Fintel reports that on February 23, 2024, Northcoast Research upgraded their outlook for Franklin Electric (NasdaqGS:FELE) from Neutral to Buy .

Analyst Price Forecast Suggests 2.65% Upside

As of February 24, 2024, the average one-year price target for Franklin Electric is 100.98. The forecasts range from a low of 87.87 to a high of $115.50. The average price target represents an increase of 2.65% from its latest reported closing price of 98.37.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Franklin Electric is 2,092MM, an increase of 1.30%. The projected annual non-GAAP EPS is 4.56.

Franklin Electric Declares $0.25 Dividend

On January 22, 2024 the company declared a regular quarterly dividend of $0.25 per share ($1.00 annualized). Shareholders of record as of February 1, 2024 received the payment on February 15, 2024. Previously, the company paid $0.22 per share.

At the current share price of $98.37 / share, the stock's dividend yield is 1.02%.

Looking back five years and taking a sample every week, the average dividend yield has been 1.01%, the lowest has been 0.73%, and the highest has been 1.39%. The standard deviation of yields is 0.15 (n=234).

The current dividend yield is 0.07 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.24. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.43%, demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

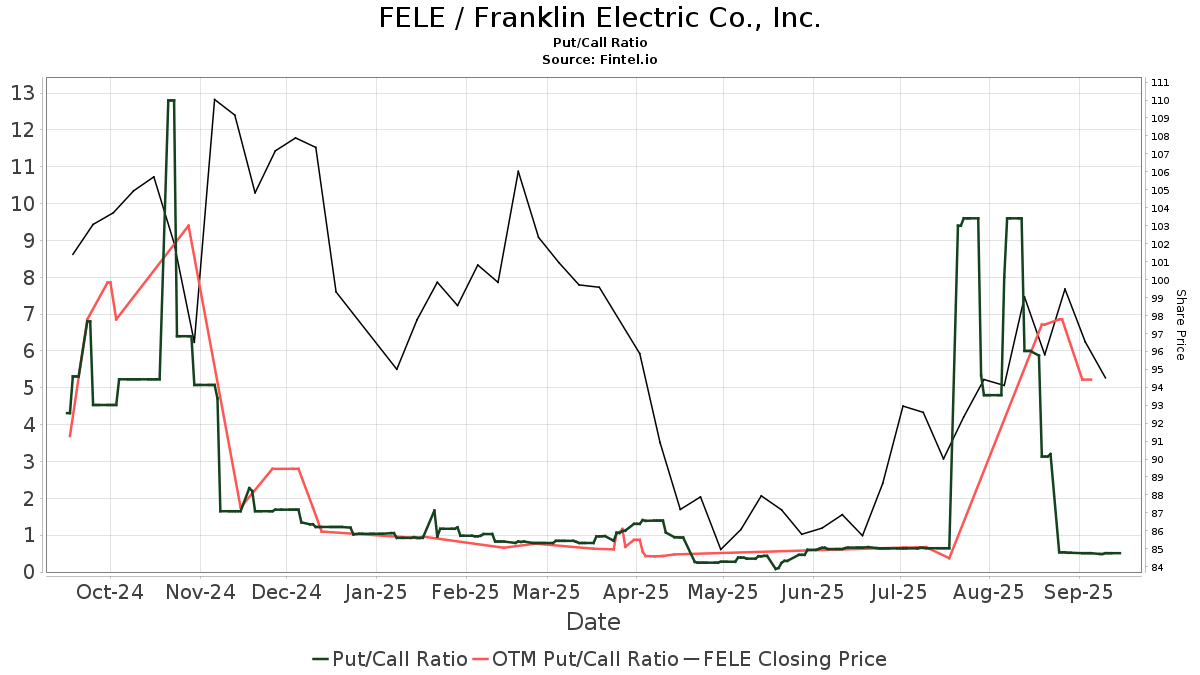

There are 654 funds or institutions reporting positions in Franklin Electric. This is an increase of 30 owner(s) or 4.81% in the last quarter. Average portfolio weight of all funds dedicated to FELE is 0.20%, a decrease of 10.60%. Total shares owned by institutions increased in the last three months by 0.17% to 42,679K shares.  The put/call ratio of FELE is 0.48, indicating a bullish outlook.

The put/call ratio of FELE is 0.48, indicating a bullish outlook.

What are Other Shareholders Doing?

IJR - iShares Core S&P Small-Cap ETF holds 2,687K shares representing 5.82% ownership of the company. In it's prior filing, the firm reported owning 2,721K shares, representing a decrease of 1.29%. The firm decreased its portfolio allocation in FELE by 11.19% over the last quarter.

Allspring Global Investments Holdings holds 1,961K shares representing 4.25% ownership of the company. In it's prior filing, the firm reported owning 1,955K shares, representing an increase of 0.30%. The firm decreased its portfolio allocation in FELE by 2.68% over the last quarter.

Earnest Partners holds 1,740K shares representing 3.77% ownership of the company. In it's prior filing, the firm reported owning 1,823K shares, representing a decrease of 4.81%. The firm decreased its portfolio allocation in FELE by 10.53% over the last quarter.

ESPAX - Wells Fargo Special Small Cap Value Fund holds 1,603K shares representing 3.47% ownership of the company. In it's prior filing, the firm reported owning 1,608K shares, representing a decrease of 0.34%. The firm decreased its portfolio allocation in FELE by 8.56% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,227K shares representing 2.66% ownership of the company. In it's prior filing, the firm reported owning 1,226K shares, representing an increase of 0.09%. The firm decreased its portfolio allocation in FELE by 9.92% over the last quarter.

Franklin Electric Background Information

(This description is provided by the company.)

Franklin Electric is a global leader in the production and marketing of systems and components for the movement of water and fuel. Recognized as a technical leader in its products and services, Franklin Electric serves customers around the world in residential, commercial, agricultural, industrial, municipal, and fueling applications.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.