OFS Capital said on May 4, 2023 that its board of directors declared a regular quarterly dividend of $0.33 per share ($1.32 annualized). Previously, the company paid $0.33 per share.

Shares must be purchased before the ex-div date of June 22, 2023 to qualify for the dividend. Shareholders of record as of June 23, 2023 will receive the payment on June 30, 2023.

At the current share price of $9.58 / share, the stock's dividend yield is 13.78%.

Looking back five years and taking a sample every week, the average dividend yield has been 12.38%, the lowest has been 7.45%, and the highest has been 34.78%. The standard deviation of yields is 4.27 (n=196).

The current dividend yield is 0.33 standard deviations above the historical average.

The company's 3-Year dividend growth rate is -0.03%.

Learn to Harvest Dividends

Buy Stock. Capture Dividend. Sell Stock. Repeat. This is the essence of dividend harvesting and you can do it easily with Fintel's Dividend Capture Calendar.

What is the Fund Sentiment?

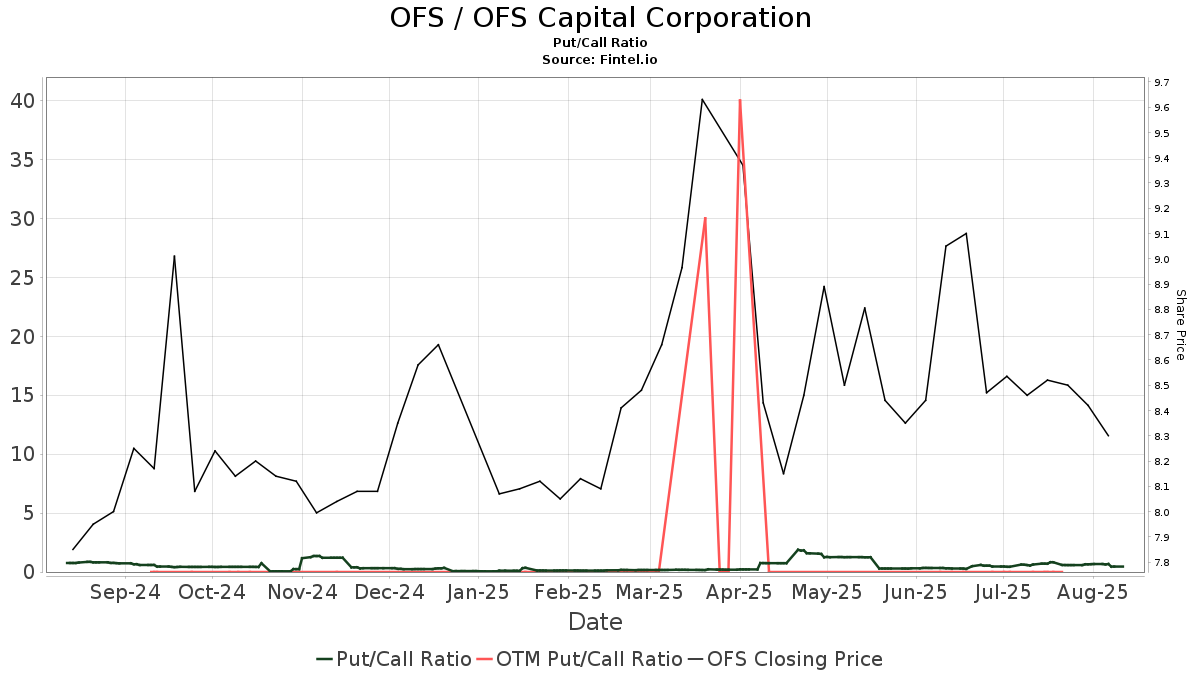

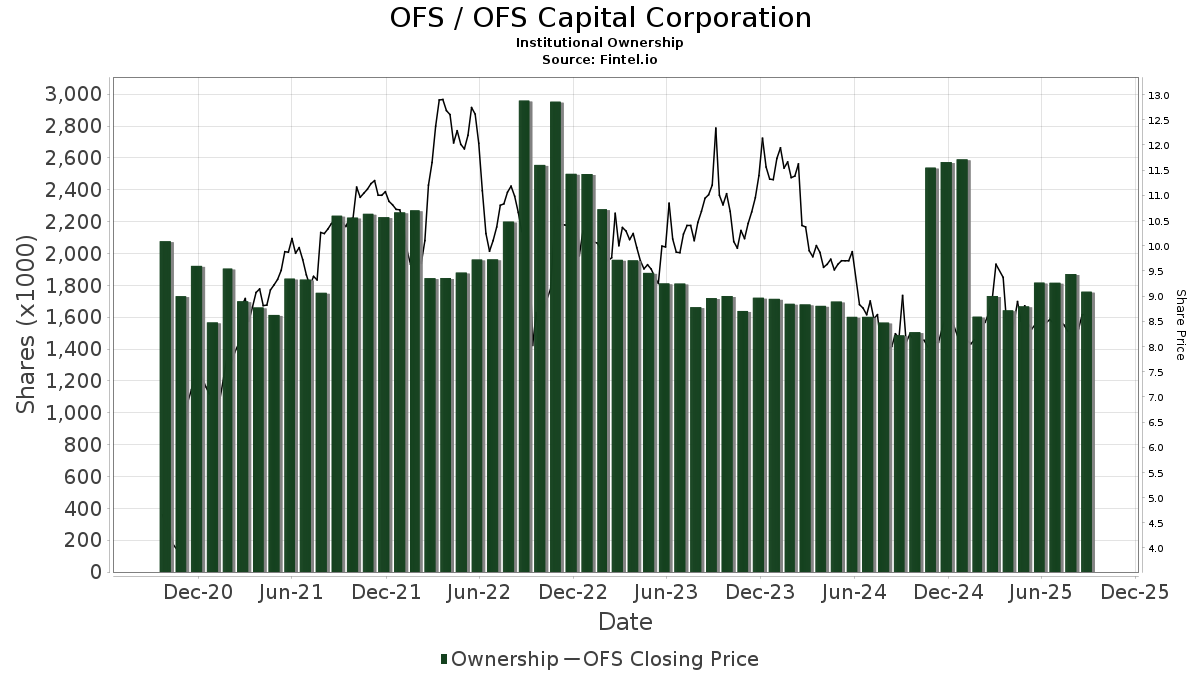

There are 41 funds or institutions reporting positions in OFS Capital. This is a decrease of 3 owner(s) or 6.82% in the last quarter. Average portfolio weight of all funds dedicated to OFS is 0.19%, an increase of 20.44%. Total shares owned by institutions decreased in the last three months by 17.32% to 1,891K shares.  The put/call ratio of OFS is 0.27, indicating a bullish outlook.

The put/call ratio of OFS is 0.27, indicating a bullish outlook.

Analyst Price Forecast Suggests 19.78% Upside

As of April 24, 2023, the average one-year price target for OFS Capital is 11.48. The forecasts range from a low of 11.11 to a high of $12.08. The average price target represents an increase of 19.78% from its latest reported closing price of 9.58.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for OFS Capital is 53MM, an increase of 9.65%. The projected annual non-GAAP EPS is 1.38.

What are Other Shareholders Doing?

Confluence Investment Management holds 299K shares. In it's prior filing, the firm reported owning 319K shares, representing a decrease of 6.57%. The firm decreased its portfolio allocation in OFS by 12.65% over the last quarter.

First Trust Specialty Finance & Financial Opportunities Fund holds 268K shares. No change in the last quarter.

Acadian Asset Management holds 235K shares. In it's prior filing, the firm reported owning 243K shares, representing a decrease of 3.26%. The firm increased its portfolio allocation in OFS by 7.73% over the last quarter.

Advisors Asset Management holds 203K shares. In it's prior filing, the firm reported owning 150K shares, representing an increase of 25.77%. The firm decreased its portfolio allocation in OFS by 99.83% over the last quarter.

International Assets Investment Management holds 102K shares. In it's prior filing, the firm reported owning 158K shares, representing a decrease of 55.32%. The firm decreased its portfolio allocation in OFS by 8.58% over the last quarter.

OFS Capital Background Information

(This description is provided by the company.)

OFS Capital Corporation is an externally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company. The Company's investment objective is to provide stockholders with both current income and capital appreciation primarily through debt investments and, to a lesser extent, equity investments. The Company invests primarily in privately held middle-market companies in the United States, including lower-middle-market companies, targeting investments of $3 to $20 million in companies with annual EBITDA between $5 million and $50 million. The Company offers flexible solutions through a variety of asset classes including senior secured loans, which includes first-lien, second-lien and unitranche loans, as well as subordinated loans and, to a lesser extent, warrants and other equity securities. The Company's investment activities are managed by OFS Capital Management, LLC, an investment adviser registered under the Investment Advisers Act of 19401 and headquartered in Chicago, Illinois, with additional offices in New York and Los Angeles.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.