Overview of Triple Candlestick Patterns

Morning Stars and Evening Stars

The first type of triple candlestick pattern that we'll talk about is morning and evening stars. Both morning and evening stars occur during a trend and can signal a reversal in momentum.

The first candlestick for a morning star is a bearish candle with a long body. It is then followed by a doji (a small body candle with long shadows on bottom and top). The doji signals indecisions and doesn't matter if it closes up or down. The third candlestick is a bullish candlestick that should at least pass the halfway point of the first bearish candle. The morning star is a buy indicator.

The evening star is similar to the morning star pattern but occurs during an uptrend and signals a reversal downwards. The evening stars' first candle is a bullish candle with a long body. The second candle is a doji, which signals indecision. The third and final candle in the chart pattern is the bearish candle that closes past at least the halfway point of the first bullish candle.

An important note is that the doji, the second candle for both patterns, doesn't have to close higher or lower, it just maters that the body is small.

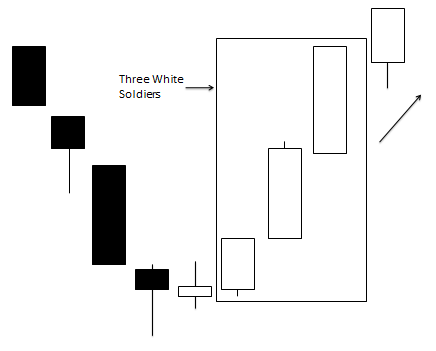

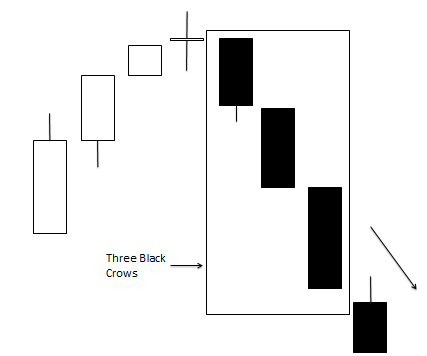

Three White Soldiers and Black Crows

The three white soldiers and black crows are another type of three-candlestick pattern. Instead of signaling a reversal, compared to many other patterns we've looked at, the white soldiers and black crows are used to confirm a trend.

Both patterns occur after there's been an extended trend and a period of consolidation following that trend.

The three white soldiers pattern can appear after an extended downtrend and a period of consolidation. The first candlestick of the chart pattern that needs to appear is a bullish candlestick with a long body. The next candlestick in the pattern is another bullish candlestick, but this candlestick needs to have a body of greater size than the first candlestick. This second candlestick also needs to have little to no shadow. The last candlestick is another bullish candlestick that needs to be equal or greater length of a body than the second candlestick.

When all three candlesticks appear, this chart pattern can be used to confirm the start of a new uptrend.

The three black crows chart pattern is the opposite of the three white soldiers chart pattern. Instead of three bullish candles with the three white soldiers, you have three bearish candles instead. Also, the three black crows pattern needs to come after an extended uptrend and consolidation for it to confirm a new downtrend.

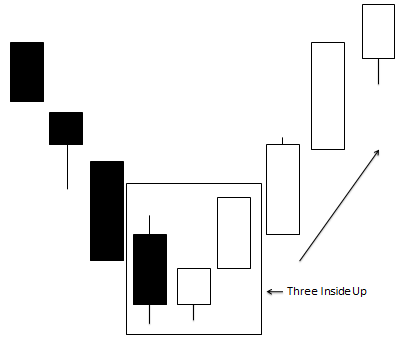

Three Inside Up and Down

The three inside up and down candlestick patterns are the last type of triple candlestick patterns. Both signal the reversal of a trend.

The three inside up pattern occurs after a recent downtrend and signals for a reversal to an uptrend.

The first candle in the pattern is a bearish candle with a long body. The next is a bullish candle that passes at least the halfway point of the first bearish candle. The third and final candle is another bullish candle that passes at least the high of the first bearish candle.

The three inside down pattern is the opposite of the three inside up pattern. In this case, the pattern is an indicator for a reversal downwards and must follow a recent uptrend. The first candlestick in the pattern is a bullish candle with a long body. The second is a bearish candle that passes at least the halfway point of the first bullish candle. The last candlestick is another bearish candle that passes at least the low of the first bullish candle.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.