Nothing Ever Changes on Wall Street

Legendary stock speculator Jesse Livermore once said:

“There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in thestock market todayhas happened before and will happen again.”

I have discovered that, while history never repeats completely on Wall Street, it does tend to rhyme. By studying historical patterns, investors can gain a mental edge and perhaps even a roadmap if proven correctly. For instance, last year, I pointed out to Tech Innovator Investors the uncanny resemblance between Google’s (GOOGL) 2004 IPO U-turn base structure and CoreWeave’s (CRWV) 2025 IPO U-turn base. Each stock was in a hot industry group, was liquid, and had several bullish catalysts. CRWV would go on to mimic GOOGL’s 2004 performance and provide me with a juicy 118% in 2025.

Image Source: TradingView

Meanwhile, Paul Tudor Jones famously predicted the “Black Monday” crash of 1987 by using a 1929 overlay chart as precedent.

Is Oklo’s Chart Pattern Repeating?

Earlier, while scanning through charts, I made a fascinating discovery. Oklo (OKLO), a leader in the small modular reactor (SMR) nuclear space, is forming a near-identical pattern to April 2024. In 2024, the stock corrected in a zig-zag fashion (with the first leg being the longest), dropped ~70%, and then tagged its 200-day moving average before exploding higher. Currently, OKLO shares have created an identical zig-zag pattern, have corrected ~63.44%, and recently found support at the rising 200-day moving average.

Image Source: TradingView

While precedents are by no means a guarantee, the performance potential is undeniable. Following the April 2024 correction, OKLO shares would scream higher from ~$17 to nearly $200 a share!

Data Centers are Moving Off the Grid (Bullish for SMRs)

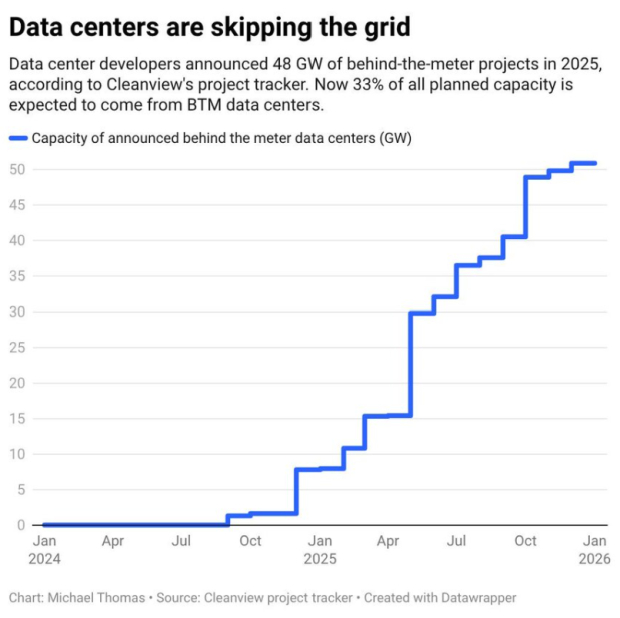

President Donald Trump recently said that he will not allow big tech companies to drive consumer electric prices higher. In other words, tech giants who are building energy-hungry data centers will need to supply their own power. Already, tech leader Microsoft (MSFT) has pledged to make major changes to its energy consumption to ensure that taxpayers “do not pick up the tab” for data center power. Meanwhile, 33% of planned data centers will not use the grid, and this number will only grow (a positive for OKLO0.

Image Source: Michael Thomas

OKLO: Mega Deals in the Pipeline

Oklo recently received validation of its nuclear ambitions after signing a major deal with Meta Platforms (META) to develop a 1.2 GW energy campus.

Bottom Line

Technical patterns tend to repeat on Wall Street. Nuclear power leader OKLO has a near-identical pattern to its 2024 surge. However, this time, it has even more catalysts.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Oklo Inc. (OKLO) : Free Stock Analysis Report

CoreWeave Inc. (CRWV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.