Pegasystems PEGA is seeing accelerated momentum as its cloud segment increasingly drives subscription-based revenues. In the first quarter of 2025, Pega Cloud’s Annual Contract Value (ACV) jumped 23% year over year to $701 million, reflecting growing demand for its AI-powered, cloud-native solutions. Pega Cloud’s revenues grew 15% year over year to $151.1 million, underscoring the strength of its high-margin, recurring revenue model and its growing impact on total subscription revenues.

This cloud momentum is backed by a clear shift among enterprises toward scalable and intelligent automation. PEGA’s AI-infused platforms, like GenAI Blueprint and Pega Infinity, are simplifying digital transformation and reducing technical debt, leading to faster adoption and long-term client retention. With more workloads moving from legacy systems to the cloud, the increase in ACV reflects deeper customer engagement and more durable multi-year contracts.

Pegasystems has set an ambitious goal to grow Cloud ACV by 20% or more, and first-quarter results validate that trajectory. From just $50 million in 2017, Pega Cloud ACV now comprises nearly half of the company’s total ACV, driven by successful cross-selling, upselling and new client acquisitions. Strategic efforts to move legacy workloads to Pega Cloud are paying off.

As the cloud business continues to scale, Pegasystems is shaping up to become a more predictable, durable enterprise software company. With expanding subscription revenues, accelerating cloud adoption and strong execution, Pega Cloud is well-positioned to become a key engine of long-term shareholder value.

Rivals Challenge PEGA’s Market Position

Salesforce CRM excels in cloud-native CRM and low-code workflows, integrating Einstein AI for automation and analytics. Salesforce’s strong CRM-centric automation, extensive third-party integrations through AppExchange and scalable platform give it a competitive edge over PEGA in customer engagement. Strategic partnerships with Amazon and Alphabet enhance Salesforce’s global cloud reach.

Oracle ORCL offers a powerful cloud platform through OCI, Fusion Cloud apps and BPM tools, directly competing with PEGA in process automation. Oracle’s strengths lie in deep database integration, enterprise scalability and a full-stack cloud ecosystem. While Oracle excels in infrastructure and large-scale deployments, PEGA often outshines it in BPM usability, AI-driven decision-making and rapid implementation.

PEGA’s Price Performance, Valuation & Estimates

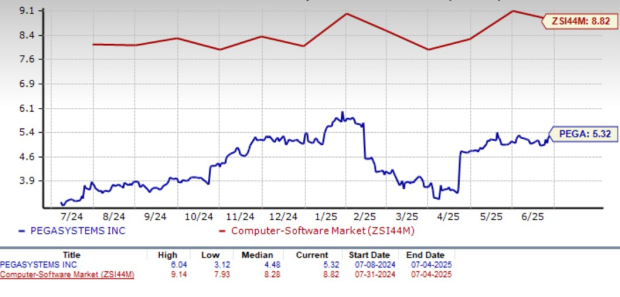

Pegasystems shares have gained 16% year to date, while the broader Zacks Computer and Technology sector has returned 8.2% and the Computer-Software industry has risen 17%.

PEGA YTD Price Return Performance

Image Source: Zacks Investment Research

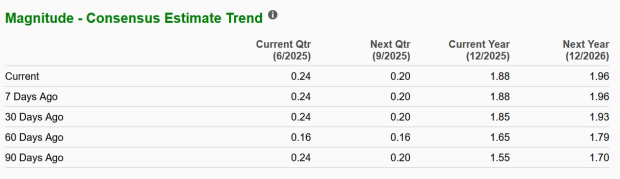

PEGA has a Value Score of F. It is currently trading at a forward 12-month Price/Sales of 5.32X compared to the industry’s 8.82X.

PEGA Forward 12-Month Price/Sales Ratio

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for PEGA’s earnings is pegged at $1.88 per share for 2025, reflecting year-over-year growth of 24.5%. The 2025 earnings estimate has been revised upward by 3 cents over the past 30 days, indicating consistent upward momentum.

Image Source: Zacks Investment Research

PEGA stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Salesforce Inc. (CRM) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.