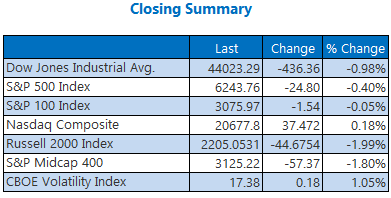

The Dow closed at its session lows on Tuesday, giving back 436 points for its worst single-session decline since June 13. The S&P 500 also finished in the red, as inflation data for June left investors concerned, while the Nasdaq finished higher and notched a second-straight record close.

Nvidia's (NVDA) plans to resume chip sales to China boosted the semiconductor and broader tech sectors. Rising bond yields created some inconsistencies across the market today, with the 10-year Treasury yield last seen just below 4.5%.

Continue reading for more on today's market, including:

- 2 chip stocks enjoying the Nvidia news.

- Double upgrade worthy of your attention.

- Plus, bank earnings in focus; Trade Desk set to join SPX; and the airline earnings to watch.

5 Things to Know Today

- Crypto Week failed to clear a key hurdle in Congress today. (CNBC)

- The Treasury Secretary put pressure on Federal Reserve Chair Jerome Powell. (Bloomberg)

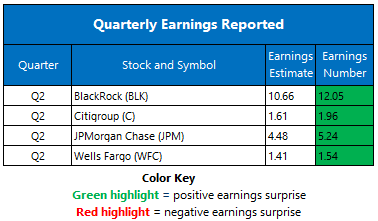

- How did Wells Fargo and Citigroup fare in the earnings confessional?

- Trade Desk stock is finally in big leagues.

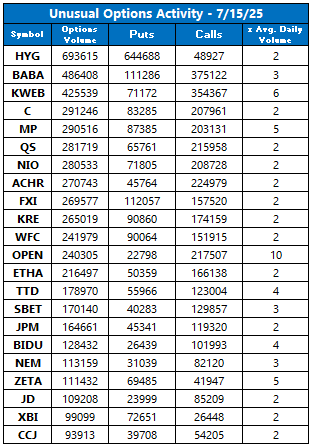

- Puts popular as United Airlines stock rolls into earnings.

Commodities Cool Across the Board

Oil prices slid again today, with supply fears easing after President Donald Trump imposed a 50-day deadline on Russia to end its war in Ukraine. August-dated West Texas Intermediate (WTI) crude fell 46 cents or 0.7%, to settle at $66.52 a barrel.

Gold prices also fell as traders eyed tariff updates and inflation data. August-dated gold futures lost 0.4% to settle at $3,345.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.