Key Points

Nvidia's graphics processing centers have captivated the market.

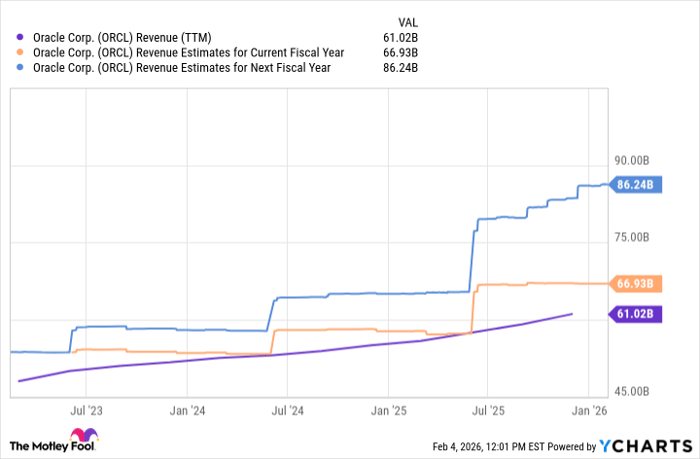

Oracle is down more than 50% since September, but revenue is expected to rise sharply.

- 10 stocks we like better than Oracle ›

Nvidia (NASDAQ: NVDA) has been the most compelling stock on Wall Street in the last several years. Its graphics processing units (GPUs) are the go-to chip for training and running high-performance artificial intelligence applications. Each GPU costs in the tens of thousands of dollars, and hyperscalers are bundling them by the hundreds to perform complex computing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

That's why Nvidia stock is up more than 700% in the last three years, pushing the company to a market capitalization of more than $4 trillion. It's the biggest company in the world by market cap.

But as interesting as Nvidia is, I think another stock has a more compelling growth story right now. And because it's deeply discounted, I think this stock is ripe for the picking.

Image source: Getty Images.

Let's look at Oracle

Oracle (NYSE: ORCL) doesn't get nearly as much attention as Nvidia. It's smaller, with a market cap of just $440 billion. And the stock is down steeply from its September highs, dropping more than 52%.

Part of the issue is Oracle's steep spending on AI infrastructure. The stock started falling last year as investors became skeptical of the company's debt load. Oracle's debt exceeds $100 billion, as the company raised $58 billion to fund data center projects in Texas, Wisconsin, and New Mexico. Oracle has a $300 billion deal with OpenAI to supply AI infrastructure and cloud computing services to the maker of ChatGPT, but analysts at TD Cowen project the company will need about $156 billion in infrastructure to support the project that begins in 2027.

Those concerns have pushed Oracle stock down sharply. But while debt is certainly an issue, the company's recent performance shows it has a ton of potential.

The bullish case for Oracle

Oracle recently reported earnings for its fiscal 2026 second quarter, which ended Nov. 30, 2025. Revenue was up 14% from a year ago to $16.05 billion, and net income was $6.13 billion -- up a whopping 95% from last year. It's important to note that the net income reflects a $2.7 billion pre-tax gain from the company's sale of Ampere Computing to SoftBank Group. Without that gain, income would have been up only 9%.

However, scaling up is an important part of the business -- you need to spend money to make money, and Oracle's putting its money in its biggest growth driver.

|

Segment |

Q2 FY2026 (Ending Nov. 30, 2025) |

Q2 FY2025 (Ending Nov. 30, 2024) |

Year-Over-Year Change |

|---|---|---|---|

|

Cloud |

$7.977 billion |

$5.937 billion |

34% |

|

Software |

$5.877 billion |

$6.064 billion |

-3% |

|

Hardware |

$766 million |

$728 million |

7% |

|

Services |

$1.428 billion |

$1.330 billion |

7% |

|

Total |

$16.058 billion |

$14.059 billion |

14% |

Source: Oracle

And those numbers are expected to improve. Oracle's revenue has been on a slow climb higher, but its revenue estimates for this fiscal year and the next are dramatically higher.

ORCL Revenue (TTM) data by YCharts

Oracle is an interesting stock right now because of the compelling growth story. And with a forward price-to-earnings ratio of only 19.8, the stock is the cheapest it's been in more than two years.

Should you buy stock in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Patrick Sanders has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Oracle. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.