Oracle’s ORCL increasing cloud capital spending is positioning the company for its next growth phase by expanding capacity to meet rising AI and enterprise cloud demand. Management raised its fiscal 2026 capital expenditure forecast to around $50 billion, nearly $15 billion above earlier estimates, reflecting strong visibility into cloud bookings and future workloads.

During the second quarter of fiscal 2026, Oracle invested roughly $12 billion, primarily in GPU-based infrastructure and data centers to support growth in Oracle Cloud Infrastructure. While this heavy spending drove negative free cash flow in the quarter, the company emphasized that most of this expenditure is focused on revenue-generating equipment rather than long-term real estate assets. Because the equipment is added late in the data center build cycle, Oracle can start generating revenues shortly after customers go live, shortening the gap between investment and monetization.

These investments are closely linked to Oracle’s expanding backlog and demand pipeline. Management said many new bookings can be monetized quickly because capacity is already available or under construction. As a result, the company expects about $4 billion in incremental revenue acceleration beginning in fiscal 2027, driven by AI training, inference and multicloud deployments.

Oracle is taking a disciplined approach to funding this growth through a mix of debt markets and alternative models like customer-provided or leased chips, which helps keep revenues in line with costs. In addition, the company continues to expand its global cloud footprint by adding new regions and multicloud data centers, strengthening its ability to capture AI workloads worldwide.

How Rivals Are Competing With Oracle’s Massive Cloud CapEx

Oracle competes with Amazon AMZN and Alphabet GOOGL, which are investing heavily in data centers and AI infrastructure to expand their cloud businesses.

Amazon’s edge in cloud CapEx comes from the scale and speed of its AWS and AI investments. In the third quarter of 2025, Amazon spent nearly $90 billion on CapEx, mainly for AWS, custom silicon and AI capacity, showing strong confidence in long-term cloud demand. The company added 3.8 gigawatts of power capacity and deployed Trainium chips and large AI clusters like Project Rainier, enabling faster monetization and reinforcing Amazon’s cloud leadership.

Alphabet’s strength in cloud CapEx is rooted in its full-stack AI strategy and infrastructure spending. In the third quarter of 2025, Alphabet invested about $24 billion in CapEx, mainly in servers and data centers to support growing Google Cloud and AI demand. Its TPU roadmap, alongside NVIDIA GPUs, improves performance and cost efficiency, while rapid data center expansion supports a $155 billion backlog, strengthening Alphabet’s position as a scalable, AI-first cloud leader.

ORCL’s Price Performance, Valuation & Estimates

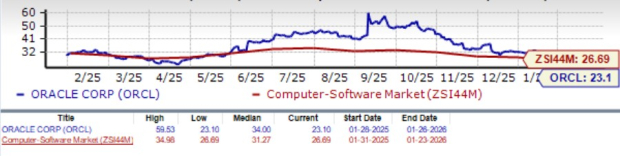

Shares of Oracle have declined 26.3% in the past six months, underperforming both the Zacks Computer and Technology sector’s growth of 14.4% and the Zacks Computer - Software industry’s fall of 13.5%.

ORCL’s Six-Month Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, ORCL stock is currently trading at a forward 12-month Price/Earnings ratio of 23.1x, which is lower than the industry average of 26.69x. Oracle carries a Value Score of D.

ORCL’s Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for ORCL’s fiscal 2026 earnings is pegged at $7.42 per share, down by 0.7% over the past 30 days. The earnings figure suggests 23.05% growth over the figure reported in fiscal 2025.

Image Source: Zacks Investment Research

ORCL stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.