PacBio PACB recently entered into a strategic partnership with EpiCypher to accelerate advancements in epigenomics research through the adoption of its Fiber-Seq workflow. This collaboration brings together PacBio’s long-read sequencing technology with EpiCypher’s expertise in chromatin biology, aiming to deliver more comprehensive insights into genome regulation and disease mechanisms.

The Fiber-Seq workflow combines single-molecule precision with novel epigenomic mapping capabilities, enabling scientists to study chromatin structure and modifications at unprecedented scale and accuracy. By aligning with EpiCypher, PacBio strengthens its presence in the growing epigenetics market, where demand for deeper biological insights is accelerating.

Likely Trend of PACB Stock Following the News

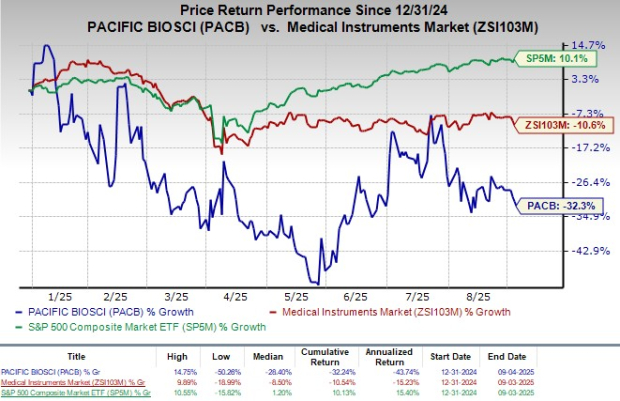

Following the announcement on Wednesday, shares of the company closed flat at $1.24 after yesterday’s market close. In the year-to-date period, PACB shares have lost 32.3% compared with the industry’s 10.6% decline. The S&P 500 increased 10.1% in the same time frame.

However, the partnership is likely to boost PacBio’s long-term business by expanding its technology into the fast-growing epigenomics space, creating new revenue streams beyond traditional sequencing. By integrating Fiber-Seq with EpiCypher’s chromatin tools, PacBio can tap into increasing demand for single-molecule epigenetic insights in drug discovery, precision medicine, and academic research. This not only strengthens its competitive positioning but also diversifies applications of its sequencing platforms, supporting broader adoption, higher utilization rates, and sustained growth.

Meanwhile, PACB currently has a market capitalization of $378.5 million. In the last reported quarter, PACB delivered an earnings surprise of 27.8%.

Image Source: Zacks Investment Research

More on PACB and EpiCypher Partnership

The collaboration between PacBio and EpiCypher introduces the CUTANA Hia5 enzyme for use with Fiber-seq assays on PacBio’s HiFi sequencing systems, giving researchers a new tool to study chromatin biology at single-molecule resolution. Fiber-seq, or single-molecule chromatin fiber sequencing, is a next-generation multi-omic whole genome assay that simultaneously measures chromatin accessibility, DNA methylation, and DNA variation on individual DNA molecules. Unlike short-read epigenetic assays such as ATAC-seq, Fiber-seq leverages PacBio’s HiFi sequencing to connect genetic and epigenetic features in one workflow, delivering more comprehensive insights into genome regulation and its role in human health and disease.

By combining PacBio’s HiFi sequencing with EpiCypher’s Hia5 enzyme, researchers gain the ability to examine DNA regulation at the level of individual molecules, directly linking genetic variation with gene expression. The approach also enables interrogation of complex genomic regions that are often missed by short-read technologies, including areas associated with rare diseases. Importantly, Fiber-seq consolidates multiple traditional assays into a single streamlined workflow, saving time and resources while producing richer data. The CUTANA Hia5 enzyme is now commercially available from EpiCypher in eight and 24 reaction formats with a supported Fiber-seq protocol, extending access to advanced epigenomic analysis for the broader research community.

Favorable Industry Prospects for PACB

Per a report by Grand View Research, the global epigenetics market size was estimated at $14.63 billion in 2023 and is projected to reach $39.15 billion by 2030, registering a CAGR of 15.3% from 2024 to 2030.

This growth can be attributed to the pivotal role of epigenetics in understanding gene regulation beyond DNA sequencing, aiding disease research, and advancing personalized medicine.

PACB’s Zacks Rank & Key Picks

Currently, PACB carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank of 1 (Strong Buy), reported second-quarter 2025 EPS of $3.10, beating the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank of 1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpBoston Scientific Corporation (BSX) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.