Nu Skin Enterprises said on February 14, 2024 that its board of directors declared a regular quarterly dividend of $0.06 per share ($0.24 annualized). Previously, the company paid $0.39 per share.

Shareholders of record as of February 26, 2024 will receive the payment on March 6, 2024.

At the current share price of $12.66 / share, the stock's dividend yield is 1.90%.

Looking back five years and taking a sample every week, the average dividend yield has been 4.02%, the lowest has been 2.32%, and the highest has been 9.55%. The standard deviation of yields is 1.63 (n=234).

The current dividend yield is 1.31 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 1.38. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

- Read the Ultimate Guide to Dividend Harvesting.

The company's 3-Year dividend growth rate is -0.84%.

What is the Fund Sentiment?

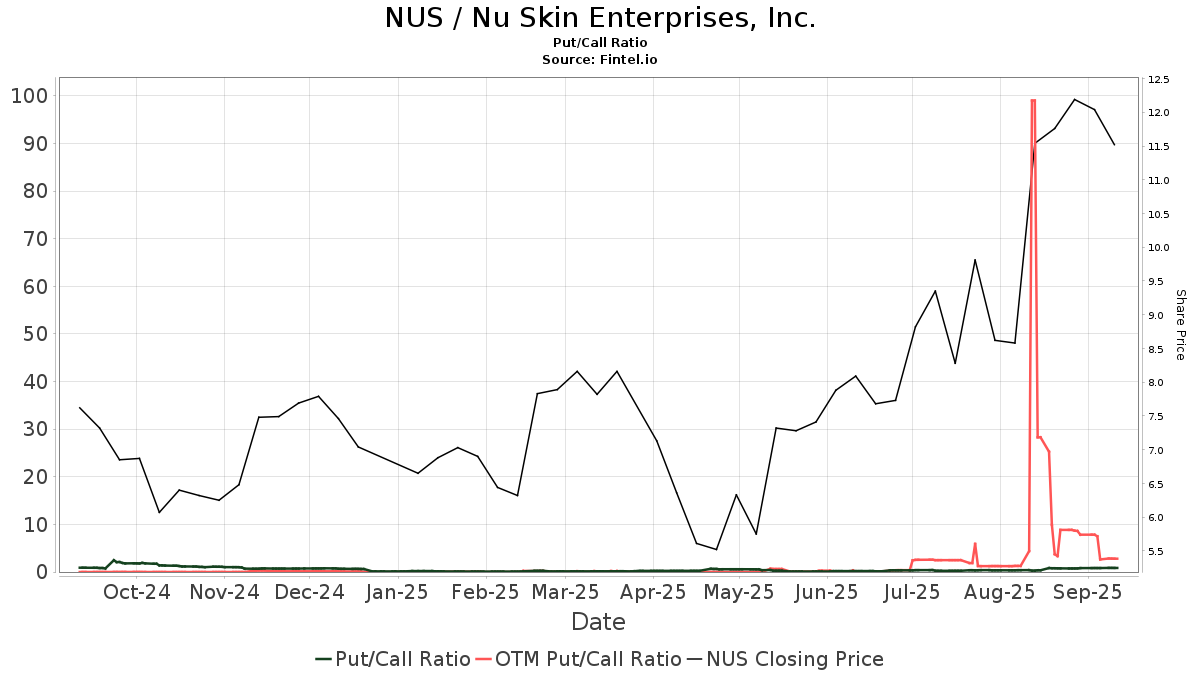

There are 468 funds or institutions reporting positions in Nu Skin Enterprises. This is a decrease of 2 owner(s) or 0.43% in the last quarter. Average portfolio weight of all funds dedicated to NUS is 0.06%, a decrease of 22.14%. Total shares owned by institutions decreased in the last three months by 1.84% to 44,751K shares.  The put/call ratio of NUS is 1.17, indicating a bearish outlook.

The put/call ratio of NUS is 1.17, indicating a bearish outlook.

Analyst Price Forecast Suggests 69.19% Upside

As of January 18, 2024, the average one-year price target for Nu Skin Enterprises is 21.42. The forecasts range from a low of 18.18 to a high of $26.25. The average price target represents an increase of 69.19% from its latest reported closing price of 12.66.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Nu Skin Enterprises is 2,318MM, an increase of 17.72%. The projected annual non-GAAP EPS is 3.30.

What are Other Shareholders Doing?

IJR - iShares Core S&P Small-Cap ETF holds 3,374K shares representing 6.83% ownership of the company. In it's prior filing, the firm reported owning 3,499K shares, representing a decrease of 3.70%. The firm decreased its portfolio allocation in NUS by 36.09% over the last quarter.

Invesco holds 2,857K shares representing 5.78% ownership of the company. In it's prior filing, the firm reported owning 1,694K shares, representing an increase of 40.70%. The firm decreased its portfolio allocation in NUS by 87.57% over the last quarter.

Renaissance Technologies holds 1,929K shares representing 3.90% ownership of the company. In it's prior filing, the firm reported owning 1,994K shares, representing a decrease of 3.40%. The firm decreased its portfolio allocation in NUS by 19.61% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,630K shares representing 3.30% ownership of the company. In it's prior filing, the firm reported owning 1,634K shares, representing a decrease of 0.24%. The firm decreased its portfolio allocation in NUS by 33.85% over the last quarter.

PEY - Invesco High Yield Equity Dividend Achievers ETF holds 1,410K shares representing 2.85% ownership of the company. In it's prior filing, the firm reported owning 651K shares, representing an increase of 53.85%. The firm increased its portfolio allocation in NUS by 62.65% over the last quarter.

Nu Skin Enterprises Background Information

(This description is provided by the company.)

Founded more than 35 years ago, Nu Skin Enterprises, Inc. empowers innovative companies to change the world with sustainable solutions, opportunities, technologies and life-improving values. The company currently focuses its efforts around innovative consumer products, product manufacturing and controlled environment agriculture technology. The NSE family of companies includes Nu Skin, which develops and distributes a comprehensive line of premium-quality beauty and wellness solutions through a global network of sales leaders in Asia, the Americas, Europe, Africa and the Pacific; and Rhyz, company's strategic investment arm that includes a collection of sustainable manufacturing and technology innovation companies.

Additional reading:

- Nu Skin Enterprises, Inc. Executive Severance Policy, amended and restated effective as of January 4, 2023.

- Form of Third Amended and Restated 2010 Plan Restricted Stock Unit Grant Agreement.

- Form of Third Amended and Restated 2010 Plan Performance Restricted Stock Unit Grant Agreement.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.