKZOY) : Free Stock Analysis Report

Balchem Corporation (BCPC) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.