Another day, another AI headline. Unsurprisingly, NVIDIA NVDA is the one in the news again, with an announced partnership with fellow Magnificent 7 member Meta Platforms META keeping interest in the broader AI buildout red-hot.

Specifically, the partnership will enable the large-scale deployment of NVIDIA CPUs and millions of NVIDIA Blackwell and Rubin GPUs, as well as the integration of NVIDIA Ethernet switches for Meta’s Facebook Open Switching System platform.

In other words, Meta Platforms will deploy a massive number of NVDA’s AI chips and technology to power its data center computing needs, helping META achieve its lofty AI goals while also giving NVDA a huge customer.

NVIDIA Earnings Loom

Interestingly, NVIDIA headlines the reporting docket for next week, whose release will pretty much wrap up the Q4 cycle in general. The company is always a late reporter in the cycle, making investors be patient for the most highly-awaited release over the last several years.

As shown below, both earnings and revenue estimates for the quarter to be reported have been positive since late November of 2025, reflecting implied growth rates of 70% and 67%, respectively.

While we haven’t seen any major upward revisions in the new year so far, the stability here remains a big positive, reflecting continued bullishness overall, particularly following the release of many companies involved in the AI buildout over recent weeks.

Image Source: Zacks Investment Research

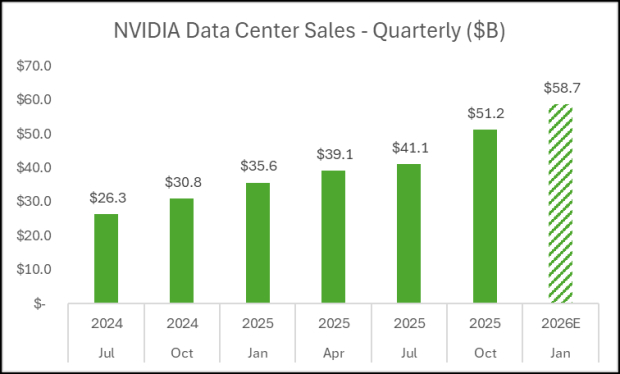

Concerning the Data Center, which is what everybody really cares about, the Zacks Consensus Estimate for the quarter stands at $58.7 billion, reflecting an implied YoY growth rate of 65%.

The growth here has been nearly unbelievable for the company, as shown in the chart below that illustrates NVIDIA’s Data Center sales on a quarterly basis, with the upcoming quarter's $58.7 billion estimate also blended in.

Image Source: Zacks Investment Research

META Remains Committed to AI

It’s no secret that META continues to invest heavily in AI, as reflected in guidance for its full-year 2026. META forecasts total FY26 expenses in a band of $162 - $169 billion, of which the majority is allocated to infrastructure costs. Higher compensation for key talent to support the buildout is the second-biggest contributor to its FY26 expenses, underscoring how high a priority it remains for the company.

Bottom Line

It’ll be a long time before AI-related news tires investors out, with new partnerships and deals seemingly being announced every day at the moment. NVIDIA NVDA remains the go-to AI stock thanks to its established position at the forefront, with Meta Platforms META remaining a massive spender. Keep in mind that NVIDIA remains a Zacks Rank #2 (Buy).

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpNVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.