ServiceNow’s NOW AI-powered platform is helping enterprises undergo business transformation by automating workflows across IT, customer service and business operations. NOW’s cloud-based solutions streamline processes and improve productivity through intelligent automation.

Growth in subscription revenues is the key driver of NOW’s financial performance.

In the second quarter of 2025, subscription revenues increased 22.5% year over year to $3.11 billion, surpassing the Zacks Consensus Estimates by 2.66%. Current Remaining Performance Obligations appreciated 21.5% year-over-year to $10.92 billion in the second quarter. ServiceNow secured 89 net new ACV deals over $1 million, including 11 above $5 million, implying strong enterprise demand during the reported quarter.

Growth in NOW’s subscription business is supported by rising adoption of its innovative product suite. AI-enhanced Pro Plus tiers of core products like ITSM, CSM and HRSD help customers automate workflows and accelerate resolution times. Tools such as Workflow Data Fabric and RaptorDB Pro unify data and support high-performance AI applications. In the reported quarter, the AI Pro Plus deal count increased by over 50% sequentially. ServiceNow also closed its largest Now Assist deal to date, exceeding $20 million, with 21 large transactions involving five or more Now Assist products.

With strong adoption trends in place, ServiceNow expects 2025 subscription revenues of $12.785 billion and the Zacks Consensus Estimate for the same is pegged at $12.661 billion. As enterprises deepen platform adoption and expand across AI-driven SKUs, subscription growth is expected to remain the central engine for NOW’s revenue expansion.

NOW Faces Stiff Competition

NOW faces stiff competition in the subscription-driven workflow automation space from the likes of Salesforce CRM and Pegasystems PEGA.

Salesforce is benefiting from strong demand for its Einstein AI platform, which integrates across subscription offerings to enhance customer relationship management and automation capabilities. Salesforce has a steady subscription revenue growth driven by AI adoption. Salesforce recently expanded its subscription platform with advanced AI agents and workflow automation tools to compete directly with specialized automation providers like ServiceNow.

Pegasystems remains a formidable competitor in the enterprise workflow subscription market, leveraging its GenAI Blueprint solution to accelerate application development. Pegasystems continues expanding its subscription-based platform with AI-powered decisioning capabilities, positioning it as a key rival for enterprise automation budgets in the growing subscription economy.

NOW’s Share Price Performance, Valuation and Estimates

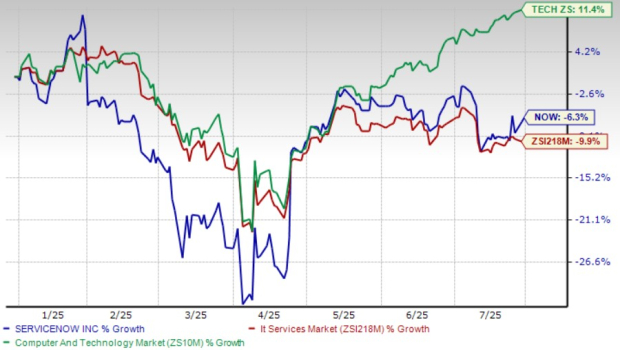

ServiceNow’s shares have declined 6.3% year to date, underperforming the broader Zacks Computer & Technology sector’s return of 11.4% but beating the Zacks Computer- IT services industry’s decline of 9.9%.

NOW Stock Performance

Image Source: Zacks Investment Research

ServiceNow stock is trading at a premium, with a forward 12-month Price/Sales of 14.19X compared with the sector’s 6.72X. NOW has a Value Score of F.

NOW Valuation

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for ServiceNow’s third-quarter 2025 earnings is pegged at $4.22 per share, which decreased by a penny over the past 30 days. This indicates a 13.44% increase year over year.

ServiceNow, Inc. Price and Consensus

ServiceNow, Inc. price-consensus-chart | ServiceNow, Inc. Quote

The consensus mark for NOW’s 2025 earnings is pegged at $16.79 per share, which has increased by 25cents over the past 30 days, suggesting 20.62% year-over-year growth.

NOW currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Salesforce Inc. (CRM) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.