POSCO Holdings Inc.’s PKX unit POSCO Future M has invested in a U.S.-based all-solid-state battery company, Factorial, further strengthening the partnership that was entered into following the MOU signed in November 2025.

POSCO Future M is poised for rapid growth in the all-solid-state battery market, while Factorial will secure a high-quality supply of solid-state battery materials to enhance manufacturing competitiveness.

Factorial’s all-solid-state battery platform — Solstice — offers higher energy density and safety, with successful partnerships with automakers across Korea, Europe and North America. POSCO Future M’s partnership is also expected to benefit from the network and derive synergies. POSCO’s all-solid-state battery materials currently being developed are expected to be significantly utilized in autonomous electric vehicles and urban air mobility, as well as in physical AI markets, such as humanoids and robotics.

With the partnership in line, POSCO Future M’s material design and coating technologies will be optimized, and portfolios expanded to include sulfide-based solid electrolytes and silicon and lithium metal anode materials, offering higher energy retention. As the demand for solid-state batteries accelerates globally, the partnership will target such emerging applications.

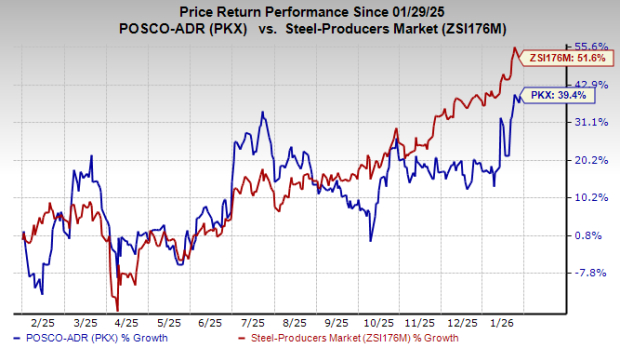

PKX stock has gained 39.4% over the past year compared with the industry’s 51.6% growth.

Image Source: Zacks Investment Research

PKX’s Zacks Rank & Key Picks

PKX currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Coeur Mining, Inc. CDE, Albemarle Corporation ALB and Avino Silver & Gold Mines Ltd. ASM.

While CDE and ALB sport a Zacks Rank #1 (Strong Buy) each at present, ASM carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CDE’s 2025 earnings is pegged at 82 cents per share, indicating a rise of 355.56% year over year. Its earnings beat the Zacks Consensus Estimate in two of the trailing four quarters while missing it in the remaining two, with an average surprise of 106.61%. CDE’s shares have soared 304.2% over the past year.

The Zacks Consensus Estimate for ALB’s 2025 loss is pinned at $1 per share, indicating a 57.26% year-over-year increase. ALB's shares have surged 125% over the past year.

The Zacks Consensus Estimate for ASM’s 2025 earnings is pinned at 17 cents per share, indicating a 13.33% year-over-year increase. ASM’s shares have skyrocketed 770.6% over the past year.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>POSCO (PKX) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Coeur Mining, Inc. (CDE) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.