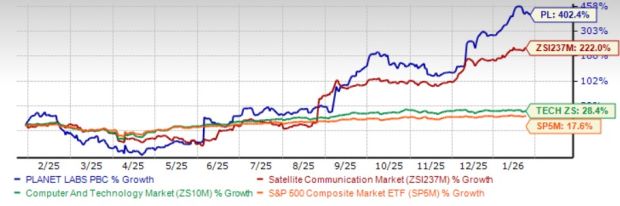

Shares of Planet Labs PL have gained 402.4% in a year, outperforming the industry, its sector as well as the Zacks S&P 500 composite. Planet Labs is a leading provider of Earth-imaging data and geospatial analytics, operating the largest fleet of Earth-observation satellites globally.

PL stock has moved above its 50- as well as 200-day simple moving average (SMA), signaling a bullish trend. The 50-day and 200-day SMAs are key indicators for traders and analysts to identify support and resistance levels. These are considered particularly important as they are the first markers of an uptrend or downtrend.

1-Year Price Performance of PL

Image Source: Zacks Investment Research

Shares of Rocket Lab RKLB and BlackSky Technology BKSY have gained 177.7% and 73.4% in a year, respectively.

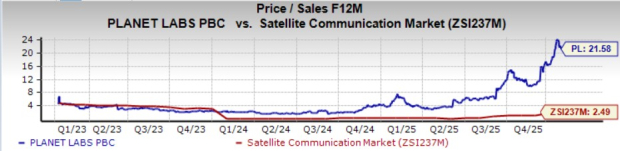

PL Shares Are Expensive

The stock is overvalued compared with its industry. It is currently trading at a price-to-sales multiple of 21.58, higher than the industry average of 2.49 and above the median of 3.61 over three years.

Image Source: Zacks Investment Research

PL is relatively cheap compared to RKLB but expensive compared to BKSY.

The Case for PL Stock

Planet Labs generates most of its revenues through a mix of fixed-price subscription agreements and usage-based contracts, providing satellite imagery and analytics via its cloud-based platform to government agencies and large commercial customers. Its revenue growth continues to be supported by the steady maturation of its subscription model, rising demand from government customers and a strategic pivot toward higher-value satellite services and more sophisticated analytics offerings.

In recent years, the company has placed greater emphasis on securing large government and defense contracts, which offer improved revenue visibility and long-term stability. While this segment remains a key growth driver, management continues to view the commercial market as a significant long-term opportunity. Ongoing enhancements to Planet Labs’ products and solutions are expected to support broader commercial adoption over time. In particular, the expansion of AI-enabled analytics, initially developed for government customers, is anticipated to translate into wider commercial use cases, including supply chain monitoring, security and surveillance, operational efficiency, insurance risk evaluation, financial and economic analysis, energy management and agricultural optimization.

Planet Labs’ growing contract backlog further strengthens revenue visibility. As of the end of fiscal third-quarter 2026, backlog was $734.5 million, representing a 216% year-over-year increase. Management has also guided toward positive adjusted EBITDA in fiscal 2026, reflecting efforts to balance continued growth investments with improving financial discipline.

Despite these positives, the company remains unprofitable, and a near-term turnaround is not expected. While revenue growth has been strong, sustained investment in satellite development, deployment and replacement continues to weigh heavily on margins. Given the breadth and technological complexity of its offerings, Planet Labs must maintain elevated research and development spending. In addition, higher sales and marketing expenses, along with rising general and administrative costs, continue to put pressure on profitability. The company has reported losses over the past five years and is expected to remain unprofitable in fiscal 2027. Returns on equity and invested capital remain below industry averages, underscoring ongoing execution and profitability risks.

Muted Analyst Sentiment

The Zacks Consensus Estimate for fiscal 2027 revenues indicates a 26% year-over-year increase, while that for earnings implies a 78% year-over-year increase.

The consensus estimate for fiscal 2027 earnings witnessed no movement in the past 30 days.

Image Source: Zacks Investment Research

The consensus estimate for 2026 earnings of RKLB has moved north in the past 30 days, while that for BKSY has moved south in the same time frame.

Parting Thoughts on PL Shares

Planet Labs, a data-driven company focused on Earth-observation imagery and analytics, is poised to grow, given the rising global demand for commercial satellites.

However, current factors warrant caution. With the stock trading at a premium, returns on capital comparing unfavorably with the industry, looming near-term earnings pressure, muted analyst sentiment and a VGM Score of D, it is better to stay away from this Zacks Rank #5 (Strong Sell) stock presently.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Planet Labs PBC (PL) : Free Stock Analysis Report

Rocket Lab Corporation (RKLB) : Free Stock Analysis Report

BlackSky Technology Inc. (BKSY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.